A scam is an English slang term for fraud. It is widely used in trading to describe deceptive actions and suspicious products or services. The cryptocurrency sector is no exception.

With the rise of internet technologies and the growing popularity of online investments, the threat of scams is constantly increasing. This is driven by the anonymity of cryptocurrency transactions and the eagerness of naive newcomers to get rich quickly.

In this article, you will learn:

How Crypto Scams Work

Crypto scams are generally categorized into two types, based on the scammers’ objectives:

- Access to confidential information. Scammers aim to gain access to a wallet or other sensitive data, such as passwords or security codes. Sometimes, this can also involve gaining access to the victim’s computer or smartphone.

- Deception. These schemes involve tricking users into voluntarily transferring their cryptocurrencies to the scammers. This is usually done through fake investment offers or business projects, using fabricated stories or fake identities.

However, this classification does not exclude other schemes where users might lose their cryptocurrencies by interacting with scammers.

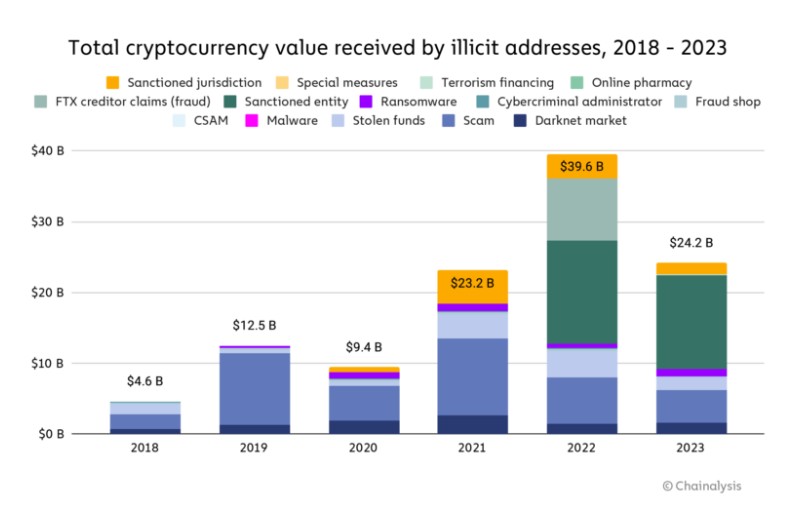

According to Chainalysis:

- The number of transactions related to illegal activities accounts for 0.3% to 0.5% of the total transactions.

- The number of scams has been rising since 2018. Scammers have accumulated nearly $40 billion in cryptocurrencies in their wallets.

Do not be misled by the apparent decrease in the amount for 2023. There is a time lag in identifying scammer addresses, so the initial figure of $24.2 billion for 2023 can increase by 1.5 to 2 times as new information emerges in 2024.

Current Types of Scams

We reviewed expert publications from mainstream media and online security resources to provide a brief overview of more than 10 major scams you could encounter this year.

Please note:

✓ This list is not exhaustive.

✓ Some scams may overlap with others.

✓ We do not recommend or endorse attempting to profit from any of the schemes mentioned below.

Investment Scams

Investment scams involve fraudsters promising “huge profits” from cryptocurrency investments. They often pose as “investment managers,” claiming they can grow your investment if you transfer your funds to them. Following their advice usually leads to losing your cryptocurrency.

To recognize such investment schemes, watch for promises of unusually high returns, assurances of low risk, and the absence of proper licenses. Exercise caution if approached suddenly on social media with tempting cryptocurrency investment offers.

Phishing

Phishing is an old and favored method among fraudsters. The goal is to obtain access to your account credentials: logins, passwords, cryptocurrency wallet keys. Scammers may impersonate well-known companies like Amazon, Binance, or bank websites to trick users into providing personal information.

Scammers attract victims by sending emails or messages with links to fake websites, where users are asked to enter login details.

For example, the scheme could be like this. A user gets a notification about the start of a transaction and a link to cancel it. Clicking on the link redirects to a fraudulent website. If you hastily attempt to cancel the supposed theft of your crypto by impulsively clicking on the phishing link, you will give away your data to scammers. Here is an example of what such a phishing email might look like:

To protect yourself from phishing:

- Do not enter confidential information through links from emails;

- It is always better to visit websites directly, even if the link appears genuine;

- Check the domains where you enter personal information for any “typos.” For instance, instead of binance.com, it might be spelled as “biananc.com”.

Romance Scams

Scammers often exploit dating websites. They can spend months manipulating their victims’ emotions, gradually drawing them into romantic relationships. Once trust is established, conversations shift towards supposed lucrative opportunities in cryptocurrency, leading to the transfer of coins or account details.

This scheme may seem naive, but according to Chainalysis, victims lost over $7.7 billion to this type of scam in 2021.

Example. 24-year-old Nicole Hutchinson (pictured in CBS program) from Tennessee lost $390,000 belonging to her and her father. This was a scam on the Hinge dating site.

If your dating site partner avoids video calls and offline meetings and instead suggests investing in cryptocurrencies, you should consider that you might be targeted for a scam.

Fake News

Example. The case involved fake news about a partnership between Litecoin and Walmart, which occurred in September 2021.

Initially, a press release allegedly from Walmart claimed that the largest U.S. retailer would start accepting Litecoin as payment. This news spread through numerous major news agencies and cryptocurrency news platforms. The information first appeared on the GlobeNewswire website, known for its reliable corporate press releases. Following the publication, the price of Litecoin surged instantly.

However, Walmart soon issued an official statement denying any partnership with Litecoin. It turned out that the press release was fake (scammers had gained access to the login and password of one of GlobeNewswire’s editors). Following this clarification, the price of Litecoin sharply dropped (as shown by CNBC’s presenter below), returning to previous levels.

This case highlighted how sensitive cryptocurrency markets are to information flows. Always have a backup plan, even if the information guiding your investment decisions seems to come from credible sources.

The sharp rise and fall in Litecoin’s price leads us to the next type of scam.

Pump and Dump

In this scheme, scammers convince you to buy little-known cryptocurrency at a “low price,” promising that its value is about to skyrocket.

Moreover, they organize communities on Telegram and other social networks where people gather to start actively buying a specific crypto asset at a particular time. This leads to a rapid increase in the asset’s price (especially if the market is illiquid) and, consequently, attracts other buyers.

When the price indeed rises (pump) following these coordinated purchases, the temptation to lock in profits leads to a cascade of sells, causing the market to crash (dump) and often resulting in losses for those who participated in the scheme.

Example. Pumpers coordinate the purchase of the IZI token, causing its price to skyrocket.

In theory, it is possible to profit from pump and dump schemes (although it resembles gambling more than actual work). However, there are several significant challenges:

- entering a position at a low price can be difficult due to reaction speed and slippage;

- exiting a position at a favorable price may be problematic;

- in centralized and regulated stock markets, this is considered manipulation and is prosecuted by law.

Giveaways

Crypto scammers often pose as celebrities or influential figures in the industry to attract potential victims. They organize so-called “giveaways,” promising to double or increase the amount of cryptocurrency sent to them by participants. These giveaway messages often look convincing, creating an illusion of legitimacy and urgency, prompting people to quickly transfer their funds in hopes of instant profits.

Example. Engadget captured a screenshot of a live stream where an AI-generated Elon Musk urged viewers to invest cryptocurrency in a scam project during a YouTube broadcast.

Scammers increasingly exploit AI technology, making it difficult for the average user to detect a scam. These fraudulent streams often trend on YouTube.

Here is one of the popular schemes:

- A promoted social media post promises a Bitcoin giveaway for the first 1,000 subscribers.

- Clicking the link redirects the user to a scam site, where they are asked to complete “verification” to receive the Bitcoins, which includes making a payment to confirm their account’s legitimacy.

- The victim either makes the payment or provides personal information to the scammers.

Blackmail

Blackmail scammers often follow a simple yet effective scheme:

- They claim to have compromising data (like texts, photos, or videos) showing the victim visiting adult websites or engaging in other sensitive activities.

- They then threaten to make this information public unless their demands are met.

- These demands usually involve sending cryptocurrency.

Such actions are criminal extortion and should be reported to law enforcement immediately.

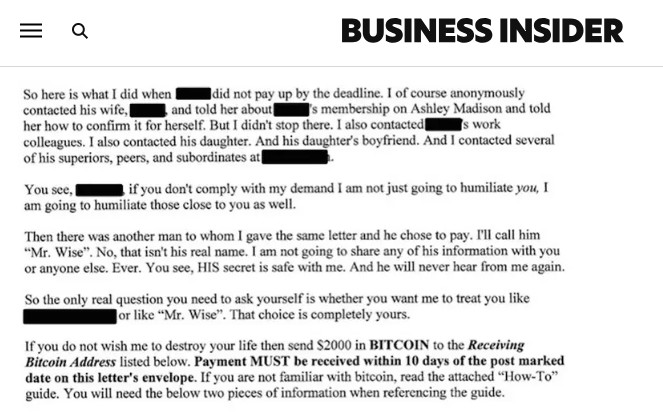

Example. Business Insider shared a story about the Ashley Madison (a dating website) data breach.

Victims received emails (screenshot above) demanding $2,000 in Bitcoin within 10 days to keep their personal information private.

Rug Pulls

How does a “rug pull” work? Simply put, it is a scam involving the sale of unknown tokens.

Here is how it typically unfolds:

- Scammers create hype around their project, often claiming it will be listed on a major exchange, announcing a significant partnership, or attracting investments from a well-known venture capital fund.

- They then gather investment capital during the early stages of this seemingly promising project, offering project tokens or non-fungible tokens (NFTs) in return.

- Once the scammers have collected enough money, they disappear. The smart contracts for these investments are often set up to prevent victims from selling the cryptocurrency after purchase, leaving them with useless assets.

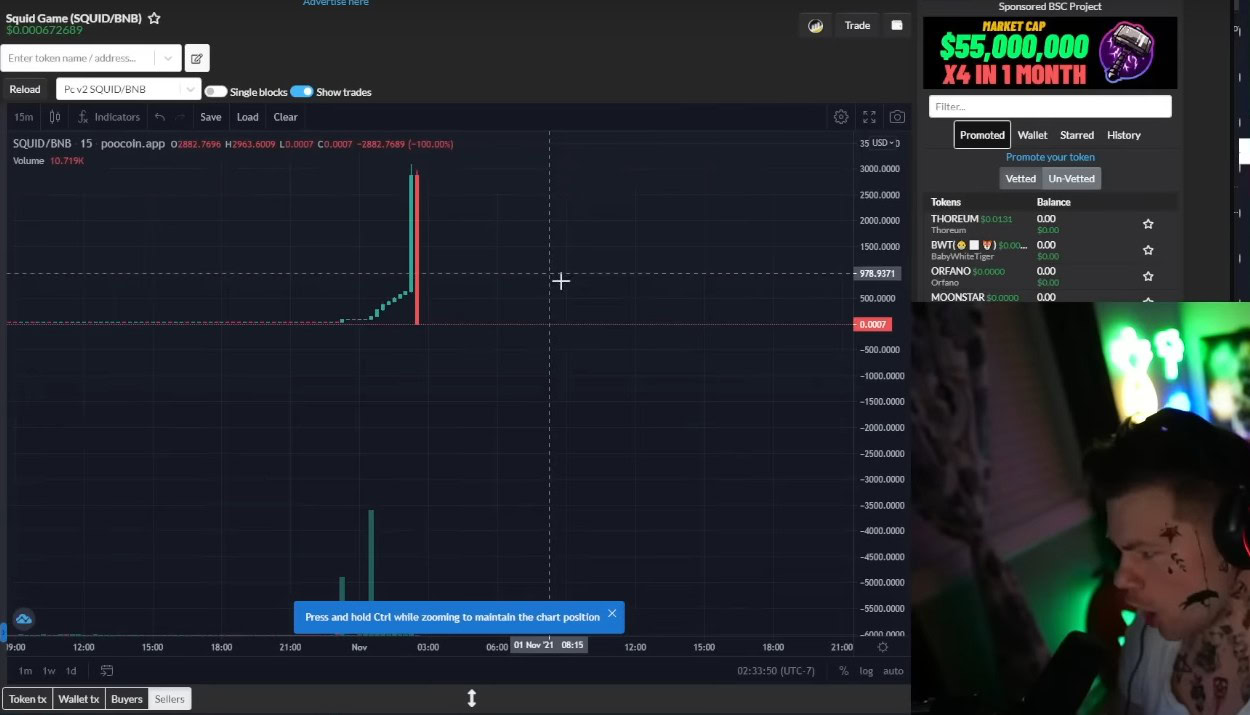

Example. The Squid coin scam, named after the popular Netflix series “Squid Game.” Investors bought tokens for online games with the promise of earning more later and exchanging them for other cryptocurrencies. The price of the Squid token soared from 1 cent to about $90 per token.

Ultimately, the token’s value plummeted (the YouTube screenshot shows a trader’s reaction as he monitored the SQUID/BNB market in real time). People tried but could not sell their Squid tokens, while the scammers made about 3 million dollars.

Other Types of Scams

Scammers are inventive and always come up with new schemes to earn money through deceit.

Ponzi schemes are a classic type of scam where organizers promise investors high returns from new projects, often without clearly explaining the sources of profit or the stability of the business model. Profits for new participants usually come from funds contributed by subsequent investors rather than from genuine investment activities or trading. This creates an illusion of successful growth and profitability. However, in reality, the system remains viable only as long as it continues to attract enough new participants.

ICO scams ICO scams involve the fraudulent issuance of new coins through Initial Coin Offerings. Organizers of these projects raise funds from investors under various pretenses, such as revolutionary products or technologies, but they have no intention of fulfilling the promised project.

Cloud mining. While cloud mining itself is a legitimate activity, scammers exploit it for their schemes. These scams typically require an upfront payment in exchange for mining power and subsequent rewards from the mined coins. In reality, these fake projects do not possess the claimed hashing power and fail to deliver the promised payouts after receiving the initial payment.

Fake job offers. Job scams involve fraudsters, often pretending to be recruiters, who create fake job postings. A distinguishing feature of these “jobs” is the requirement to make a payment in cryptocurrency to start working.

Trading through API. API trading scams in cryptocurrency involve fraudsters tricking users into giving them access to their API keys. These keys allow the scammers to programmatically manage trading accounts on cryptocurrency exchanges and sometimes even withdraw funds if the API keys have the necessary permissions.

Pretexting. Scammers create convincing stories or scenarios to trick victims into providing confidential information, such as during a security check or account update.

Quizzing. Seemingly harmless questions (“What’s your mother’s maiden name?“) are asked to gather information that can be used to hack accounts.

Pressure tactics. Scammers often create a sense of urgency or rush to push the victim into making hasty decisions without proper consideration.

The Most Notorious Crypto Scams

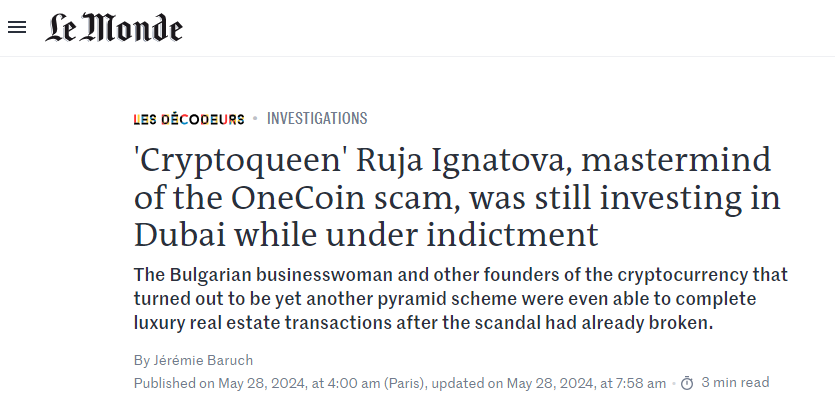

OneCoin. OneCoin. This scam became one of the largest in history, with losses totaling around $25 billion. OneCoin claimed to be a cryptocurrency but was actually a Ponzi scheme with no real blockchain.

In 2014, Bulgarian businesswoman Ruja Ignatova launched the OneCoin project, touting it as a new cryptocurrency aimed at competing with Bitcoin. The scam was exposed two years later, but Ignatova evaded capture. In 2024, Le Monde (screenshot above) reported that Ignatova was investing in luxury real estate in Dubai through intermediaries.

BitConnect (2016-2018). This platform promised huge returns from investing in their cryptocurrency lending program. After gaining popularity and attracting about $4 billion, the platform collapsed, and the owners were accused of running a Ponzi scheme.

Bitclub Network (2014-2019). This scam claimed to be involved in Bitcoin mining but turned out to be a Ponzi scheme. Organizers convinced investors to put in up to $722 million for mining equipment that either did not exist or was used ineffectively.

FTX. This cryptocurrency exchange collapsed in 2022, causing client losses of over $8 billion. The collapse of FTX was caused by a series of financial violations and insufficient liquidity on the platform.

PlexCoin (2017). This project promised users over 1300% returns in a month, raising suspicions and attracting regulatory intervention. The creators of PlexCoin were charged with fraud, and the project was shut down.

The DAO (2016). While not a scam, it was a hacker attack that resulted in over $50 million in Ethereum being stolen. This led to significant debate within the Ethereum community and ultimately a hard fork of the currency.

Mt. Gox. One of the first and largest cryptocurrency exchanges, Mt. Gox, went bankrupt after hackers stole approximately 850,000 Bitcoin. In 2024, Reuters reported that affected Mt. Gox clients would be compensated at a rate of $483 per BTC, resulting in a total reimbursement of $68.5 million to clients instead of the original $8.7 billion.

How to Avoid Crypto Scams

Here are some tips that might seem obvious, but could greatly reduce the number of scam victims if followed:

✓ Ignore messages or calls from unknown people, especially if they involve investments.

✓ Be cautious of links or attachments from unknown senders.

✓ If you receive a notification about unusual activity, immediately freeze all transactions.

✓ Check domain spelling carefully. Ensure the address has HTTPS for security and encrypted traffic.

✓ Never share your private keys. They control access to your cryptocurrency and are not needed for legitimate transactions.

✓ Be skeptical of promises of high earnings. Scammers often promise to quickly increase your money.

✓ Be wary of “celebrities” promoting cryptocurrencies.

✓ Do not send money to people you only know online.

✓ Stay calm if you receive a message saying your account is frozen. It might be a scam.

✓ Avoid job offers that require upfront payments in cryptocurrency for training or other reasons.

✓ Be suspicious of “free” money or cryptocurrency giveaways.

✓ Store your crypto in cold wallets to reduce the risk of theft.

FAQ

How to recognize scam projects?

Assess the credibility of the offer. Study the project’s documentation (White Paper), goals, roadmap, and operating mechanisms. Look into the team’s background, including their professional experience and real-world connections. Check licenses and the domain’s history. Ensure the project’s smart contracts have undergone an independent audit.

How to identify a scam exchange?

Follow the advice above. Additionally, check if the Terms of Service are copied from a previous scam. Scam exchanges often have an overly large deposit button.

Is it possible to get your money back?

Recovering cryptocurrency lost due to a scam can be very challenging, but in some cases, it is possible. To improve the chances, a victim should act quickly: freeze transactions by contacting the exchange’s support service and also report the incident to law enforcement.

How big is a crypto scam?

Estimates vary across different sources. For instance, according to a report from the Federal Bureau of Investigation (FBI), losses from cryptocurrency investment fraud in the United States were $3.94 billion in 2023, which is 53% higher than $2.57 billion in 2022.

How to Profit in a Scam-Ridden Market

On one hand, to avoid becoming a victim, it is crucial to be cautious, stay well-informed, and apply critical thinking. It is impossible to completely eliminate the risk of fraud, given the emotions that surround the financial market.

On the other hand, using exchange volume analysis helps maintain objectivity and independent judgment, steering clear of FOMO and other psychological influences.

Example. The screenshot (taken from the ATAS platform) below shows the hourly footprint of the cryptocurrency pair 1000XECUSDT, sourced from BinanceFutures. The Delta indicator has been added to the chart.

Take note of the hourly candle at 22:00 on the left side:

- There was excessive price growth, but it closed near the bottom.

- Excessively high volume of market buys (a sign of FOMO).

- “Upper tail” on the delta – a sign of sellers becoming active.

- Most notably, convexity on the profile around the 0.03366 level (the hourly Point of Control, or POC), indicating abnormal trading activity.

If the candle showed an excess of market buys and closed near its low, well below the area of intense trading activity around the 0.03366 level, this could be a sign of a market peak. Why?

Retail traders were attracted by a sharp price increase (possibly fueled by project news), but their purchases did not lead to an upward momentum. In other words, their efforts (indicated by positive delta) did not yield results (closing below POC). Often, these trapped buyers are compelled to liquidate their positions upon witnessing the development of a downward trend.

Thus, a market peak forms when many small traders seek to buy an asset that appears to be a profitable investment on the chart. However, they are sold to by professionals — typically those who bought the asset early in the trend. This is not a scam scheme but rather the mechanics of exchange trading, which you can observe by analyzing the interaction between price and volumes during the formation of market highs and lows.

How to Learn Analyzing Trading Volumes?

To get started, you will need a professional trading volume analysis program for cryptocurrency exchanges that offers features like:

- The ability to analyze charts with trade-level precision.

- Footprint or cluster charts.

- Vertical volume indicators with delta breakdown.

- Market profiles.

- Order book analysis tools.

The ATAS platform is perfect for this and can be downloaded for free. It includes all these features and offers additional tools for beginner traders:

- a Market Replay trader simulator;

- educational materials in the Learn section of the platform’s main menu;

- statistics analysis and demo accounts;

- support from live representatives.

Conclusions

It is crucial to maintain a high level of awareness and critical thinking, but it is impossible to completely eliminate the risk of fraud. Scammers continually refine their methods to deceive even the most cautious and prepared individuals.

Almost all the scams mentioned in this article rely on social engineering and exploit human emotions such as fear, trust, and sympathy. This makes them particularly effective in the cryptocurrency industry, where people are often driven by the desire to get rich quickly and easily.

On the other hand, you can study market behavior patterns and use them as the foundation for your cryptocurrency trading strategy. Professional volume analysis indicators can help you identify entry points with acceptable risk. The advantage is that learning to trade is not an investment in a scam but in yourself and your skills, which you can monetize many times over in the future.

Download ATAS. It is free. During the trial period, you will get full access to the platform’s tools to experiment with different strategies for crypto trading. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis in futures markets.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.