The world of trading is diverse and dynamic, as various types of traders operate in financial markets. You can choose a trading style that suits you best, whether it is the swift decision-making of day traders or the calculating patience of position traders.

This article explores the characteristics, methods, and mindsets of different trader types. For beginners, it can serve as a guide to finding their niche in this diversity. For experienced traders, it offers a better understanding of other styles that can enhance their strategies.

Read more:

The article will examine the pros and cons of each type, provide examples of trades, and compare the main types of traders.

What Kinds of Traders Are There?

In trading, each style comes with its own rhythm, level of risk, and strategic frameworks. In this article, we adhere to the classification of traders into four types:

- Day Traders

- Swing Traders

- Position Traders

- Scalpers

This division is well-founded. It is based on the trading horizon, acceptable risk, and strategic approach rather than the type of asset or other characteristics. Classifying traders into these four types allows beginner traders to grasp fundamental strategies and mindsets.

What Happens if You Make a Mistake in Choosing Your Type?

When a trader makes a mistake in their choice, intentionally or unintentionally deviating from their primary style, the consequences can be extremely unfavorable:

- Loss of strategic focus. When a scalper shifts to position trading (and vice versa), they may analyze the market less effectively and react less aptly to its signals. Settings and indicators optimal for short-term analysis may not be suitable for long-term trends, leading to flawed judgments and strategic errors.

- Risk management mismatch. Acceptable risks and capital allocation strategies vary significantly for different types of traders. Confusion in trading style can result in inadequate risk-taking — overusing borrowed funds for short-term profit or being unable to capitalize on long-term opportunities due to excessive caution.

- Psychological stress. Engaging in high-stakes day trading can drain one’s mental reserves, potentially leading to burnout for individuals not naturally inclined for such intensity. Conversely, positional trading demands patience and detachment—this approach may feel monotonous for those who thrive on the adrenaline.

- Inconsistency in work. If a trader shifts between styles, analyzing their trading history becomes tricky — results across different timeframes become hard to compare. Such inconsistency can hinder a trader from learning lessons from past trades and evolving their strategies

When a trader sticks to their chosen trading style consistently, it is not just about personal preference; it is a fundamental factor for success and sustainability in the market. Aligning your psychological traits, strategies, and risk management is essential. For this very purpose, we will take a closer look at each of the four trader types.

Scalpers

Scalping is a trading style that involves holding positions for a relatively short time. Scalpers see opportunities to extract profits in the minor price fluctuations, referred to as ‘trading noise’ by others. For more details, check out the article: What Is Scalping?

Scalpers aim to maximize small profits from minor price fluctuations throughout the day. This strategy requires a disciplined approach and a deep understanding of market fluctuations.

Scalp traders must think quickly and make decisions rapidly. Attention to detail, discipline, and the ability to remain calm under pressure are crucial. Scalp traders also need a high level of technical proficiency to analyze market data and execute trades swiftly.

Cryptocurrencies and volatile futures are particularly well-suited for scalping. Stocks from defensive sectors or government bonds are unlikely to be a rational choice.

A typical trade of a scalper

A scalp trader may buy cryptocurrency or futures, noticing a slight upward impulse on a 1-minute chart, and sell the asset a few minutes later after it has increased by a fraction of a percentage. This process can be repeated multiple times throughout the trading day.

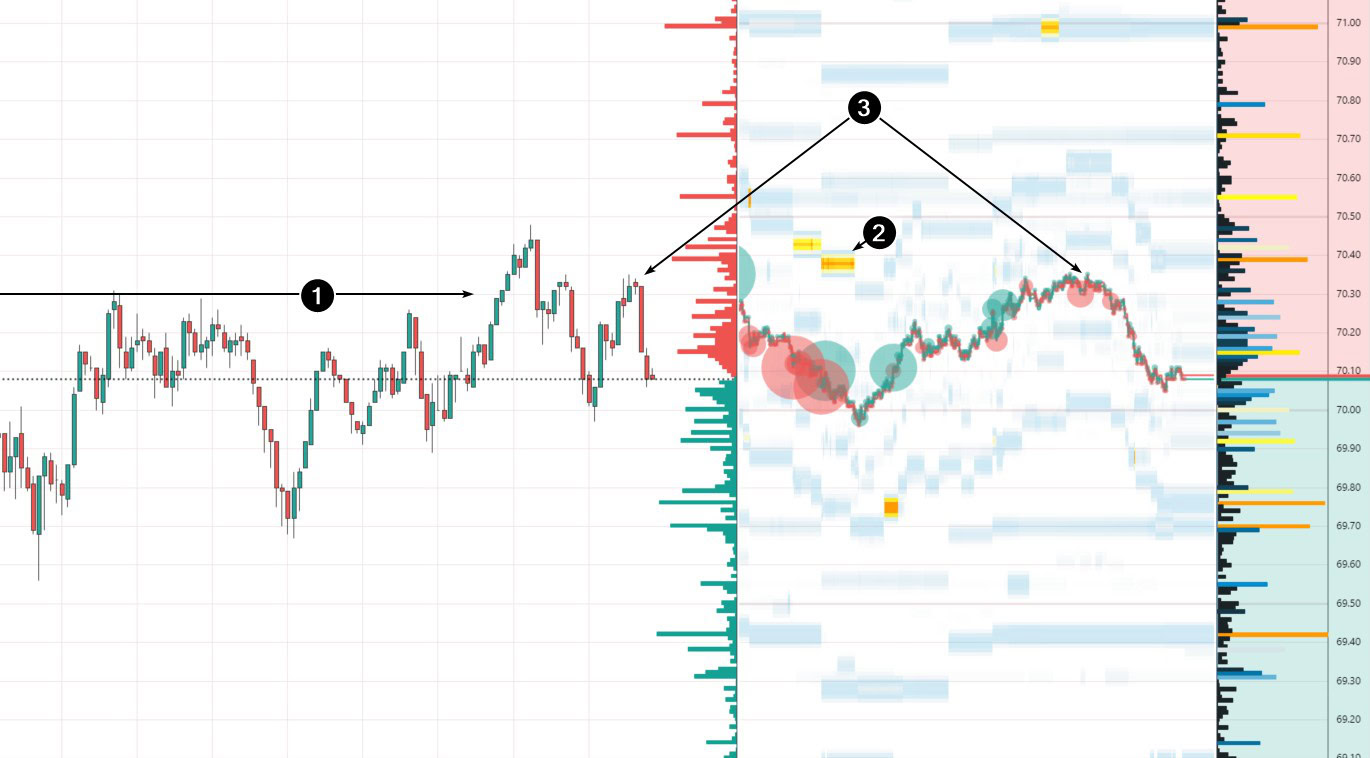

Example. The screenshot below shows a trading situation in the Litecoin futures market, data sourced from Binance Futures exchange.

The trader observed that above the $70.30 per coin level, the price behaved bearishly — there was an attempt at a bullish breakout (1), but then a sharp reversal downward occurred. Significant selling volumes were noticed at around $70.40 per coin (2).

With these arguments favoring seller activity around the $70.40 level (not the most convincing ones, but nothing else), the scalper entered a short position (3). When seeing that the price entered a range after rising to $70.30, the goal was to capture the anticipated decline to the previous support of around $70.00.

Indicators and tools of scalpers

To operate efficiently, scalping traders require a reliable internet connection, a fast computer, and software equipped with advanced indicators, including those designed for working with Level II data.

ATAS offers scalpers a specialized tool called DOM Trader (or Scalping DOM) – which is shown in the chart. This module combines a user-friendly interface for working with the DOM, Order Flow, a heatmap, chart viewing, and quick order placement.

Day Traders

Day trading is the embodiment of market activity. It involves the buying and selling of exchange assets within a single trading day. Traders in this category are like sprinters, aiming to capitalize on short-term market fluctuations. Their trading horizon is limited to one day, so they are not exposed to the risks of overnight fluctuations.

The primary goal of a day trader is to achieve consistent profits by using small price movements in highly liquid exchange instruments. Although day traders may seem similar to millions of typical office workers engaged in routine computer work for 8 hours a day, day trading is not for the faint-hearted.

Successful day traders are decisive, capable of swiftly processing information, and adept at handling stress and emotions effectively. Additionally, a profound understanding of market trends, the ability to work with big volumes of financial information, and maintaining concentration over extended periods are crucial aspects of their skill set.

A typical trade of a day trader

A typical day trader strategy may involve trading in a market experiencing heightened volatility.

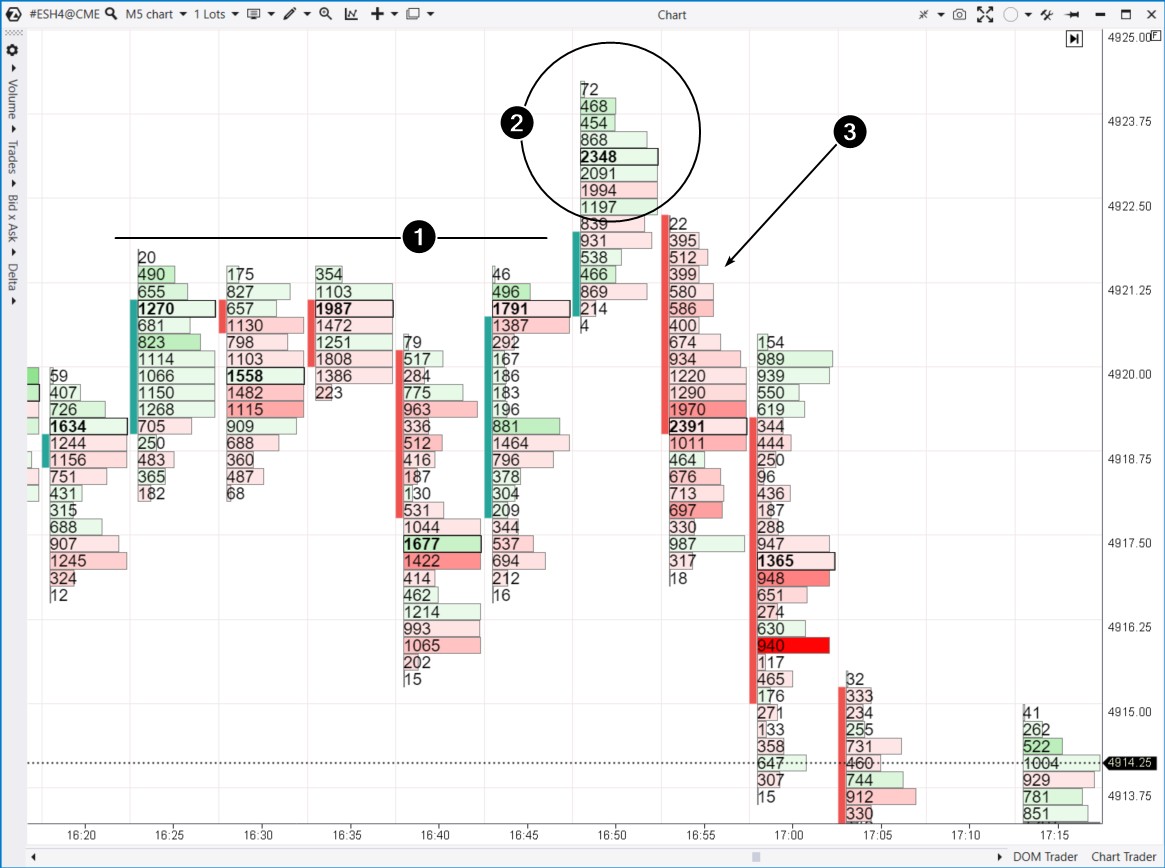

Example. The screenshot below shows a trading situation in the E-mini futures market for the S&P-500 index, data sourced from the CME exchange, with a 5-minute chart.

Let’s say a trader noticed a resistance level on the chart (1). More importantly, they observed a failure in continuing this breakout, indicated by green clusters above the resistance level (2). This could be interpreted as:

- the activity of buyers who had a period of waiting and then decided to rush into entering long positions during the breakout;

- the activity of buyers who were closing their short positions to avoid increasing losses.

The price disappointed both sides by closing below the block of green clusters. Upon seeing the formation of red clusters on the next candle, a more patient day trader might have opened a short position along with other sellers (3). The first target could be the previous low, around 4915, and the second could be a lower support level not shown on this chart.

Indicators and tools of day traders

The presented example of a trap with a false breakout is a pretty common scenario on 5-minute charts. Day traders can use such situations to their advantage across various markets. Footprint charts with diverse setting functionality in the ATAS platform will help day traders gain insights and have an edge over other market participants.

Swing Traders

Swing trading is the art of profiting from trends that last from several days to several weeks. In the quest for trading opportunities, swing traders primarily employ a combination of fundamental and technical analysis (analyzing price trends and patterns).

Successful swing traders possess patience and discipline. They must also be adept at risk management, maintain composure, and stay focused when trades deviate from their planned scenarios.

Examples of typical trades

Having read headlines in the media, a swing trader may pay attention to the market to apply indicators, technical analysis patterns, and formulate a trading plan.

Example. The screenshot below shows a daily chart of oil futures, data sourced from the NYMEX exchange. The Commitments of Traders indicator has been applied to the chart. This indicator reflects the positioning of other market participants. For more details, check out the article: What COT Reports Are. Explanations With Examples.

Pay attention to the sharp drop from point 1 to point 2. It was triggered by market participants’ concerns about a potential decrease in oil demand due to central banks raising interest rates, which was expected to slow down economic activity.

Given the abrupt price drop, a swing trader could hypothesize that the upward swing has ended, and a downward swing is likely to form soon. This hypothesis finds support in the following:

- a breakout of a lower line of the ascending channel;

- divergence on the COT Net positions indicator;

- minimal values on the COT Index indicator.

In that case, the swing trader could use Fibonacci levels to wait for a temporary 50% retracement and enter a short position. After that, they monitor the trade, gradually lowering the stop-loss as the price moves in the anticipated direction.

Swing trading offers traders the flexibility of spending minimal time monitoring diverse markets. However, swing trading requires the use of a substantial deposit, a profound understanding of market trends, and the skill to patiently await unfolding opportunities. If the market moves against the swing trader’s position, it can result in significant losses.

Position Traders

Position trading is a long-term strategy primarily focused on fundamental factors, although technical methods like long-term trend lines can also be employed. Position traders examine end-of-day/week charts, considering trends that may last from several days to several months or even years.

The primary goal of position trading is to profit from major market movements driven by macroeconomic conditions, central bank policies, and other fundamental factors. Position traders are unconcerned with minor price fluctuations or intraday pullbacks. Their attention is concentrated on the overall picture and long-term market trends.

Position traders need a strong understanding of the market’s fundamental principles, the ability to identify long-term trends, and proficiency in analyzing company financial reports. Patience, a clear strategy, and the ability to withstand market volatility without deviating from their strategy are crucial qualities for a position trader.

Example of a typical trade of a position trader

A position trader may buy company shares after a significant market decline, anticipating market recovery over the next several years. They will hold onto the shares, disregarding any short-term volatility, as they expect substantial returns from their investment.

Example. Suppose a position trader aims to outperform the S&P-500 stock index. While a typical investor might regularly invest a fixed amount at specific intervals in an instrument tracking the fluctuations of the stock index, the position trader buys the instrument, evaluating the fundamental background and weekly chart (as shown in the screenshot below):

Reasons to enter a long position on the weekly chart may include:

- A false breakout of the previous low. Learn more about the pattern in the article: False Breakout in Trading

- A 50% retracement. More about the pattern in the article: 50% Retracement: Examples of Analysis and Trading

- Testing a level with significant volume. It is noticeable using the market profile indicator

Position trading can yield substantial profits with favorable market development in the long term. However, it requires significant patience and a high tolerance for market volatility. Invested capital will be tied up for an extended period, and there is a risk of significant losses in case of a market trend reversal.

Comparison of Different Trading Types

[av_one_fourth first min_height=” vertical_alignment=’av-align-top’ space=” row_boxshadow=” row_boxshadow_width=’10’ row_boxshadow_color=” custom_margin=” margin=’0px’ av-desktop-margin=” av-medium-margin=” av-small-margin=” av-mini-margin=” mobile_breaking=” mobile_column_order=” border=” border_style=’solid’ border_color=” radius=” min_col_height=” padding=” av-desktop-padding=” av-medium-padding=” av-small-padding=” av-mini-padding=” svg_div_top=” svg_div_top_color=’#333333′ svg_div_top_width=’100′ svg_div_top_height=’50’ svg_div_top_max_height=’none’ svg_div_top_flip=” svg_div_top_invert=” svg_div_top_front=” svg_div_top_opacity=” svg_div_top_preview=” svg_div_bottom=” svg_div_bottom_color=’#333333′ svg_div_bottom_width=’100′ svg_div_bottom_height=’50’ svg_div_bottom_max_height=’none’ svg_div_bottom_flip=” svg_div_bottom_invert=” svg_div_bottom_front=” svg_div_bottom_opacity=” svg_div_bottom_preview=” fold_type=” fold_height=” fold_more=’Читать далее’ fold_less=’Read less’ fold_text_style=” fold_btn_align=” column_boxshadow=” column_boxshadow_width=’10’ column_boxshadow_color=” background=’bg_color’ background_color=” background_gradient_direction=’vertical’ background_gradient_color1=’#000000′ background_gradient_color2=’#ffffff’ background_gradient_color3=” src=” background_position=’top left’ background_repeat=’no-repeat’ highlight=” highlight_size=” fold_overlay_color=” fold_text_color=” fold_btn_color=’theme-color’ fold_btn_bg_color=” fold_btn_font_color=” size-btn-text=” av-desktop-font-size-btn-text=” av-medium-font-size-btn-text=” av-small-font-size-btn-text=” av-mini-font-size-btn-text=” animation=” animation_duration=” animation_custom_bg_color=” animation_z_index_curtain=’100′ parallax_parallax=” parallax_parallax_speed=” av-desktop-parallax_parallax=” av-desktop-parallax_parallax_speed=” av-medium-parallax_parallax=” av-medium-parallax_parallax_speed=” av-small-parallax_parallax=” av-small-parallax_parallax_speed=” av-mini-parallax_parallax=” av-mini-parallax_parallax_speed=” fold_timer=” z_index_fold=” css_position=” css_position_location=” css_position_z_index=” av-desktop-css_position=” av-desktop-css_position_location=” av-desktop-css_position_z_index=” av-medium-css_position=” av-medium-css_position_location=” av-medium-css_position_z_index=” av-small-css_position=” av-small-css_position_location=” av-small-css_position_z_index=” av-mini-css_position=” av-mini-css_position_location=” av-mini-css_position_z_index=” link=” linktarget=” link_hover=” title_attr=” alt_attr=” mobile_display=” mobile_col_pos=’0′ id=” custom_class=” template_class=” aria_label=” av_uid=” sc_version=’1.0′]

Scalp Trading

Trade Duration: Trades last from a few seconds to a few minutes.

Pros:

- Numerous opportunities to profit due to a high volume of trades.

- Limited risks thanks to extremely close stop-loss orders.

Cons:

- Trade commission expenses can noticeably impact results.

- It consumes a significant amount of time and energy.

- It requires a large number of successful trades to achieve a small profit.

Suitable For: Those with quick reflexes, the ability to dedicate the entire trading day to the markets, and the capacity to make extremely rapid decisions. It is suitable for individuals who prefer a rapidly changing, high-intensity environment, can handle stress well, and can stay focused for extended periods.

[/av_one_fourth]

[av_one_fourth min_height=” vertical_alignment=’av-align-top’ space=” row_boxshadow=” row_boxshadow_width=’10’ row_boxshadow_color=” custom_margin=” margin=’0px’ av-desktop-margin=” av-medium-margin=” av-small-margin=” av-mini-margin=” mobile_breaking=” mobile_column_order=” border=” border_style=’solid’ border_color=” radius=” min_col_height=” padding=” av-desktop-padding=” av-medium-padding=” av-small-padding=” av-mini-padding=” svg_div_top=” svg_div_top_color=’#333333′ svg_div_top_width=’100′ svg_div_top_height=’50’ svg_div_top_max_height=’none’ svg_div_top_flip=” svg_div_top_invert=” svg_div_top_front=” svg_div_top_opacity=” svg_div_top_preview=” svg_div_bottom=” svg_div_bottom_color=’#333333′ svg_div_bottom_width=’100′ svg_div_bottom_height=’50’ svg_div_bottom_max_height=’none’ svg_div_bottom_flip=” svg_div_bottom_invert=” svg_div_bottom_front=” svg_div_bottom_opacity=” svg_div_bottom_preview=” fold_type=” fold_height=” fold_more=’Читать далее’ fold_less=’Read less’ fold_text_style=” fold_btn_align=” column_boxshadow=” column_boxshadow_width=’10’ column_boxshadow_color=” background=’bg_color’ background_color=” background_gradient_direction=’vertical’ background_gradient_color1=’#000000′ background_gradient_color2=’#ffffff’ background_gradient_color3=” src=” background_position=’top left’ background_repeat=’no-repeat’ highlight=” highlight_size=” fold_overlay_color=” fold_text_color=” fold_btn_color=’theme-color’ fold_btn_bg_color=” fold_btn_font_color=” size-btn-text=” av-desktop-font-size-btn-text=” av-medium-font-size-btn-text=” av-small-font-size-btn-text=” av-mini-font-size-btn-text=” animation=” animation_duration=” animation_custom_bg_color=” animation_z_index_curtain=’100′ parallax_parallax=” parallax_parallax_speed=” av-desktop-parallax_parallax=” av-desktop-parallax_parallax_speed=” av-medium-parallax_parallax=” av-medium-parallax_parallax_speed=” av-small-parallax_parallax=” av-small-parallax_parallax_speed=” av-mini-parallax_parallax=” av-mini-parallax_parallax_speed=” fold_timer=” z_index_fold=” css_position=” css_position_location=” css_position_z_index=” av-desktop-css_position=” av-desktop-css_position_location=” av-desktop-css_position_z_index=” av-medium-css_position=” av-medium-css_position_location=” av-medium-css_position_z_index=” av-small-css_position=” av-small-css_position_location=” av-small-css_position_z_index=” av-mini-css_position=” av-mini-css_position_location=” av-mini-css_position_z_index=” link=” linktarget=” link_hover=” title_attr=” alt_attr=” mobile_display=” mobile_col_pos=’0′ id=” custom_class=” template_class=” aria_label=” av_uid=” sc_version=’1.0′]

Day Trading

Trade Duration: Trades last from a few minutes to the entire trading day but never exceed it.

Pros:

- One can gain quick profits.

- No overnight risk.

Cons:

- It takes a significant amount of time.

- It requires constant market monitoring.

- A high stress level.

Suitable For: Individuals who can dedicate the entire trading day to monitoring markets, excel under pressure, make quick decisions, and prefer a rapidly changing trading environment.

[/av_one_fourth]

[av_one_fourth min_height=” vertical_alignment=’av-align-top’ space=” row_boxshadow=” row_boxshadow_width=’10’ row_boxshadow_color=” custom_margin=” margin=’0px’ av-desktop-margin=” av-medium-margin=” av-small-margin=” av-mini-margin=” mobile_breaking=” mobile_column_order=” border=” border_style=’solid’ border_color=” radius=” min_col_height=” padding=” av-desktop-padding=” av-medium-padding=” av-small-padding=” av-mini-padding=” svg_div_top=” svg_div_top_color=’#333333′ svg_div_top_width=’100′ svg_div_top_height=’50’ svg_div_top_max_height=’none’ svg_div_top_flip=” svg_div_top_invert=” svg_div_top_front=” svg_div_top_opacity=” svg_div_top_preview=” svg_div_bottom=” svg_div_bottom_color=’#333333′ svg_div_bottom_width=’100′ svg_div_bottom_height=’50’ svg_div_bottom_max_height=’none’ svg_div_bottom_flip=” svg_div_bottom_invert=” svg_div_bottom_front=” svg_div_bottom_opacity=” svg_div_bottom_preview=” fold_type=” fold_height=” fold_more=’Читать далее’ fold_less=’Read less’ fold_text_style=” fold_btn_align=” column_boxshadow=” column_boxshadow_width=’10’ column_boxshadow_color=” background=’bg_color’ background_color=” background_gradient_direction=’vertical’ background_gradient_color1=’#000000′ background_gradient_color2=’#ffffff’ background_gradient_color3=” src=” background_position=’top left’ background_repeat=’no-repeat’ highlight=” highlight_size=” fold_overlay_color=” fold_text_color=” fold_btn_color=’theme-color’ fold_btn_bg_color=” fold_btn_font_color=” size-btn-text=” av-desktop-font-size-btn-text=” av-medium-font-size-btn-text=” av-small-font-size-btn-text=” av-mini-font-size-btn-text=” animation=” animation_duration=” animation_custom_bg_color=” animation_z_index_curtain=’100′ parallax_parallax=” parallax_parallax_speed=” av-desktop-parallax_parallax=” av-desktop-parallax_parallax_speed=” av-medium-parallax_parallax=” av-medium-parallax_parallax_speed=” av-small-parallax_parallax=” av-small-parallax_parallax_speed=” av-mini-parallax_parallax=” av-mini-parallax_parallax_speed=” fold_timer=” z_index_fold=” css_position=” css_position_location=” css_position_z_index=” av-desktop-css_position=” av-desktop-css_position_location=” av-desktop-css_position_z_index=” av-medium-css_position=” av-medium-css_position_location=” av-medium-css_position_z_index=” av-small-css_position=” av-small-css_position_location=” av-small-css_position_z_index=” av-mini-css_position=” av-mini-css_position_location=” av-mini-css_position_z_index=” link=” linktarget=” link_hover=” title_attr=” alt_attr=” mobile_display=” mobile_col_pos=’0′ id=” custom_class=” template_class=” aria_label=” av_uid=” sc_version=’1.0′]

Swing Trading

Trade Duration: Trades last from several days to several weeks.

Pros:

- One can capitalize on short-term market trends.

- No need for constant monitoring.

Cons:

- Trades are exposed to market risk during overnight and weekends.

- It requires a deep understanding of market trends.

Suitable For: Those who cannot constantly monitor the market but are willing to dedicate a few hours daily or weekly to charts. For patient individuals who understand market trends well and can handle its short-term fluctuations.

[/av_one_fourth]

[av_one_fourth min_height=” vertical_alignment=’av-align-top’ space=” row_boxshadow=” row_boxshadow_width=’10’ row_boxshadow_color=” custom_margin=” margin=’0px’ av-desktop-margin=” av-medium-margin=” av-small-margin=” av-mini-margin=” mobile_breaking=” mobile_column_order=” border=” border_style=’solid’ border_color=” radius=” min_col_height=” padding=” av-desktop-padding=” av-medium-padding=” av-small-padding=” av-mini-padding=” svg_div_top=” svg_div_top_color=’#333333′ svg_div_top_width=’100′ svg_div_top_height=’50’ svg_div_top_max_height=’none’ svg_div_top_flip=” svg_div_top_invert=” svg_div_top_front=” svg_div_top_opacity=” svg_div_top_preview=” svg_div_bottom=” svg_div_bottom_color=’#333333′ svg_div_bottom_width=’100′ svg_div_bottom_height=’50’ svg_div_bottom_max_height=’none’ svg_div_bottom_flip=” svg_div_bottom_invert=” svg_div_bottom_front=” svg_div_bottom_opacity=” svg_div_bottom_preview=” fold_type=” fold_height=” fold_more=’Читать далее’ fold_less=’Read less’ fold_text_style=” fold_btn_align=” column_boxshadow=” column_boxshadow_width=’10’ column_boxshadow_color=” background=’bg_color’ background_color=” background_gradient_direction=’vertical’ background_gradient_color1=’#000000′ background_gradient_color2=’#ffffff’ background_gradient_color3=” src=” background_position=’top left’ background_repeat=’no-repeat’ highlight=” highlight_size=” fold_overlay_color=” fold_text_color=” fold_btn_color=’theme-color’ fold_btn_bg_color=” fold_btn_font_color=” size-btn-text=” av-desktop-font-size-btn-text=” av-medium-font-size-btn-text=” av-small-font-size-btn-text=” av-mini-font-size-btn-text=” animation=” animation_duration=” animation_custom_bg_color=” animation_z_index_curtain=’100′ parallax_parallax=” parallax_parallax_speed=” av-desktop-parallax_parallax=” av-desktop-parallax_parallax_speed=” av-medium-parallax_parallax=” av-medium-parallax_parallax_speed=” av-small-parallax_parallax=” av-small-parallax_parallax_speed=” av-mini-parallax_parallax=” av-mini-parallax_parallax_speed=” fold_timer=” z_index_fold=” css_position=” css_position_location=” css_position_z_index=” av-desktop-css_position=” av-desktop-css_position_location=” av-desktop-css_position_z_index=” av-medium-css_position=” av-medium-css_position_location=” av-medium-css_position_z_index=” av-small-css_position=” av-small-css_position_location=” av-small-css_position_z_index=” av-mini-css_position=” av-mini-css_position_location=” av-mini-css_position_z_index=” link=” linktarget=” link_hover=” title_attr=” alt_attr=” mobile_display=” mobile_col_pos=’0′ id=” custom_class=” template_class=” aria_label=” av_uid=” sc_version=’1.0′]

Position Trading

Trade Duration: Trades can last from several months to several years.

Pros:

- One can gain significant profit in favorable market trends.

- Low stress level, as it does not require constant market monitoring.

Cons:

- Capital is tied up for a longer period.

- It requires patience and a high tolerance for market volatility.

Suitable For: Traders that use long-term strategies and do not need immediate liquidity. It is perfect for those who prefer conducting thorough research and are willing to wait for their investment predictions to prove accurate.

[/av_one_fourth]

FAQ

Can these trading styles be applied to all types of markets for stocks, forex, and cryptocurrencies?

In general, yes. Although the fundamental principles of each trading style can be applied universally, traders need to consider each market’s unique characteristics and volatility individually. For example, the cryptocurrency market is known for its high volatility and 24/7 trading, making it more suitable for scalping.

How important is it to stick to one trading style?

Generally, traders are recommended to stick to the trading style that aligns with their personality type, acceptable risk, and schedule. However, with experience, traders may adopt or incorporate specific aspects of other trading styles. Ensuring that such experiments do not make the strategy overly complex is crucial.

What capital is needed to start trading?

The required capital varies depending on the market and trading style. It is considered that scalping and day trading require a smaller initial capital. On the other hand, swing traders will need more capital due to wider stop-loss levels and the cost of holding positions overnight. It is important to trade only with money you can afford to lose.

Can one change their trading style?

Yes, traders can change their trading styles, but it should be well-considered. Ensure the new style aligns with your goals, acceptable risks, and life circumstances. Base decisions on facts rather than preferences. It is recommended that any new strategy be thoroughly tested before fully committing.

Psychological Types of Traders

Earlier, we categorized traders based on the duration of their trades, ranging from scalpers holding positions for a few seconds to position traders maintaining positions for several years.

Traders are also classified according to three psychological types:

- Intellectuals

- Intuitive Traders

- Instinctive Traders

These categories are conditional, as real traders may exhibit a combination of different traits. The most effective trading approach usually relies on a balance of intellectual analysis, intuitive understanding, and controlled emotional responses. And, of course, individual characteristics should always be taken into account.

Intellectual Traders

Characteristic Traits. These traders heavily rely on their analytical abilities. They quickly interpret market data, indicator values, and make informed decisions. Intellectual traders thoroughly research the market, refer to statistics, and continuously learn to stay ahead.

Strengths. The ability to make informed decisions based on objective analysis, resisting emotional reactions during market fluctuations.

Challenges. They may sometimes overlook market sentiments or unconventional indicators that do not fit into their analytical system.

Intuitive Traders

Characteristic Traits. Intuitive traders have a keen sense of market sentiments and trends. They often base their decisions on an innate understanding of market dynamics, which may not always be quantitatively assessable.

Strengths. The ability to intuitively notice subtle market signals that other traders might miss. This often leads to the creation of innovative trading strategies.

Challenges. Excessive reliance on intuition, which can result in inconsistency if not supplemented with objective analysis.

Instinctive Traders

Characteristic Traits. These traders are significantly influenced by emotions and instinctive reactions. Their trading style can be more aggressive or defensive, depending on their emotional state.

Strengths. They quickly respond to instant market changes, using the potential of short-term opportunities.

Challenges. They are prone to impulsive decisions driven by fear or greed, which can lead to inconsistent results.

Recommendations for All Types of Traders

- Assess your risk tolerance. Every trading style has its unique risk profile. Carefully assess your risk tolerance and choose a style that suits your comfort level.

- Keep learning. Regardless of your chosen trading style, understanding market mechanics, volume analysis, and fundamental trends significantly influences the outcome.

- Start with a demo account. Before investing real capital, practice with a demo account or a trading simulator that uses historical data. This will enable you to learn market dynamics and apply trading platform tools without risking money.

- Develop a trading plan. A well-thought-out trading plan is a roadmap to success. It should include a strategy, entry and exit points, as well as risk management rules.

- Control your emotions. Emotions during trading are similar to a roller coaster ride. Develop strategies for emotional management and maintaining discipline.

ATAS platform is premium-class software designed for analyzing and executing trades in stock, cryptocurrency, and futures markets.

ATAS offers advanced functionality beneficial for various types of traders:

- Market Replay is a market simulator that enables you to replay historical data and practice trading on the financial exchange as if trading was happening in real time. It will enable you to gain the necessary experience without risking real capital.

- Indicators. Scalpers and day traders can appreciate Cluster Search, Big Trades, Speed of Tape, DOM levels. Daily footprints, market profiles, and COT report indicators are useful for swing and position trading.

- Educational resources. Different types of traders can use our blog, YouTube channel, and Knowledge Base to find detailed instructions on how to set up charts and work with them, use indicators, and develop strategies. Additionally, ATAS platform users can rely on responsive customer support.

Conclusions

Understanding different trader types is more than an academic task. It is a foundational aspect of adeptly navigating financial markets.

Recognizing and embracing your trading style is crucial, regardless of whether you are:

- a scalp trader seeking the adrenaline of rapid trading;

- a day trader, capitalizing on small price movements;

- a swing trader using short-term market trends;

- position trader, contemplating the long-term future.

Download ATAS. Right after registration, you will have a free START tariff activated. It allows you to trade cryptocurrencies without restrictions and use basic functionality to analyze classic markets. You can use the START tariff as long as you want. At any time, you can activate the Free Trial to get the platform’s full functionality within 14 days, or you can buy an advanced tariff at once.

Do not miss the next article on our blog. Subscribe to our YouTube channel, and follow us on Facebook, Instagram, Telegram, or X, where we publish the latest ATAS news.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.