Mark Douglas, author of the popular “Trading in the Zone” book, started his trading career in 1978. However, by 1981, he had lost all his capital, struggling with a lack of discipline and an unbalanced lifestyle. This painful experience was a turning point for him: he dedicated himself to understanding trading psychology, founded a company to help traders develop psychological skills, and wrote several bestselling books that are still relevant today.

If you already have a good grasp of market mechanics (for example, you understand how the footprint works) but are still finding it hard to achieve consistent profits, the concepts in this book will be especially useful. The issue may be psychological barriers you need to overcome in order to reach what Douglas calls the “threshold of consistency.” A crucial step in developing the right trading mindset is learning to fully accept the risks involved.

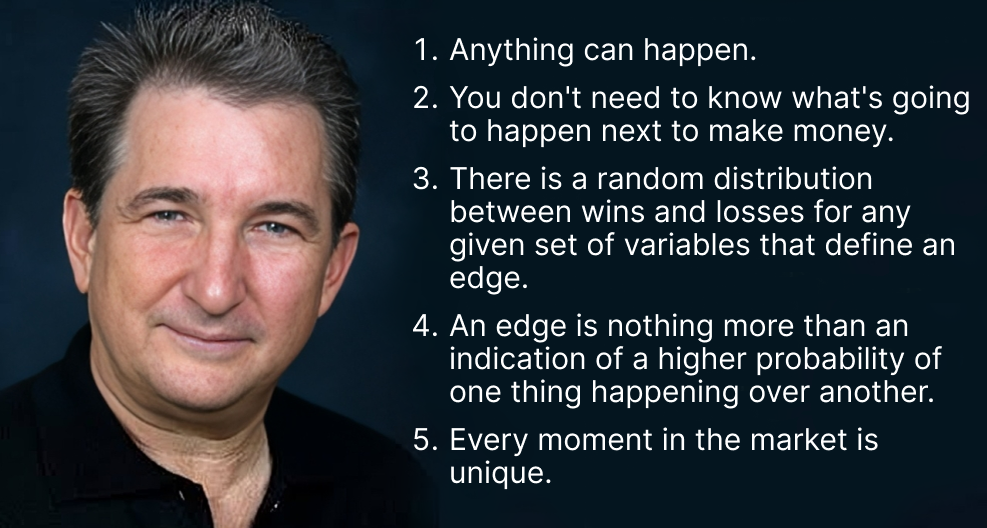

Key ideas from “Trading in the Zone”:

Why Fundamental and Technical Analyses Alone Are Not Enough for Success

“No amount of market analysis will compensate for

developing a winning attitude if you lack one.”

Mark Douglas

Fundamental analysis. In the past, fundamental analysis was the primary method for making trading decisions. However, its drawback is that it does not account for the behavior of other traders. Models based on fundamental data (like interest rates or financial reports) do not always work because markets are driven by people, and their actions can be irrational.

Technical analysis. Since the 1980s, technical analysis has gained popularity among traders. This method focuses on tracking the collective behavior of market participants and identifying patterns that tend to repeat, helping to forecast price movements. Unlike fundamental analysis, technical analysis enables traders to react more effectively to current market conditions rather than relying solely on long-term predictions.

Mental analysis. While fundamental and technical analysis provide traders with many opportunities, most traders eventually realize that this alone is not enough for consistent success — something more is needed.

95% of the mistakes that lead to losses in trading are related to:

- the attitude toward failures;

- the attitude toward being wrong;

- the attitude toward missed opportunities;

- the habit of not taking profits at the right time.

These mistakes are often made worse by the need to find a logical explanation for every market move, indecision, and impulsive actions.

The biggest challenge is that predicting the market is not the same as trading successfully. While every trade involves risk, not all traders are able to fully accept it. The fear of being wrong and losing money often clouds judgment, leading to poor decisions and ultimately, losses.

✔ The key difference between successful traders and others is their ability to accept risk while staying confident, without being driven by fear. They understand that the market does not control their decisions.

What should you do? You need to develop beliefs about trading that allow you to:

- trade without fear,

- stay disciplined and avoid impulsive actions.

Why Trading Offers Freedom but With Serious Risks

“If I had to choose one word that encapsulates

the nature of trading, it would be “paradox.”

Mark Douglas

Trading attracts people with its freedom and a chance for creative expression, something many lack in everyday life. As a result, people often approach trading with the wrong motivations, such as seeking recognition or a feeling of euphoria.

Unlike most professions, trading offers almost unlimited freedom when it comes to choosing tools, timeframes, and indicators. But this freedom also brings many risks, such as:

✔ Resistance to setting rules. Many people grow up in environments where they are controlled, so they resist creating rules for themselves, which is essential in trading. This can lead to issues with discipline and focus.

✔ Avoiding responsibility. Unlike other jobs that have clear rules and accountability, trading has no formal boundaries. Traders who avoid responsibility, risk endless financial losses.

✔ Dependence on random rewards. Random profits can make trading feel like a form of gambling, where traders continue making trades hoping for the next win.

Trading is a freedom that demands self-discipline. Success comes to those who learn to control their thoughts, actions, and perception of risk, rather than trying to control the market.

How Traders Can Learn to Take Responsibility

“When you have accepted the risk,

you will be at peace with any outcome.”

Mark Douglas

To fully take responsibility for their actions, traders need to understand that the outcome of every trade is entirely dependent on their own decisions and actions — not on the market or external factors.

What not to do:

- Blame the market (or the broker, market maker, media analysts, or trading platform) for failures.

- Expect the market to deliver success.

What is right:

- Recognize that any losses are the result of the trader’s own choices, not some malicious force in the market.

- Understand that the market is neutral, offering equal opportunities to all participants. The trader’s job is to learn how to use those opportunities effectively.

- Learn from mistakes, adjust strategies, and base decisions on objective market information.

Taking responsibility also means building mental discipline to manage emotions like fear and euphoria. This mindset helps create a “winning attitude,” where the trader is focused on continuous self-improvement and adapting to the changing market.

How Perception of Charts Affects Trading Decisions

“Objectivity is a state of mind where you have conscious access to everything

you have learned about the nature of market movement.”

Mark Douglas

The market itself does not carry positive or negative meaning — it is our perception that colors it with emotion. For example, someone who was bitten by a dog as a child may fear all dogs, even if they pose no threat. Successful traders know how to view the market neutrally, steering clear of emotions like fear or euphoria.

To see the market objectively, traders should:

✔ Stop seeing market fluctuations as an emotional trigger. It is important to treat each new signal as a unique opportunity without letting past successes or failures distort perception.

✔ Focus on opportunities, not risks. Expecting losses should be a rational part of your strategy, but it should not dominate your decision-making process.

✔ Control emotions. Feeling fear, euphoria, or hesitation? Pause. Trading should be based on rules and logic, not impulsive instincts.

✔ Accept that risk is inevitable. Before entering a trade, evaluate how much risk you are willing to take and only proceed when you can accept that risk without emotional tension.

What to Keep in Mind Before Opening a Trade

“Carefree means confident, but not euphoric.”

Mark Douglas

Casinos thrive on games where the outcomes may seem random, but because of the rules and the number of players, the casino always has a statistical edge. Similarly, the best traders do not chase certainty in every trade — they focus on maintaining an edge in probabilities over the long run.

To start thinking in terms of probabilities, you need to:

- Accept that anything can happen in the market.

- Understand that you do not have to predict every single market move to make money.

- Know that profits and losses are distributed randomly.

- Believe in your edge, recognizing it as a representation of higher chances of success in every trade.

- Recognize that every market moment is unique.

Successful traders view each trade as an independent event with an uncertain outcome, yet they understand that by consistently following their strategy, they can achieve steady profits over time.

✔ Here is what you need to keep in mind when opening a trade:

✔ There are facts pointing to a competitive edge.

✔ You need to risk a certain amount to find out if the trade will be successful.

✔ You do not have to know exactly what will happen next to make a profit.

✔ Anything can happen in the market.

The Influence of Beliefs on Trading Success

“If your beliefs about the market are not in harmony with its true nature,

your perception will be distorted, and you will not be able to act effectively.”

Mark Douglas

If a trader deep down does not believe they deserve success (for example, due to the belief that wealth is bad), this internal belief can sabotage their actions and hinder their ability to achieve consistent results and growth.

Mark Douglas identifies three key characteristics of such beliefs:

- Beliefs influence traders whether they are aware of them or not.

- Active beliefs strive to manifest, even if they are suppressed by external circumstances.

- Beliefs “resist” change but can be energetically “deactivated,” much like the belief in Santa Claus.

7 Beliefs Essential for Consistent Success in Trading:

- I objectively identify my trading edge.

- I calculate the risks for each trade in advance.

- I fully accept the potential loss of a specific amount on a trade.

- My actions align completely and unconditionally with my trading edge.

- I reward myself as the market presents opportunities to earn.

- I continually monitor my tendency to make mistakes.

- I recognize the importance of following the principles of consistent success and never compromise them.

Should You Read “Trading in the Zone”?

In “Trading in the Zone”, Mark Douglas describes the “zone” as a special mindset where traders can operate with confidence, free from fear, stress, or over-emotional reactions. It is a state of deep concentration and calmness, enabling traders to make decisions based on an objective view of market data rather than being driven by fear, thrill, or hope.

If some of the key ideas mentioned above resonate with you, it might be worth downloading “Trading in the Zone” or reading it online. This is especially true if you are already familiar with footprint patterns and volume indicators but still struggle to find consistency and discipline in your trading.

“Trading in the Zone” begins and ends with a questionnaire, and Douglas assures readers that their answers will change after finishing the book.

Conclusions

According to Douglas, the key difference between successful and struggling traders lies in their psychology. It is not just about analysis but adopting the right mindset. Successful traders have confidence in their decisions, they do not fear market unpredictability, and stay focused on opportunities, ignoring fears.

To reach that “zone” where trading flows smoothly, traders need to:

- Think in terms of probabilities.

- Stay emotionally grounded.

- Focus fully on the present moment and the trading process.

- Let go of expectations and attachments.

Mark Douglas would likely have appreciated trading simulators like ATAS Market Replay, which enables traders to practice using historical data. These tools are perfect for “reprogramming” your beliefs about the market and cultivating the right mindset.

The simulator provides traders with unique opportunities by allowing them to:

- explore different scenarios repeatedly;

- see that individual trade outcomes are always unpredictable;

- confirm that stability can be achieved within a solid strategy;

- improve their skills effectively without risking capital.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.