What makes one trading platform better than another? The answer to this question depends on a variety of factors, ranging from the available tools and assets to the speed of order execution and the level of security. Each trader, with their unique goals, trading style, and experience level, seeks specific tools and features in a trading platform.

In this article, we will discuss the strengths and weaknesses of different trading platforms. We hope this analysis will help you make an informed decision and choose the platform that best suits your individual needs.

Read more:

What Is a Trading Platform?

In trading, the term “platform” covers a wide range of tools — from simple mobile apps to advanced professional terminals. It is important to keep your goals and context in mind.

✔ Trading software. A platform in this context refers to an app for computers or smartphones that helps with various trading tasks. These platforms offer access to market data, technical and volume analysis tools, order execution features, and options for setting up exit strategies.

- Examples: ATAS, MetaTrader.

✔ Brokerage platforms. Brokers serve as intermediaries for individual traders, providing access to markets for trading stocks and other financial assets. They not only offer their own trading software but also different account types, analytics, educational resources, and other services.

- Examples: Fidelity, Charles Schwab, Robinhood.

✔ Cryptocurrency Trading Platforms. In this case, a platform usually refers to a cryptocurrency exchange that allows the trading of digital assets.

- Examples: Binance, Bybit.

Top 10 Best Official Trading Platforms

This overview of the top 10 trading platforms is intended for informational purposes only. The order in which the platforms are presented does not indicate their ranking and should not be viewed as a recommendation.

Please note that the terms and features of each trading platform can change without prior notice. We recommend visiting the official websites of these platforms to verify the latest information before making any decisions.

ATAS. Best Trading Platform for Volume Analysis

ATAS is a trading and analytics platform designed for traders who want a deeper understanding of the market. By specializing in volume analysis, ATAS gives traders a significant edge. Its advanced tools help analyze supply and demand imbalances, which are key drivers of price movement.

Key features:

- Founded in 2011.

- Over 300,000 clients from 130 countries.

- Free START plan available.

- Access to stock, futures, and cryptocurrency markets.

Advantages of the ATAS trading platform:

- Professional volume analysis tools: 400+ types of cluster charts, heatmaps, advanced indicators like Market Profile & TPO, Cluster Search, DOM Levels, Big Trades, the unique ATAS Smart Tape module, and more.

- Working with charts: standard and unique timeframes, tick data history loading.

- Trading: the Chart Trader panel and an order book module with ATAS Smart DOM features. You can use one-click trading and built-in exit strategies.

- Alerts, watchlists, saved templates, and workspaces, along with flexible customization of all platform elements, and API integration.

- You can create custom indicators and trading bots using C# or hire professional developers to create them.

- It has a Market Replay simulator for traders, demo accounts, and a module for analyzing trading statistics.

- Responsive customer support, plus the ability to ask questions in trader communities on Discord and Telegram. Comprehensive educational resources are available in the blog, on the YouTube channel, and within the platform’s Learn section.

Disadvantages:

- Primarily designed for desktop use on Windows, with no mobile version available.

- It requires additional connections to brokerage accounts or crypto exchanges.

- Options trading is not supported.

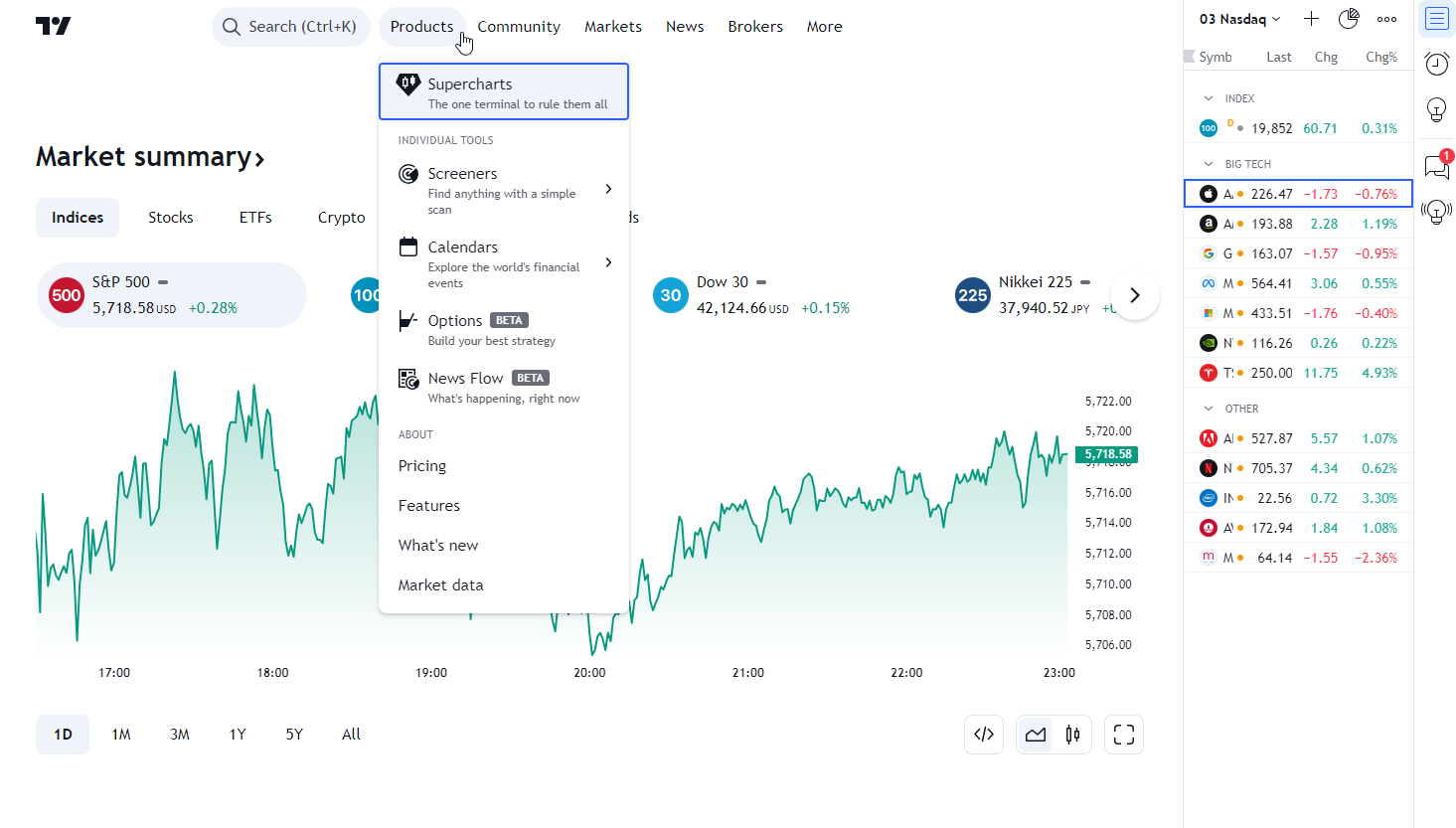

TradingView. Best Online Trading Platform for Beginners

TradingView is an online platform for technical analysis and charting that provides access to data on a wide range of financial instruments. It also allows traders to share ideas, create and distribute custom indicators, and much more.

Key features:

- Founded in 2011.

- 50+ million unique visitors per month.

- TradingView operates in a browser. It has official desktop versions and mobile apps for iOS and Android.

- Paid plans range from $14.95 to $59.95 per month.

Advantages of the platform:

- An award-winning intuitive interface featuring beautiful and functional charts with various timeframes.

- The ability to connect with multiple brokers for trading forex, futures, cryptocurrencies, and other exchange-traded assets.

- Access to fundamental analysis data for companies, along with news feeds.

- A proprietary programming language, Pine Script, that enables you to create indicators and algorithmic strategies, with the option to backtest them using historical data.

- Alerts, screeners, watchlists, built-in demo accounts, and replay functionality.

- Social features for sharing trading ideas, following other traders, and chatting.

Disadvantages of the platform:

- Support inquiries may sometimes go unanswered.

- The free version has limitations. For instance, creating a market profile requires a paid subscription.

- To save resources, the platform might reduce the accuracy of indicator readings.

- Footprint charts are not available.

- Most indicators on the platform do not offer a significant trading advantage.

- Many user-published trading ideas are overly simplistic or lack a thorough market analysis.

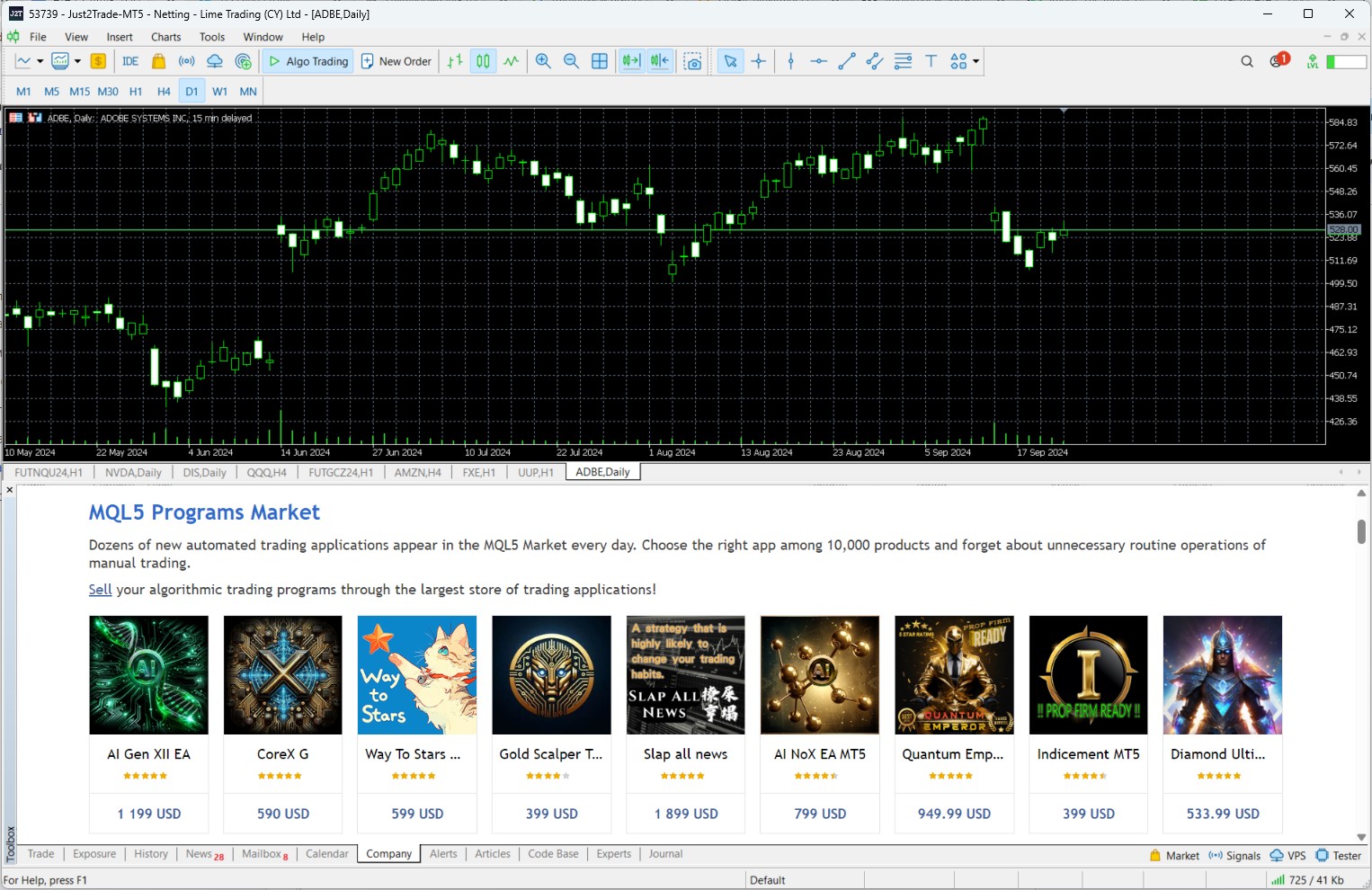

MetaTrader 5. Most Popular Trading Platform

MetaTrader 5 (MT5) is a multifunctional platform developed by MetaQuotes for trading on financial markets. The earlier version, MT4, is often associated with questionable forex brokers operating in offshore jurisdictions. However, MT5 has gained a professional reputation due to its official trading operations with brokers on exchanges like CME, Nasdaq, and others.

Key features:

- MetaTrader 4 (MT4) was launched in 2005, while MetaTrader 5 (MT5) was introduced in 2010.

- MetaQuotes is a Russian company. For some time, its trading platforms were under sanctions and could not be downloaded from official app stores.

- The platform is free, but full functionality requires payment for broker services. Over 1,000 brokers and financial institutions offer trading through MetaTrader 4 and MetaTrader 5 to their clients.

- According to Google Play and the App Store, the mobile versions of MetaTrader 4 and MetaTrader 5 have been downloaded over 10 million times on Android devices alone.

Advantages of the platform:

- Proven stability and speed of operation.

- Connections to multiple markets (depending on broker conditions).

- MQL is a language for writing indicators and trading advisors, with the option to commission freelancers to program your ideas.

- An integrated marketplace for indicators and algorithmic strategies, along with free testing options. A strategy tester that uses historical data. VPS support for uninterrupted operation of advisors.

- The option to subscribe to trading signals.

- The option to hedge — opening positions in both directions simultaneously (if allowed by your broker).

Disadvantages of the platform:

- The interface may feel outdated, and using the drawing objects can be inconvenient.

- Many algorithmic advisors and trading signals are based on high-risk trading strategies.

- Footprint charts are not available by default.

The ATAS platform has a connector to MT5. You can use your account with a supported MT5 broker for market analysis and order placement. In ATAS, you can trade on MT5 through AMP Futures, which offers affordable pricing for futures trading on the CME.

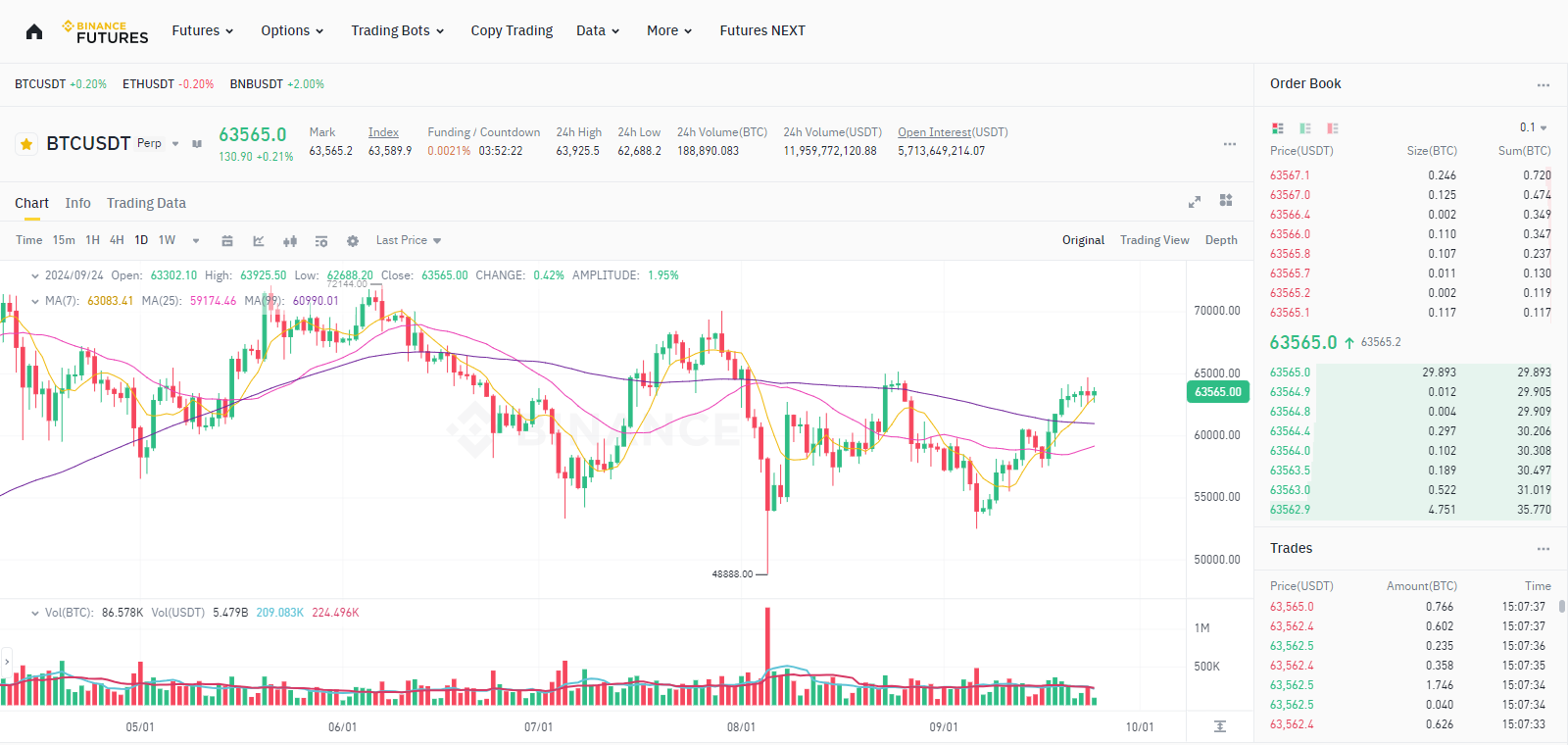

Binance. Most Popular Cryptocurrency Trading Platform

Binance is the world’s largest cryptocurrency exchange, enabling users to buy, sell, trade, and store cryptocurrencies. Founded in 2017 by Changpeng Zhao, Binance quickly became a leader in the crypto industry, naturally drawing attention from the U.S. SEC and other regulators.

Key features of the platform:

- Daily trading volume exceeds $12 billion (according to Coinmarketcap, fall 2024).

- The best trading platform in terms of market liquidity.

- 10+ million unique visitors per week.

- Free to use, with transaction fees (e.g., futures trading fees range from 0.02% to 0.05% for smaller volumes).

Advantages of Binance Crypto Platform:

- You can trade futures and profit from both rising and falling cryptocurrency prices.

- You can analyze volumes and trade on ATAS via API integration.

- It is possible to copy trades, and trade options on major cryptocurrencies.

- There are opportunities for passive income (e.g., through staking), using bots for grid trading strategies, participation in airdrops, trader tournaments, NFT operations, and more.

Disadvantages of the platform:

- Support inquiries may sometimes go unanswered.

- The exchange may restrict access to clients from certain countries.

- Risk of hacking.

- Simplified trading interface with basic indicators.

- No footprint charts or professional tools for volume analysis.

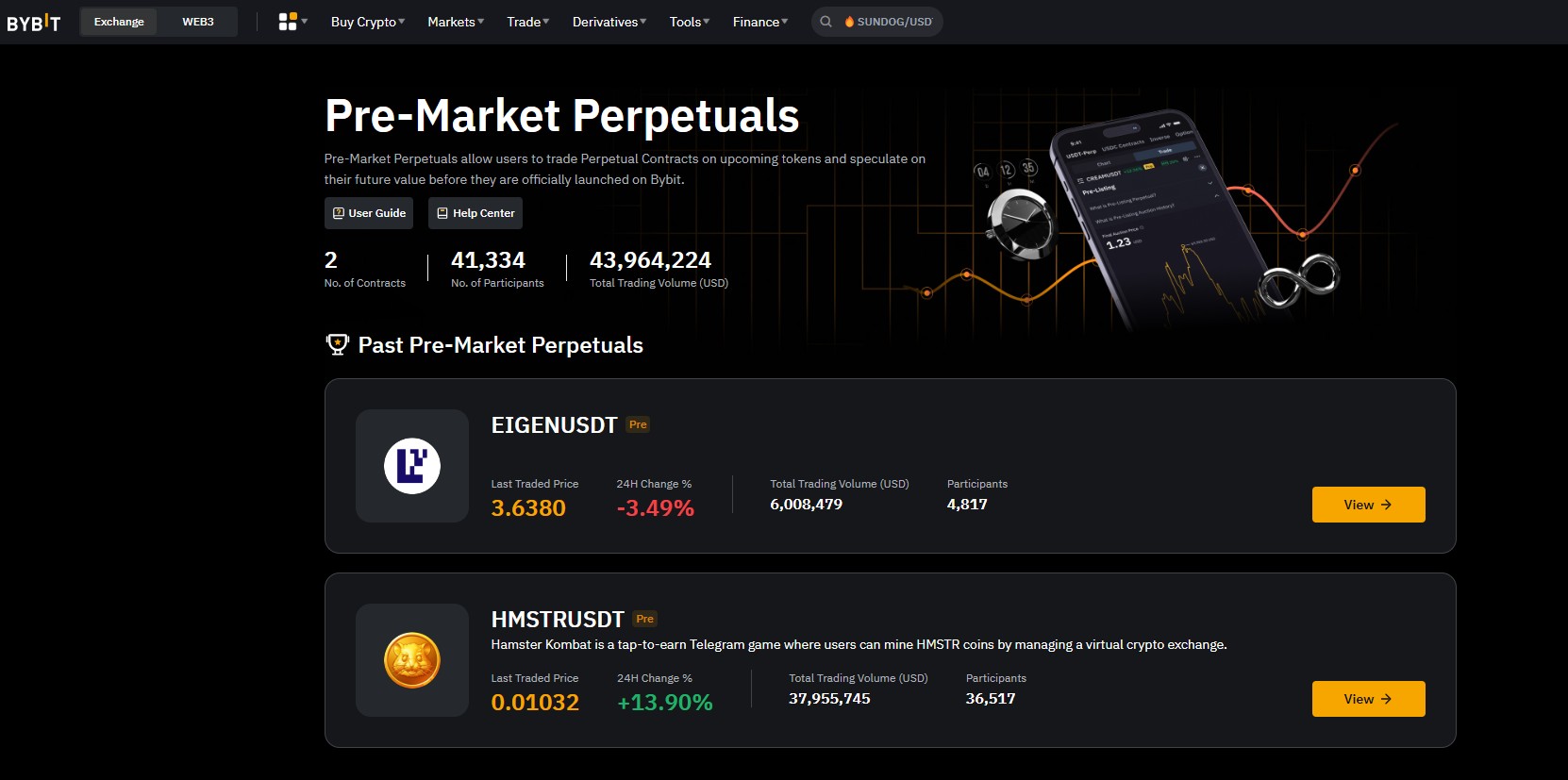

Bybit. Best for Trading New Crypto Assets

Bybit is a leading platform for trading cryptocurrency derivatives, offering a wide range of tools and features tailored to professional traders. With its futures trading options, traders can profit from both rising and falling cryptocurrency prices.

Key features:

- Founded in 2018.

- Bybit often lists new cryptocurrencies earlier than Binance.

The advantages and disadvantages of Bybit are similar to those of Binance, with differences mainly due to varying regulations. For example, U.S. citizens can trade on Binance, but not on Bybit.

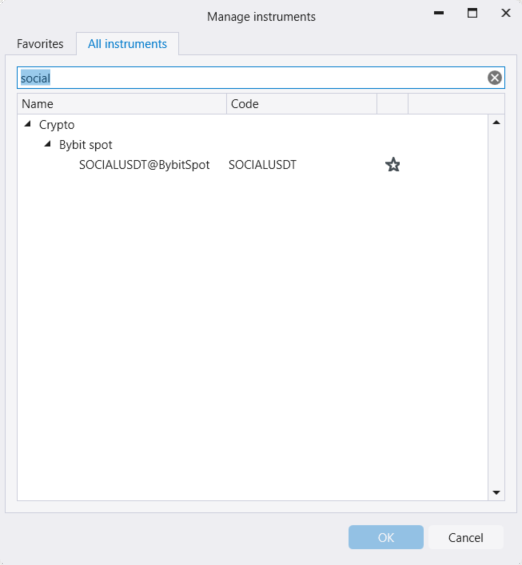

You can trade on Bybit via ATAS using an API — see the instructions for more details.

The screenshot below confirms once again that Bybit frequently lists new tokens faster than other platforms. At the time of writing, out of all the crypto exchanges available on ATAS, trading the SOCIAL token was only possible on Bybit.

Coinglass. Best Tool to Enhance Cryptocurrency Trading Platforms

Formerly known as Bybt, Coinglass focuses on delivering data on futures markets, liquidations, open interest, and other key metrics that provide cryptocurrency traders with valuable insights for more informed decision-making.

Key features:

- The platform aggregates real-time data from multiple crypto exchanges into a comprehensive overview.

- Free access.

- Available as a web version and mobile apps.

Advantages of the platform:

- You can analyze the trading activity of top cryptocurrency traders, liquidation spikes, changes in open interest, delta, cumulative delta, and other metrics.

- You can analyze options markets and order book liquidity.

- Simple and practical design.

- Registered users can save their customized settings.

Disadvantages of the platform:

- No option to place orders or connect accounts.

- Consumes significant device resources when multiple charts are open.

- Footprint charts are not available.

By using ATAS to trade cryptocurrencies, you can enhance your strategies and gain new insights by using data from Coinglass.

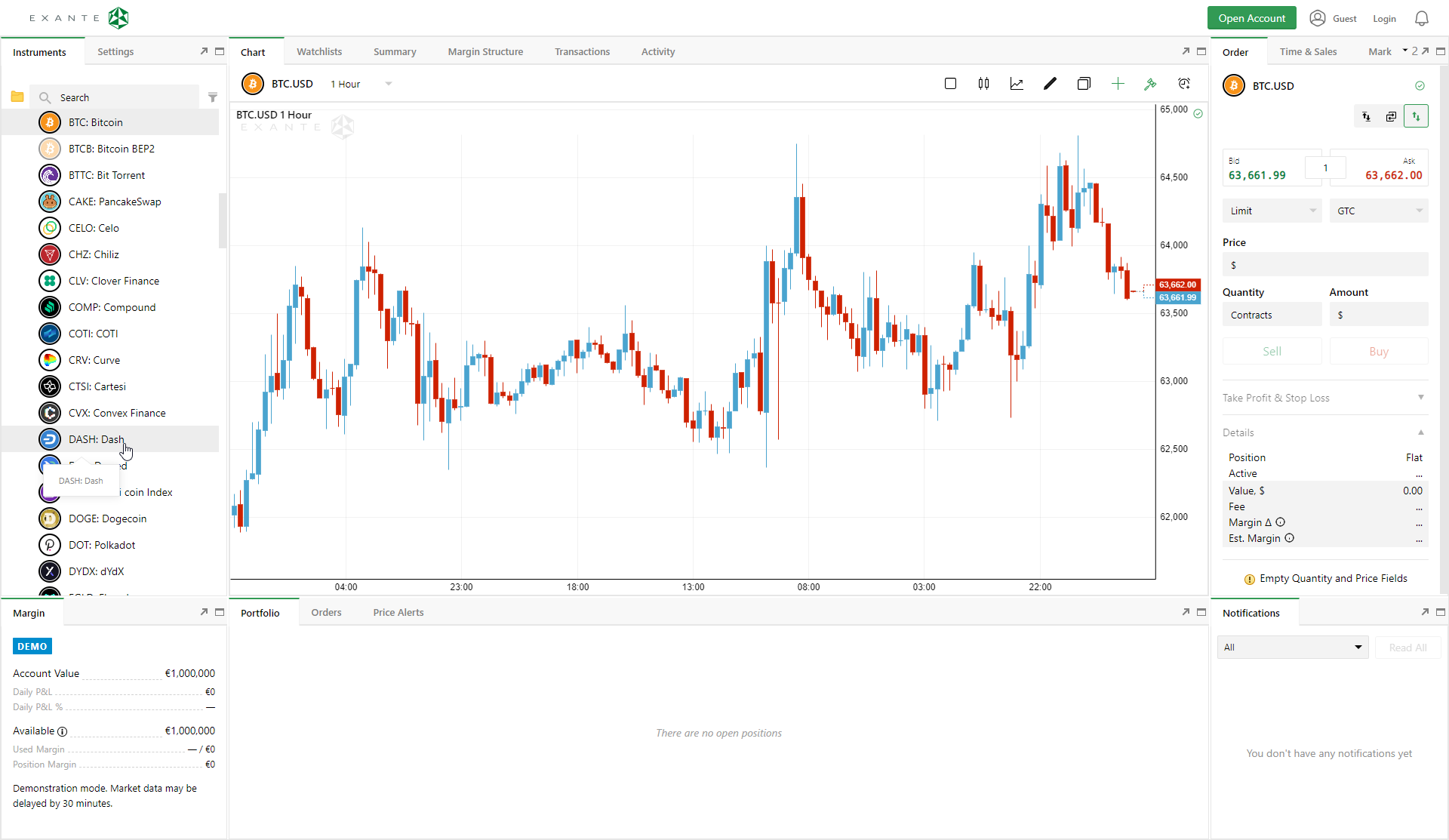

Exante. Best Trading Platform for Market Coverage

Exante is an international broker providing access to numerous financial markets worldwide through its trading platform.

Key features:

- Founded in 2011.

- Regulated by Cyprus’ CySEC.

- Has annual awards and is nominated as the “Best Trading Platform” at the 2024 Fintech Awards.

Advantages of the platform:

- Offers a web interface, mobile versions, and support for various operating systems.

- Has extensive market coverage: clients can trade over 1,000,000 instruments on exchanges across the U.S., Europe, and Asia.

- You can trade stocks, ETFs, futures, options, and forex.

- Easy access to demo accounts.

- You can trade on ATAS using an Exante brokerage account.

Disadvantages of the platform:

- The minimum deposit for a new account is €10,000.

- Limited market analysis tools: only basic classic indicators, with a less functional order book and the depth of market panel.

- No footprint charts or professional indicators for volume analysis.

ATAS users can connect Exante to their accounts to bypass these limitations, gaining access to cluster charts, advanced indicators, and other features.

IBKR. Most Reliable Trading Platform

IBKR (Interactive Brokers) — founded in 1978, is one of the largest and most respected online brokerage companies in the world. The platform is designed for both institutional and individual investors.

Key features:

- Nearly 3 million clients.

- IBKR shares are traded on NASDAQ.

- Awarded “Best Online Broker” by Barron’s, Nerdwallet, and others.

- Regulated by the US SEC and CFTC, a participant in the SIPC compensation program, and holds an FCA license for its UK division.

- Extensive educational resources, including blogs, podcasts, webinars, and courses at the Traders’ Academy.

The company offers its clients a wide range of trading platforms:

- for mobile devices: IBKR GlobalTrader, IBKR Mobile;

- for desktop: the flagship Trader Workstation (TWS) platform and the newer IBKR Desktop (shown in the screenshot below).

Advantages of the IBKR desktop platform:

- Supports options trading and the creation of options strategies.

- Offers access to data that can be used for fundamental analysis.

- Has a modern interface similar to TradingView charts.

- You can trade on ATAS using an IBKR brokerage account.

- Provides trading stats and portfolio analysis.

Disadvantages of the platform:

- Potential delays in customer support responses.

- The native IBKR Desktop platform does not offer footprint charts or advanced volume analysis indicators.

The account opening process is complicated.

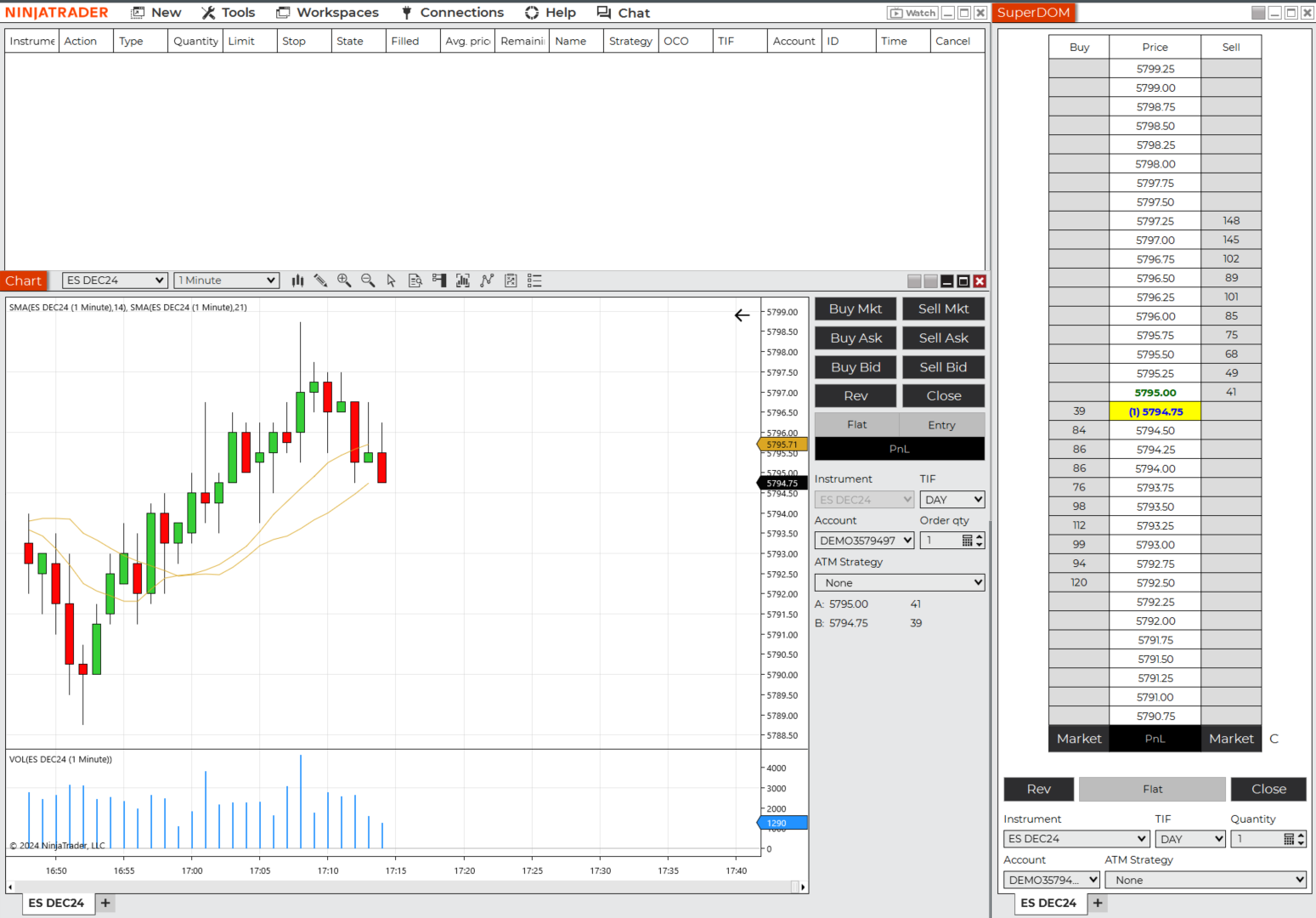

Ninja Trader. Best Trading Platform with Low Fees

Ninja Trader was initially designed as a trading platform. As its popularity grew, the company decided to expand its offering by acquiring its own brokerage, which enabled Ninja Trader to provide both trading features and brokerage services with discounted commissions for users.

Key features:

- 2-in-1: an intuitive trading platform plus a brokerage service.

- Focus on futures markets.

- Pricing options range from $0 (Free Plan) to $1,499 (Lifetime Plan).

- Daily live streams of traders using Ninja Trader to trade futures in real time.

Advantages of the Ninja Trader platform:

- User-friendly platform with support for numerous third-party add-ons.

- Various chart types and a comprehensive set of drawing objects in the basic version.

- Volume Profile, Order Flow VWAP, and other order flow analysis tools available as add-ons.

- Highly customizable, with support for algorithmic strategies.

- Demo account available.

Disadvantages of the platform:

- Slow response time from customer support.

- Available markets may only appeal to futures traders.

- The cost of the license might seem high.

How to connect ATAS to Ninja Trader — detailed instructions.

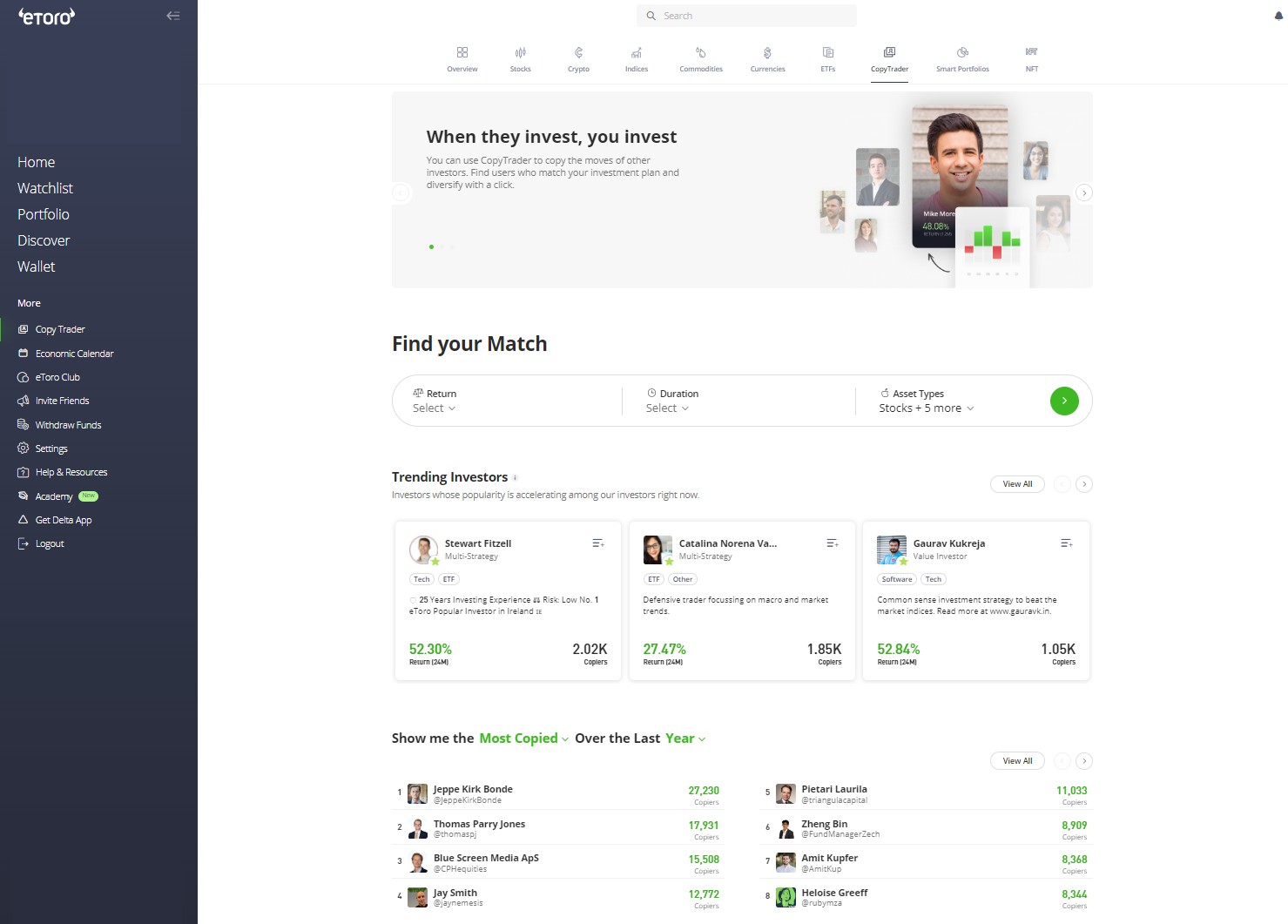

eToro. Best Platform for Social Trading

eToro combines the features of a traditional trading platform with a social network where users can connect, share strategies, discuss ideas, and copy each other’s trades.

With the copy trading provider selection functionality, users can better evaluate risks and forecast their potential earnings. eToro has a lower percentage of traders who lose money compared to other platforms.

Key features:

- Founded in 2007.

- Over 35 million users across more than 100 countries.

- Regulated in several places, including the UK (FCA), Cyprus (CySEC), and Australia (ASIC).

- Offers a wide range of assets like stocks, cryptocurrencies, forex, indices, and ETFs, totaling around 6,000 instruments.

Advantages of the eToro platform:

- Social features that offer trading education, including podcasts, strategy discussions, and chats.

- Smart Portfolios: pre-built asset portfolios curated by experts.

- Interest is earned on unused funds in your balance.

- Demo account available.

Disadvantages of the platform:

- Slow response time from customer support.

- The platform restricts registration for traders from certain countries.

- Wide spreads.

- High fees for withdrawals.

- No option to connect ATAS.

Tip: You can use ATAS to find trading setups while executing your trades on eToro, which helps you gain followers and earn additional rewards.

How to Choose a Trading Platform

Choosing a trading platform should be based on your individual needs and preferences.

Here are some criteria to consider when selecting a trading platform:

✔ Asset types: the platform should support the assets you are interested in, whether that is stocks, cryptocurrencies, futures, forex, or other instruments.

✔ User interface and ease of use: look for a platform that feels intuitive and is easy to customize to suit your style.

✔ Fees: choose a platform with reasonable fees that match your trading volume. Take a closer look at spreads, transaction fees, withdrawal costs, overnight fees, and margin position requirements.

✔ Functionality: check out the available analytical tools, indicators, charts, and options for automation (like algorithmic trading). Consider how the platform’s features can give you an edge over other traders.

✔ Regulation: research the platform’s reputation and licenses (like FCA, CySEC, ASIC, etc.) and confirm it supports clients from your country.

✔ Support. Evaluate the quality of customer service, the activity of the community, and whether there are helpful guides available for using the platform.

FAQ

What is the best trading platform?

The best trading platform is the one that helps you make consistent profits. It really depends on the individual — your trading success hinges on your psychological traits, experience, and knowledge, as well as the tools the platform provides for market analysis (like advanced charts and indicators).

Which trading platform is best for beginners?

For beginners, it is essential to choose a trading platform that offers learning resources in an easy-to-understand format. For instance, ATAS provides a demo account and a Market Replay simulator, allowing you to practice trading without risking real money. You will also find guides for each tool in the Knowledge Base, along with detailed breakdowns of features and strategies in the blog and on the YouTube channel. Moreover, you can get advice from more experienced traders in online communities on Discord and Telegram.

Conclusions

Choosing the right trading platform is an important decision that can significantly affect your trading success. In this overview, we have discussed the top 10 popular platforms, each with its own unique features, advantages and drawbacks. Remember to consider your personal needs, such as the types of markets you want to trade, your strategies, experience level, budget, and trading goals.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.