What Is a Triple Top Chart Pattern?

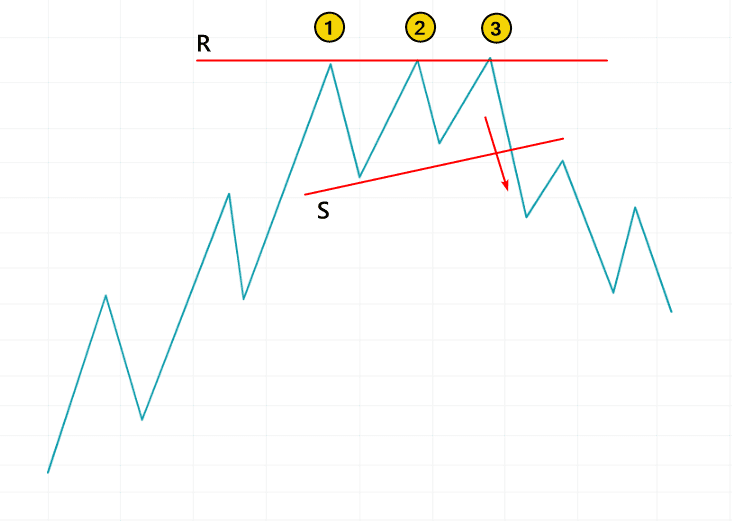

The triple top pattern visually resembles three mountain peaks, with their tops positioned at roughly the same level. A resistance line (R) is drawn across the three peaks, while a support line (S) is drawn through the intermediate lows. This pattern can be used across various time frames and markets (including stocks, futures, and cryptocurrencies).

Identifying Triple Top Patterns

To identify the pattern, the price must form three peaks at approximately the same level. According to classical technical analysis, this should occur during an existing uptrend.

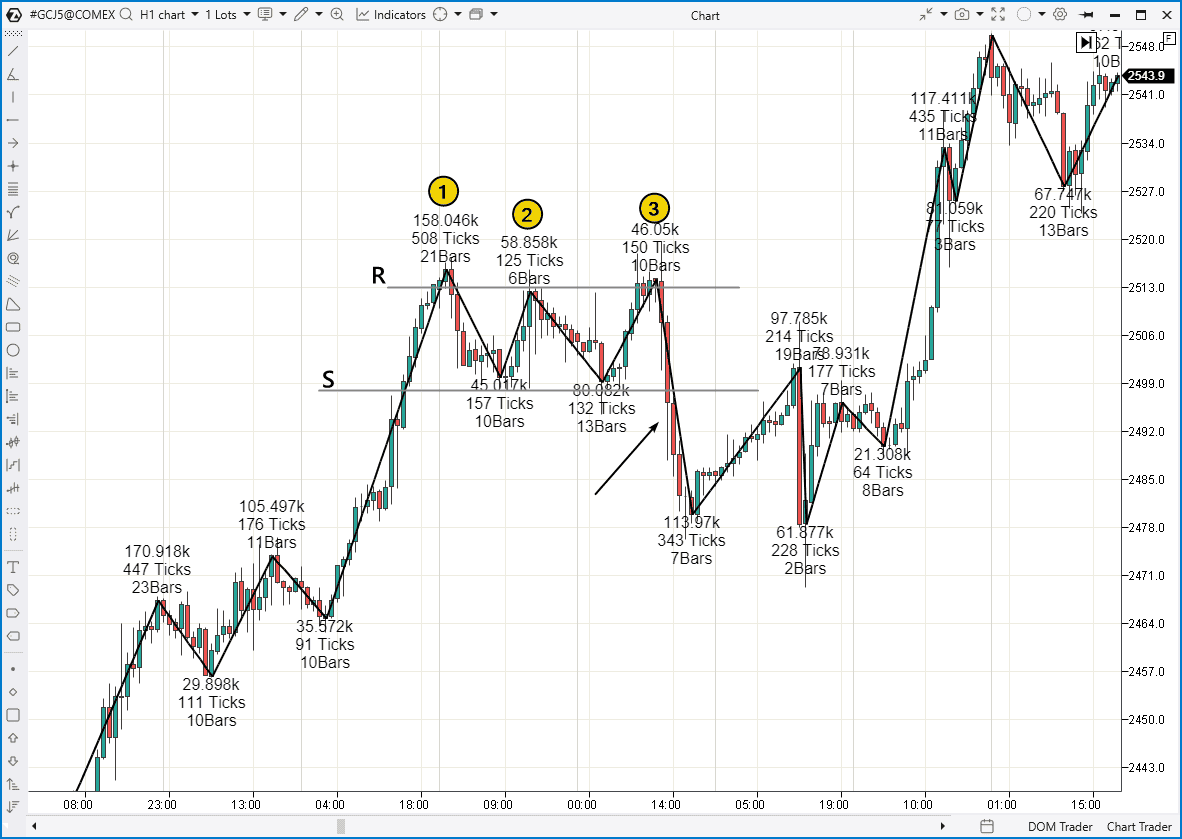

Example. The screenshot below shows a 1-hour chart of gold futures. The ZigZag Pro indicator has been added to the chart—it not only simplifies the analysis of price movements but also provides statistics for each wave.

The three consecutive peaks are marked with numbers (1–2–3). A resistance line (R) is drawn through these peaks, and a support line (S) is drawn through the intermediate lows.

Volume plays a significant role. Note the volume figures indicated by ZigZag: 158k at the first peak, 58k at the second, and 46k at the third. This decrease in cumulative volume on successive upward waves may be interpreted as a weakening of bullish pressure.

Renowned technical analyst Thomas Bulkowski (whom we will mention again later) notes that volume exhaustion is observed in 61% of cases. For a more detailed analysis of volume across wave sequences, refer to the article Weiss Waves.

Interpretation of A Triple Top Pattern

📌 In classical technical analysis, the triple top is considered a bearish reversal chart pattern, signaling a potential exhaustion of bullish momentum.

On the chart above, we can observe the following:

- Before the formation of the triple top, the market exhibited a bullish structure, characterized by higher highs and higher lows.

- A slowdown in bullish momentum occurred after the price crossed the psychological level of $2,500 per ounce, suggesting that traders were not yet prepared to pay such a high price.

How to Trade the Triple Top Pattern

It is generally believed that after the formation of the third peak and the subsequent breakout of the support level, selling pressure may increase, and the downward movement may accelerate. Therefore, traders typically consider entering a short position either on the breakout of the support level or during a test of this bearish breakout.

In the chart above, the support breakout is marked with an arrow. In this case, traders might have followed one of the following scenarios:

- Enter a short position immediately after the breakout of the previous low;

- Wait for a retest (which occurred on a lower time frame, as indicated by the OHLC values of the candles around the breakout area);

- Exit the position when the price falls below the support level (S) by a distance equal to the height of the pattern (R minus S).

When analyzing this example, it is worth noting that the appearance of the pattern did not result in a complete reversal of the uptrend but rather led to a temporary pause. Traders using classical technical analysis had an opportunity to profit; however, applying volume indicators can improve accuracy and enhance the probability of success.

How to Trade the Triple Top Pattern Using Volume Indicators

Let’s begin with the classic strategy for trading the triple top pattern, often featured in trading textbooks. Then, we will explore how these rules apply to real charts and how advanced volume indicators can improve your trading with technical analysis patterns.

Triple Top Trading Rules: Step-by-Step Guide

Step 1. Three peaks at similar levels

Pattern identification. Look for three peaks that are roughly at the same resistance level, with two valleys between them, also at approximately the same level.

Step 2. Resistance level of the triple top pattern

Confirm the pattern. Examine why the price encounters resistance and how strong that resistance is. Does the volume analysis indicate weakening demand and increasing selling pressure?

Step 3. Support level of the triple top pattern

Find the entry point. This is done by drawing a support level through the intermediate valleys, which can be tricky if they are at different levels. A signal to enter a short position occurs when a candle closes below the support level between the valleys. Alternatively, you may enter short when the price rises to test the breakout level.

Step 4. Triple top breakout below support level

Open a short position after the support breakout, following capital management guidelines:

- Stop-loss. Place a protective stop order just above the resistance level formed by the three peaks.

- Take-profit. Set the profit target equal to the distance from the support level to the peaks of the pattern.

- Position size. Ensure the position size is such that, in case of an unfavorable outcome, your capital will not decrease by more than 1-3%.

As you can see, with this approach, the potential profit will generally be slightly smaller than the risk taken. Therefore, it is highly recommended to use additional tools, which are readily available on the ATAS platform.

Example 1: Triple Top on the DAX Index

The chart below illustrates price movements of the German stock index futures, highlighting the following key elements:

- Numbers 1-3-5 indicate the formation of a triple top pattern. According to the Smart Money Concept, the price moved into the Buyside Liquidity zone, which is often seen as a signal for a potential bearish reversal.

- Numbers 2 and 4 mark the intermediate troughs. Drawing a clear support level through them is challenging, so the trader must perform additional analysis to identify an appropriate short entry level. In this case, the red support line is drawn based on local lows, which is considered acceptable.

Assuming the trader entered a short position on the bearish breakout of the red line (around 19,500), the stop-loss could be placed above peak 5, and the take-profit target calculated as the distance between extremes 3 and 4, projected downward from the entry point.

In this case, the triple top pattern played out correctly (aside from some difficulty in drawing the support level). At the same time, volume analysis indicators can provide an advantage in the following areas:

- Pattern confirmation. Analyze the volume dynamics across waves 1→2→3→4→5. Volume declines on upward waves and increases on downward ones, indicating that buying momentum is weakening while selling pressure is gaining strength.

- Identifying a more favorable entry point. A more precise entry can be found using the protrusions on the market profile built for the downward move from wave 3→4.

Example 2. Triple Top on the EURO STOXX 50 Index

The chart below shows price fluctuations of the EURO STOXX 50 futures index, highlighting the following key elements:

- Numbers 1-2-3 mark the triple top pattern;

- Line S indicates the support level, drawn through the intermediate troughs;

- Number 4 marks the entry point for a short position. As this occurred during nighttime hours, it is reasonable to assume the trader used a pending order. Bearish sentiment may have been reinforced by the Delta indicator (5), which showed seller aggression during the reversal near the second peak.

According to classical trading rules, a stop-loss was to be placed above peak 3. Alternatively, it could have been positioned above the local high around the 5023 level, which had formed midway between peak (3) and the support level. However, look at the bulge on the volume profile around the 4994 level. Located close to the entry point, it might have acted as a barrier and helped protect the stop-loss. In this case, the profile indicator was potentially used to significantly reduce risk.

But what about the take-profit (TP)? It appears that the triple top pattern played out perfectly, pointing to a clear take-profit level. However, upon closer examination, there are more compelling reasons to believe that the price reversed at this specific point:

- The bulge on the market profile (indicated by the white arrow) acted as support, this occurs so frequently that it can hardly be considered a coincidence.

- A brief dip below the previous low (marked by the red arrow), which, according to the Smart Money Concept, signaled an entry into a liquidity zone (typically seen as a signal for a reversal).

Effectiveness of the Triple Top Pattern

According to Thomas Bulkowski’s research, the triple top is not one of the most effective patterns for trading. The renowned pattern analyst ranked the triple top 24th out of 36 patterns. Based on his data (for daily stock charts):

- Break-even failure rate = 25%. This represents the percentage of cases where, after the triple top pattern is formed, the market does not reach a level where traders could at least break even. In other words, in 25% of cases, the pattern fails to produce a significant price decline.

- Average decline = 14%. This is the average price drop after the pattern is confirmed. It indicates the typical decline in price that follows the formation of a triple top.

- Pullback rate = 66%. This is the percentage of cases where, after the support break, the price returns to that support level before continuing its downward movement. This suggests that, in two-thirds of cases, the market experiences a correction before resuming the decline.

- Percentage meeting price target = 49%. This means that in about half of the cases, the market reaches or exceeds the target price determined by the height of the pattern.

How to Learn to Trade the Triple Top Pattern

To learn how to trade the triple top pattern, use the ATAS platform and its built-in Market Replay feature. This tool enables you to replay historical market data, giving beginners the opportunity to test their strategies (not only trend reversals based on the triple top pattern) and improve their trading skills in conditions that closely resemble real market environments.

Advantages of Market Replay in ATAS:

- Historical data and market visualization. ATAS enables you to load detailed tick data and analyze price and volume patterns during trend reversals.

- Advanced indicators for confirmation. Use ATAS tools such as footprint charts, cumulative delta, and vertical and horizontal volumes to confirm signals and find optimal entry points.

- Training in Market Replay mode. Practicing in a market simulator is one of the most effective ways to refine your skills. Take advantage of ATAS’s functionality to replay historical data in real time, track triple top and other patterns, trade them on a demo account, and analyze your performance without risking your capital.

To start Market Replay in ATAS:

Download the ATAS platform for free, install and launch it, and then:

- Open a chart of a financial instrument.

- Click on the Market Replay button in the main ATAS menu.

- Activate the Replay mode (the icon should turn green).

- Adjust settings (date and data type).

- Start the replay and look for three peaks at approximately the same level.

- Have you spotted the setup? Trade it on the built-in Replay demo account.

The chart above illustrates the triple top pattern in a bearish market, as the area to the left of the pattern (A-B-C) shows a price decline. In this case:

- If the triple top were traded based on classic rules, it would have resulted in a loss, as after the support break at S, the price did not reach the projected target (although a profit could have been achieved if the short position was opened on the support break between B and C).

- When analyzing volume, it is clear that peaks A-B-C formed above the psychological level of 0.800, and there is a bulge on the profile (7) in the background. This indicates a test of the bulge following a false bullish breakout of the psychological level.

Download ATAS to see how advanced volume indicators can give you a trading edge over those relying solely on traditional technical analysis.

We hope you now have a better understanding of the triple top pattern. Additionally, there is a mirror pattern – the triple bottom, which offers a chance to study the same concept but in an inverted form.

FAQ on the Triple Top

How to trade the triple top in different market conditions?

✔ Bullish Market. In a bullish market, the triple top pattern is typically seen as a signal of a potential trend reversal. However, the main risk lies in the possibility that the triple top could merely represent a consolidation phase before the trend continues (see the example of a failed pattern below).

✔ Bearish Market. When the triple top appears in a bearish market, it may indicate an unsuccessful attempt by bulls to reverse the trend. This could signal an opportunity to sell, especially if volume indicators confirm that sellers are regaining control.

✔ Sideways or Ranging Market. In a sideways market, the triple top often reflects instability and a balance between the forces of buyers and sellers. It can form within a range between key support and resistance levels.

Triple Top Pattern vs Other Trading Patterns

Identifying a triple top on a chart (as with other chart patterns) is largely a subjective process, which sometimes leads to confusion, where one trader sees a triple top, another may see something else.

✔ Head and Shoulders. The head and shoulders pattern is a variation of the triple top, where the middle peak (the head) is higher than the other two peaks (the shoulders). The head and shoulders pattern is considered a more reliable reversal signal than the triple top.

To learn how to trade the head and shoulders pattern, refer to the article: Head and Shoulders in Trading.

✔ Double Top. The double top is similar to the triple top but consists of only two peaks. While both patterns indicate potential reversals, the triple top is generally considered a more reliable signal, as the trend has been tested one additional time.

Where to place a take-profit and stop-loss when trading a triple top?

According to classical trading rules for the triple top pattern:

- The stop-loss should be placed just above the resistance level (the peaks). The actual size of the stop may vary depending on the instrument’s volatility.

- The take-profit is calculated based on the distance from the support level to the resistance level of the peak. This distance is then projected downward from the support level.

Conclusion

The triple top is a widely used technical analysis pattern that traders rely on to identify potential reversal points in a bullish trend. This pattern is interpreted as a possible exhaustion of the bullish momentum at a key resistance level.

Advantages of the Triple Top Pattern:

✔ Clarity of signals. This pattern is easy to recognize on charts and enables traders to prepare in advance for selling an asset or closing a position.

✔ Versatility. This pattern can be applied across various markets and time frames, including stocks, futures, and cryptocurrencies.

✔ Compatibility with volume analysis. Incorporating volume indicators can help confirm the pattern, boosting confidence in trading the triple top based on traditional rules, and also provide more accurate entry and exit points, reducing risk.

Disadvantages:

✘ False signals. Like any technical pattern, trading the triple top does not guarantee profitability, particularly when trading without adequate preparation, confirmations (through context analysis and volume indicators), and discipline.

✘ Risk-to-reward ratio. Following classical triple top trading rules, the distance between the stop and take-profit levels is approximately the same, making it challenging to achieve the preferred risk-to-reward ratio of 1:3.

✘ Rarity. This pattern is not commonly found, even in intraday charts.

✘ Subjectivity. When the trend is unclear, traders might mistake random market fluctuations for the formation of the pattern, which can lead to losses.

To enhance the accuracy of triple top signals, traders are encouraged to use additional tools, such as footprint chart patterns or other advanced instruments. While this may make trading more complex, it will take it to a whole new level. By combining the triple top with advanced volume analysis tools and considering the market context, traders can improve their chances of success.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions or on Discord.