The spinning top pattern in technical analysis is a single Japanese candlestick pattern. Its key feature is the small candle body (the difference between the opening and closing prices) and long shadows.

It is neither a bullish nor a bearish pattern. The spinning top is typically interpreted as a neutral signal, indicating indecision or uncertainty in the market.

Using footprint charts can help traders better understand the dynamics behind the formation of the spinning top pattern. They can also provide more valuable information for more accurate predictions of price movements while the spinning top of uncertainty is present on the chart.

Read more:

What Does Spinning Top Pattern Mean?

In Japanese candlestick analysis, the spinning top pattern is characterized by two main features:

✓ The candle has a small body. The opening and closing prices are close to each other, indicating minimal price change during the period.

✓ The candle has long shadows. The long upper and lower shadows show that both buyers and sellers tried to take control, but neither side succeeded in gaining a clear advantage.

Analysts distinguish a few variations of this pattern:

✓ A white spinning top candlestick – a candle where the closing price is higher than the opening price.

✓ A black spinning top candlestick – a candle where the closing price is lower than the opening price.

However, this does not mean that a spinning top white candle is a bullish pattern and a black one is bearish. Both types signal market indecision or a temporary balance between buyers and sellers.

In simpler terms, the spinning top resembles the toy of the same name, which balances on a thin base (the small candle body), representing the balance between supply and demand, even though the edges of the toy are far from the center (the long shadows).

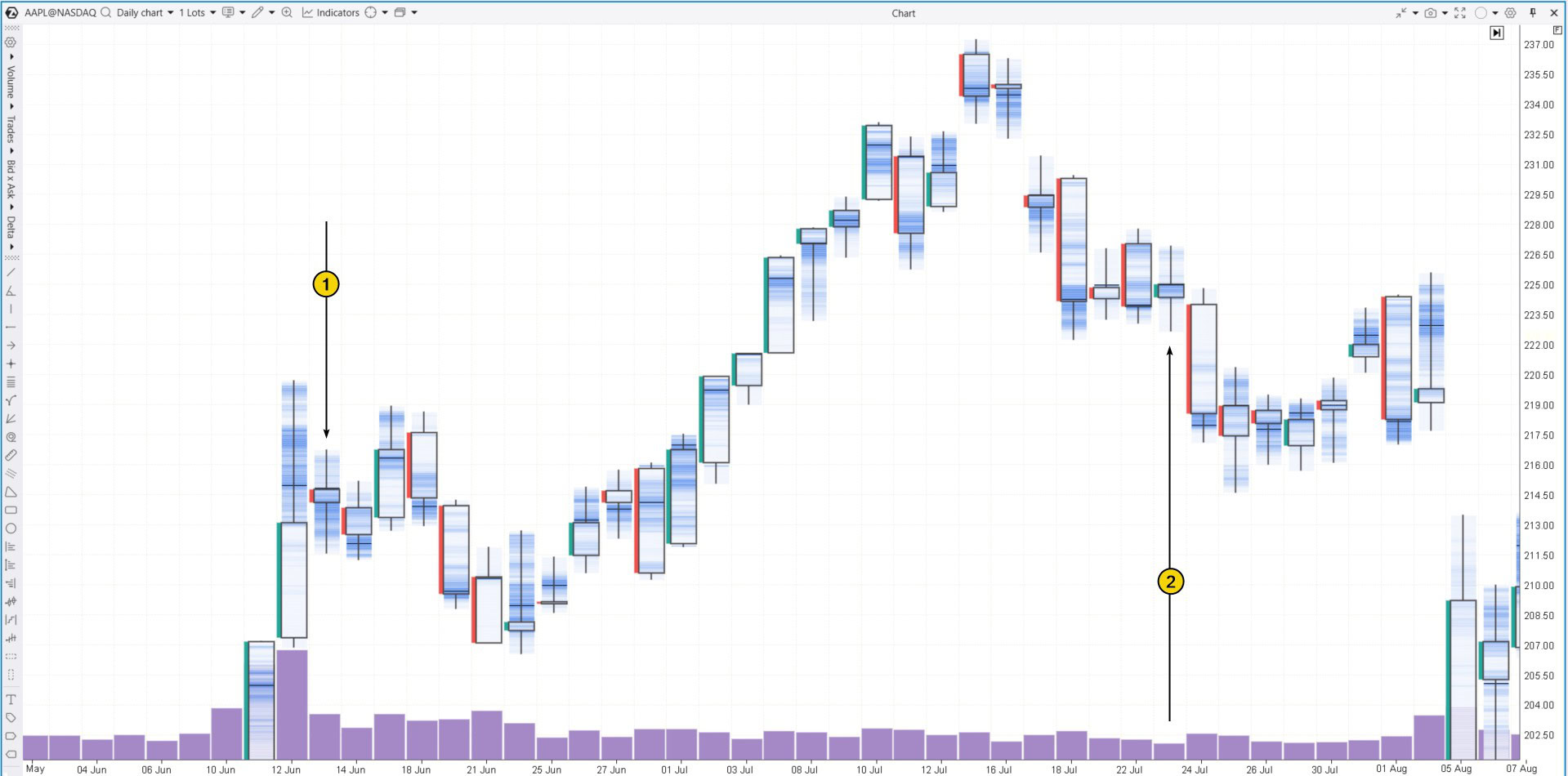

Spinning Top Example

The screenshot below shows two examples of the spinning top pattern on the daily chart of Apple (AAPL) stock. While there may be more of these patterns on the chart (the exact number is difficult to determine due to the subjectivity of analysis), we will focus on examining these two specific examples.

June 13, 2024 – a black spinning top, also known as a red spinning top candle (depending on the candlestick color settings). The closing price is near the middle of the candle, but slightly below the opening price.

July 23, 2024 – a white spinning top or green. The closing price is slightly above the opening price, approximately in the middle of the candle.

Meaning of Spinning Top Candle for Traders

The spinning top is considered a sign of market indecision. However, analyzing the context in which the pattern appears, along with studying the volumes, can provide valuable insights into what this indecision signifies.

In the case of the black spinning top, the pattern emerged after the following events:

- the price surged on June 11-12 following the presentation of Apple Intelligence;

- it is likely that on June 12, sellers became active, as indicated by bright clusters above the closing price.

Therefore, the indecision shown on June 13 could have indicated that traders had doubts about whether the uptrend would have continued after the presentation, whether a correction had started, or if the trend had reversed into a downtrend.

High trading volumes for the day suggest that both buyers and sellers were active, but neither side was able to take control.

In the second case, the white spinning top appeared after several days of sideways movement, with July 19 forming an inside bar — another candlestick signaling indecision in the market.

The next day, there was a sharp drop caused by disappointing quarterly reports. This impacted major tech companies like Alphabet (GOOG) and Tesla (TSLA), whose Q2 results put pressure on AAPL’s stock price.

Spinning Top Candlestick Pattern: How to Trade It?

The strategy for trading the spinning top candle is based on the idea that this pattern signals a temporary balance in the market during its current phase.

- In a trending market, a spinning top may indicate that the current trend is weakening, making the market vulnerable to a correction or a pause within the trend. At the same time, a trend reversal is also possible.

- In a flat market, the appearance of a spinning top within a developing range signals market sluggishness, where supply and demand are balanced.

Support and resistance levels are key factors that can provide more context. For example:

- The price was rising;

- Then it reached a resistance level;

- A spinning top formed on the chart.

In this case, the pattern can be seen as confirmation of the resistance level’s strength. However, as we will demonstrate later, volume analysis indicators and footprint charts offer the most valuable insights when interpreting candlestick patterns.

How Effective is the Spinning Top Candle Pattern?

Thomas Bulkowski, a well-known expert on candlestick patterns, describes two types of spinning tops (based on the color/direction of the candle body):

✓ A white spinning top candlestick:

- frequency: 2nd most common (very frequent);

- reversal probability: 50%;

- comment: if the price breaks out beyond the pattern, it rarely forms a significant trend.

✓ A black spinning top candlestick:

- frequency: 1st place (very frequent);

- reversal probability: 51%;

- comment: a 51% reversal probability in practice confirms that the pattern is theoretically interpreted as indecision.

Spinning Top Pattern and Footprint Trading

Since the spinning top indicates uncertainty or indecision in the market, using additional tools is not just helpful — it is essential. Footprint charts can offer crucial insights into the market dynamics behind the spinning top.

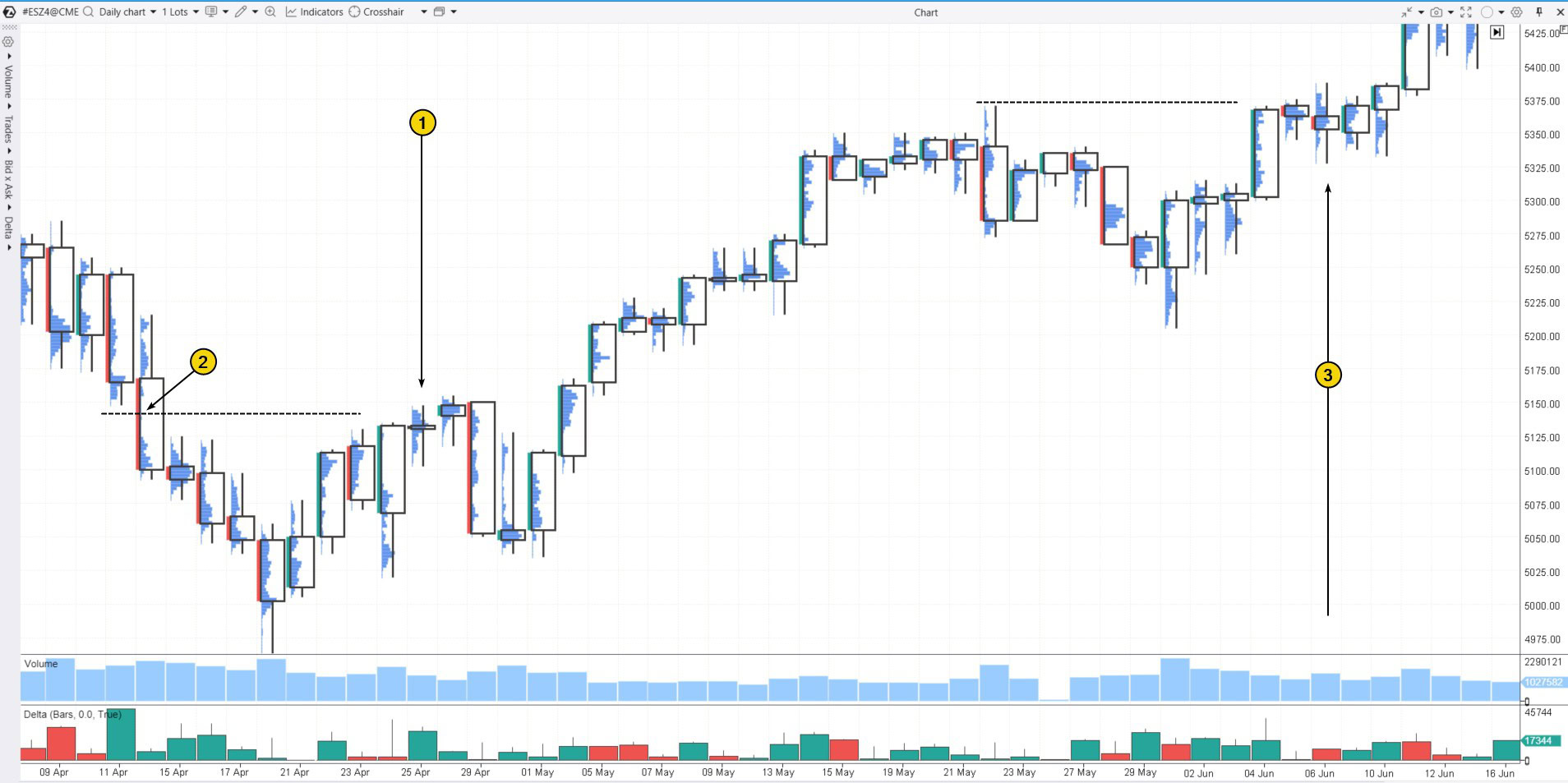

Spinning Top Candles on the E-mini S&P 500 Futures Market

Let’s take a look at two spinning top candles on the daily chart of the E-mini S&P 500 futures:

April 25, 2024 (1) – a spinning top with a narrow red body.

In this instance, the candle suggests that the buying momentum, which had been strong in the days prior, was weakening. Buyers likely became cautious as the price approached a zone where sellers had the upper hand on April 14, visible from the narrow profile (2). This was followed by a price decline on April 29.

June 6 (3) – a spinning top with a narrow green body. In the context of a bullish market, this candle indicated a moment of indecision from buyers as they faced resistance at a previously established high. Sellers may have tried to slow the upward momentum, but their efforts were short-lived — the price did not pull back much and continued rallying on June 11.

Note that on the volume profile (visible due to the selected footprint mode), you can see that the volumes are concentrated near the middle of the candle and thin at the edges, which confirms the indecision.

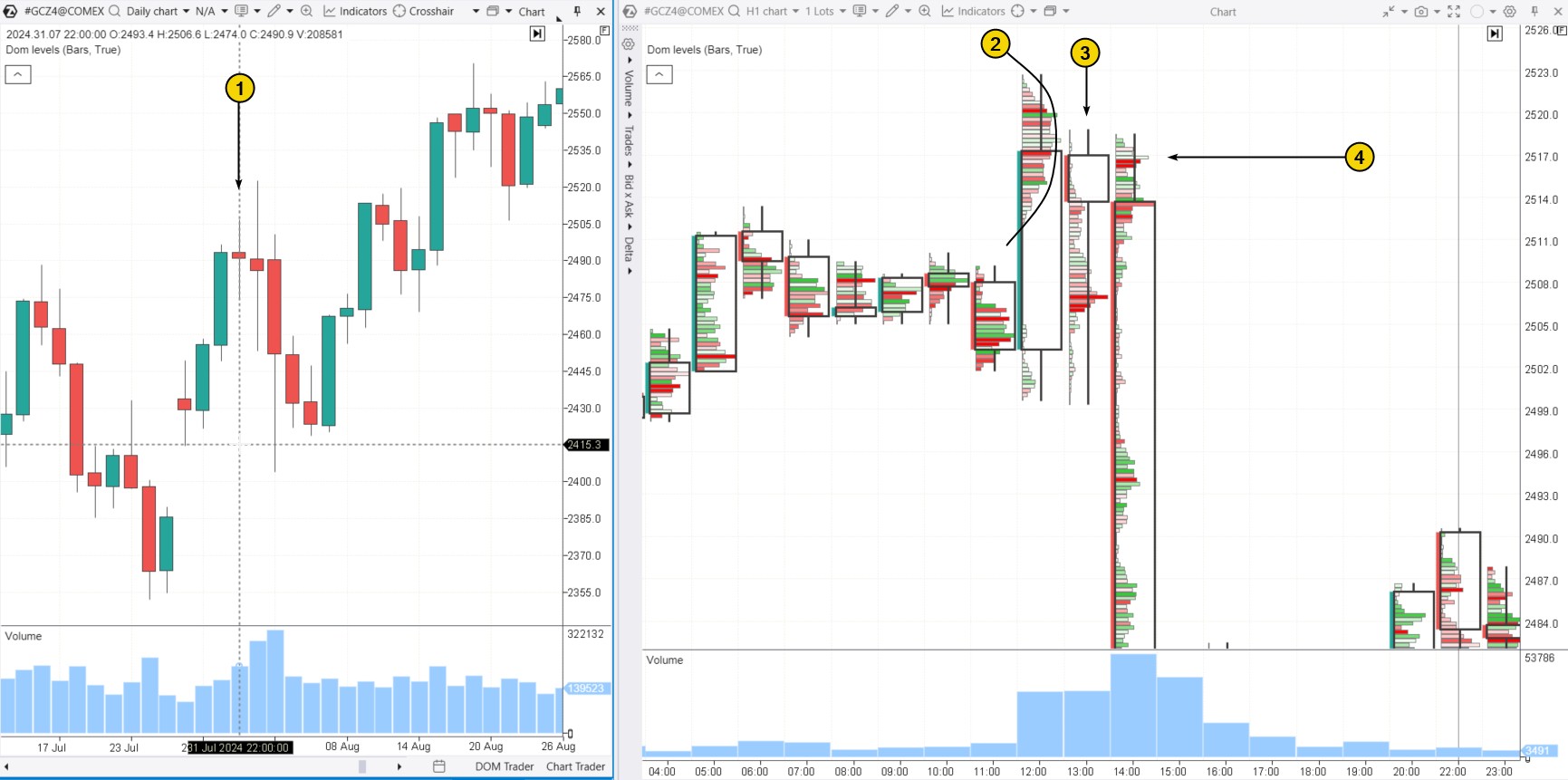

Spinning Top Pattern on a Cryptocurrency Chart

Let’s take a closer look at two spinning top candles on Litecoin’s (LTC/USDT) daily chart:

July 18, 2024 (1) – a spinning top formed after the following events:

- the market saw a price increase of more than 20% from the July 5 low;

- on July 17, sellers stepped in, which can be seen in the bright red clusters (2) as the price approached the previous high near $77.

Two consecutive spinning top candles (3). The market was clearly uncertain after more than 10 days of bulls struggling to break through the $74 resistance, while the bears’ attempt to push prices down on July 25 led to a bear trap.

Footprint analysis of the July 29 candle offered valuable insight into the most likely direction of the market. At that point (4), bulls got trapped after believing they had successfully broken through the $74-77 resistance zone. This mistake was confirmed by the strong seller activity (5) the next day, which should have given cluster chart traders a solid reason to open short positions.

FAQ

What is a spinning top candle?

A spinning top candle is characterized by a small body and long wicks. The opening and closing prices are approximately in the middle of the candle. Typically, traders look for spinning tops on daily charts.

What does a spinning top candle mean?

The appearance of a spinning top indicates that the market is in a state of uncertainty, reflecting an approximate balance of power between buyers and sellers.

Is a spinning top candle bullish?

No, it is a neutral pattern and does not imply a buy signal, as has been previously stated: the pattern is interpreted as an equilibrium of forces between buyers and sellers.

Spinning top reversal candle

A spinning top candle can suggest a potential trend reversal, particularly when it appears near key resistance after a price increase. Conversely, if a spinning top forms after a price drop towards a support level, it may indicate an upcoming upward reversal. However, to validate this reversal, it is highly advisable to conduct further analysis using cluster charts to find solid confirmation.

How to Profitably Trade the Spinning Top Pattern

To trade the Spinning Top pattern with more confidence, consider using professional volume analysis tools like:

Here is a strategy you can follow for trading the spinning top pattern:

✓ Step 1. Identify the pattern on the daily candle.

✓ Step 2. Switch to an intraday footprint to find support and resistance levels where you can open positions.

Here is an example of implementing this strategy on a gold price chart:

Let’s say you have identified a spinning top (1) as a candlestick pattern on the daily chart. Knowing that the market may be experiencing indecision after a price increase, you switch to an hourly footprint the next day. Here, you look for signs of weakness, anticipating that if the bulls attempt to push above the previous high, they will not achieve much success because their strength is exhausted.

You can spot these signals by monitoring the interaction between price and horizontal volumes:

- A bulge (2) forms above the previous day’s high (which represents the spinning top), indicating a temporary balance between buyers and sellers.

- The price drops below this bulge (3), suggesting that the initial positive reaction to the news released at noon was mistaken.

- Based on the above observations, you open a short position at the test of the bulge (3).

A stop-loss – above the intraday bulge.

The target – below the previous day’s spinning top candlestick, as the earlier indecisiveness seems to be giving way to seller dominance.

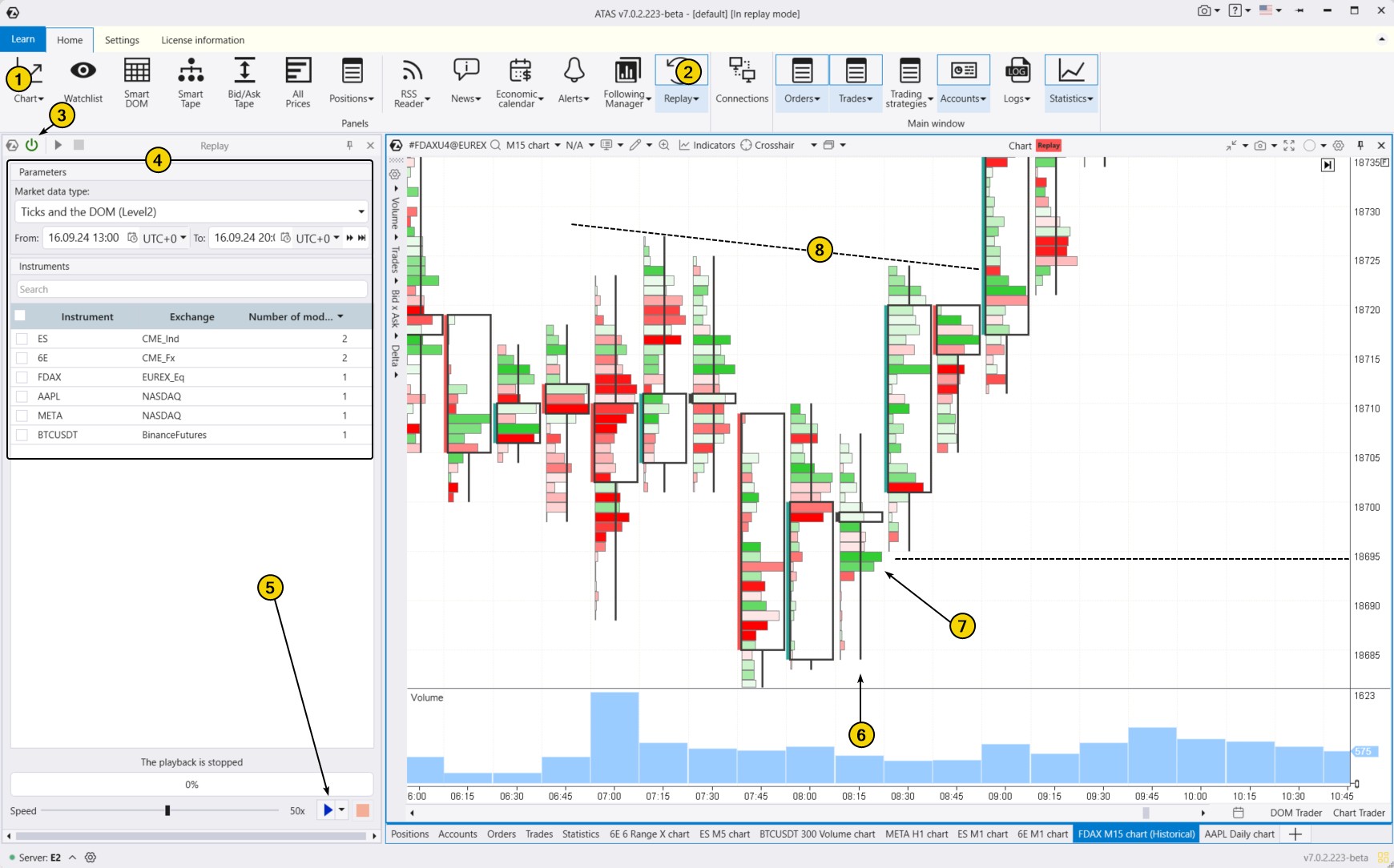

How to Learn Pattern Trading?

To see how successful your pattern trading experience can be, try using the ATAS Market Replay feature. This tool on the ATAS platform uses historical data to recreate real-time trading conditions. It enables traders to sharpen their skills in a completely realistic environment without any financial risks.

To try the simulator, download the ATAS platform for free, install, and launch it, and then:

- Open a chart of a financial instrument.

- Click on the Market Replay button in the main ATAS menu.

- Activate the Replay mode (the icon should turn green).

- Adjust settings like date and data type if needed.

- Start the replay and keep an eye out for candlestick patterns. Explore the footprint charts to uncover strong reasons for entering a trade.

Number 6 indicates the spinning top candle in the 15-minute DAX futures chart above.

However, thanks to the footprint chart, you have clear evidence that the market is not in a state of indecision. Instead, the bulls are active, as the 08:15 candle closed above a large green cluster (7) near the 18695 level.

Following the lead of the bullish traders, you could enter a buy position in these instances:

- at the low of the 08:30 candle during the test of the 18695 level;

- at the 08:45 candle as it pulls back from resistance (8);

- at the 09:00 candle upon breaking through resistance (8);

- At the 09:15 candle during the retest of the breakout of resistance (8).

Developing your ability to read modern footprint charts can greatly improve your candlestick pattern trading, even if you consider those patterns to be outdated.

Conclusions

While the name spinning top might suggest a market peak, this candlestick pattern does not indicate a top. The defining features of a spinning top are its long shadows above and below, with the opening and closing prices near the middle. These show that the market is in temporary balance, with neither buyers nor sellers taking control.

At its core, the spinning top is not bullish, bearish, trend-following, or a reversal signal. It is considered a neutral pattern. Traders typically either wait for further developments or look for additional signals to make their decisions.

Pros of the Spinning Top Pattern

✓ Frequency. According to Thomas Bulkowski’s rankings, the Black and White Spinning Top patterns are among the most common, occupying the top two spots.

✓ Interpretation. The pattern typically signals indecision and market balance, which often aligns with real market behavior.

Cons of the Spinning Top Pattern

✘ Lack of clarity. On its own, the spinning top offers limited insight for making trading decisions, requiring additional confirmation from other tools.

✘ Subjectivity. Traders might find it challenging to assess the exact proportions of the candle’s shadows and body when identifying the pattern.

✘ There are no clear guidelines on placing stop-loss and take-profit orders. Placing stop-losses beyond the pattern’s extremes can conflict with risk management strategies, especially if the candles are large.

While you read this article about trading with the spinning top pattern (or other Japanese candlestick patterns), you might realize that modern analytical tools provide more insights than traditional candlestick patterns. As a result, you may find it beneficial to shift your focus and use footprint charts and other volume analysis methods as your main sources of information, helping you make better-informed trading decisions.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.