Order Flow is a specialized trading approach that focuses on buy and sell volumes to gain insights into market dynamics.

By analyzing Order Flow, traders can get a clearer picture of the supply-demand balance, evaluate the strength of each side of the market, and anticipate potential moves. This analysis helps traders form a clear view of where prices are most likely to move in the near future.

In this article, we will explore the Order Flow tools available on the ATAS platform, which is built for professional volume analysis. We will also provide simple explanations of how each tool works and why it can be valuable for traders.

Learn more:

What Is Order Flow? Key Concepts and Principles

✔ Order Flow analysis is a method of analyzing market data where traders examine how market orders are executed and how they influence an asset’s price. It involves studying the relationship between trading volumes (within the order book and historical data) and price movements.

✔ The goal of Order Flow analysis (one of the main ones) is to spot the actions of major market players and anticipate their intentions to forecast potential price direction.

Advantages of Order Flow Analysis

Focus on real price drivers. Order Flow provides insight into the actual behavior of market participants, distinguishing between large and small players based on trade volumes.

More accurate level identification. This method helps reduce risks and find more precise entry points.

Early trend change detection. Order Flow tools signal shifts in market sentiment before they become obvious.

Key Order Flow Concepts

Before we dive into the tools and analysis examples, let’s go over some essential trading principles that are important for understanding Order Flow. We will also provide links to articles with more in-depth explanations.

Orders that traders place on the exchange can be of two types:

- Passive, or limit orders.

- Aggressive, or market orders.

Limit orders can also be classified into two types:

- Asks – sell orders placed above the current price.

- Bids – buy orders placed below the current price.

The main job of the exchange is to match buy and sell orders in a trade.

There are two types of trades:

- Market buys – trades where market-buy orders are matched with limit-sell orders (asks).

- Market sells – trades where market-sell orders are matched with limit-buy orders (bids).

We will return to this later and illustrate the process in the chart below.

For more details, check out these articles:

Order Flow Analysis Tools

To effectively use Order Flow analysis, you will need:

- A professional desktop platform like ATAS, which offers over 400 indicators and specialized tools for Order Flow analysis. Basic platforms for beginners with simple indicators like RSI and MACD are not suitable for this purpose.

- Reliable data sources. For example, ATAS provides users with detailed historical data for each trade across cryptocurrency, stock, and futures markets. Additionally, ATAS is equipped with connectors that allow integration with exchanges and market data providers, ensuring real-time data access.

Let’s take a quick look at the Order Flow analysis tools on ATAS, using data from the Binance Futures exchange for the BTC/USDT market.

Order Flow and Depth of Market Indicators

Depth of Market Indicator (Level II, or Order Book) is a fundamental indicator that is automatically added when you open a chart in ATAS. It shows all the current limit buy (bids) and sell (asks) orders at different price levels.

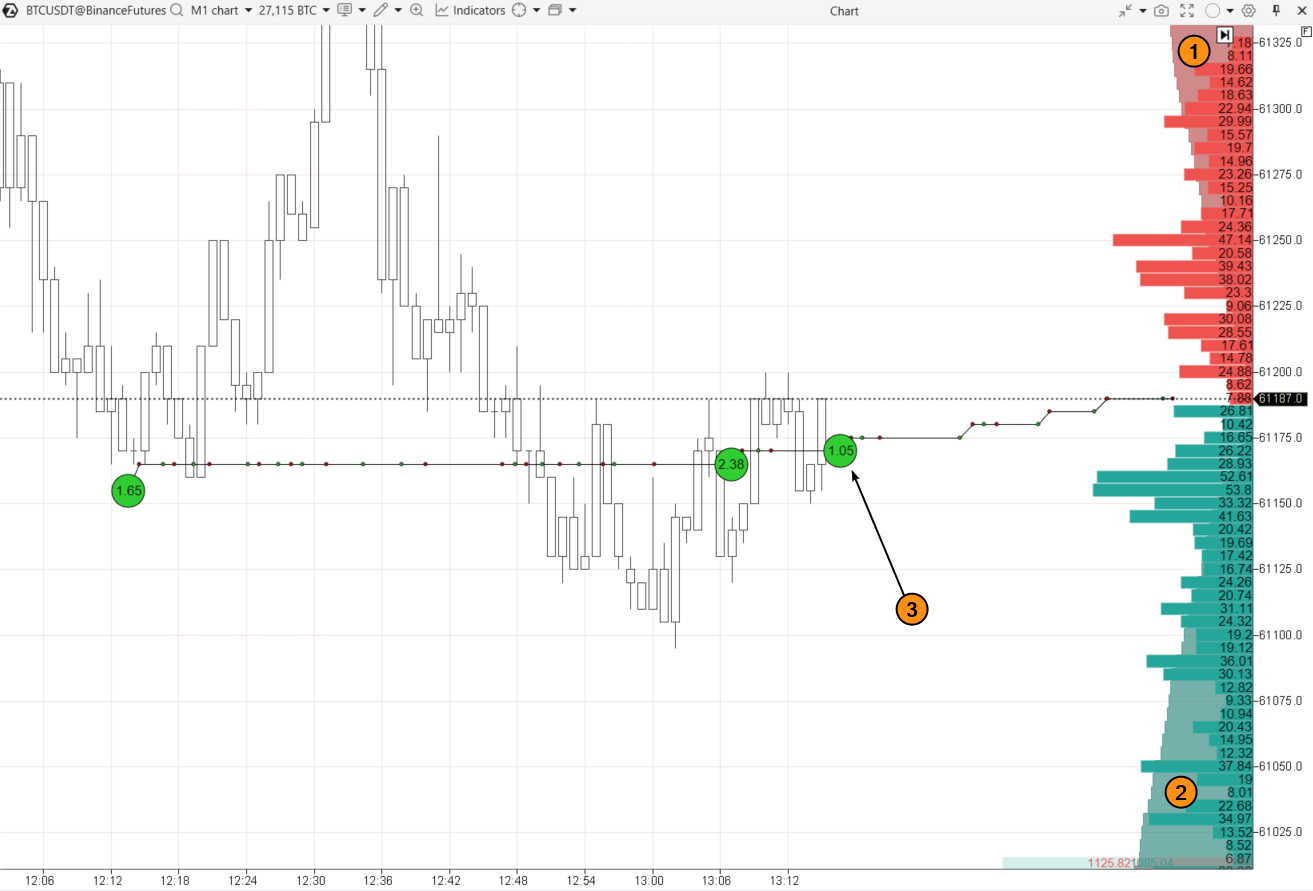

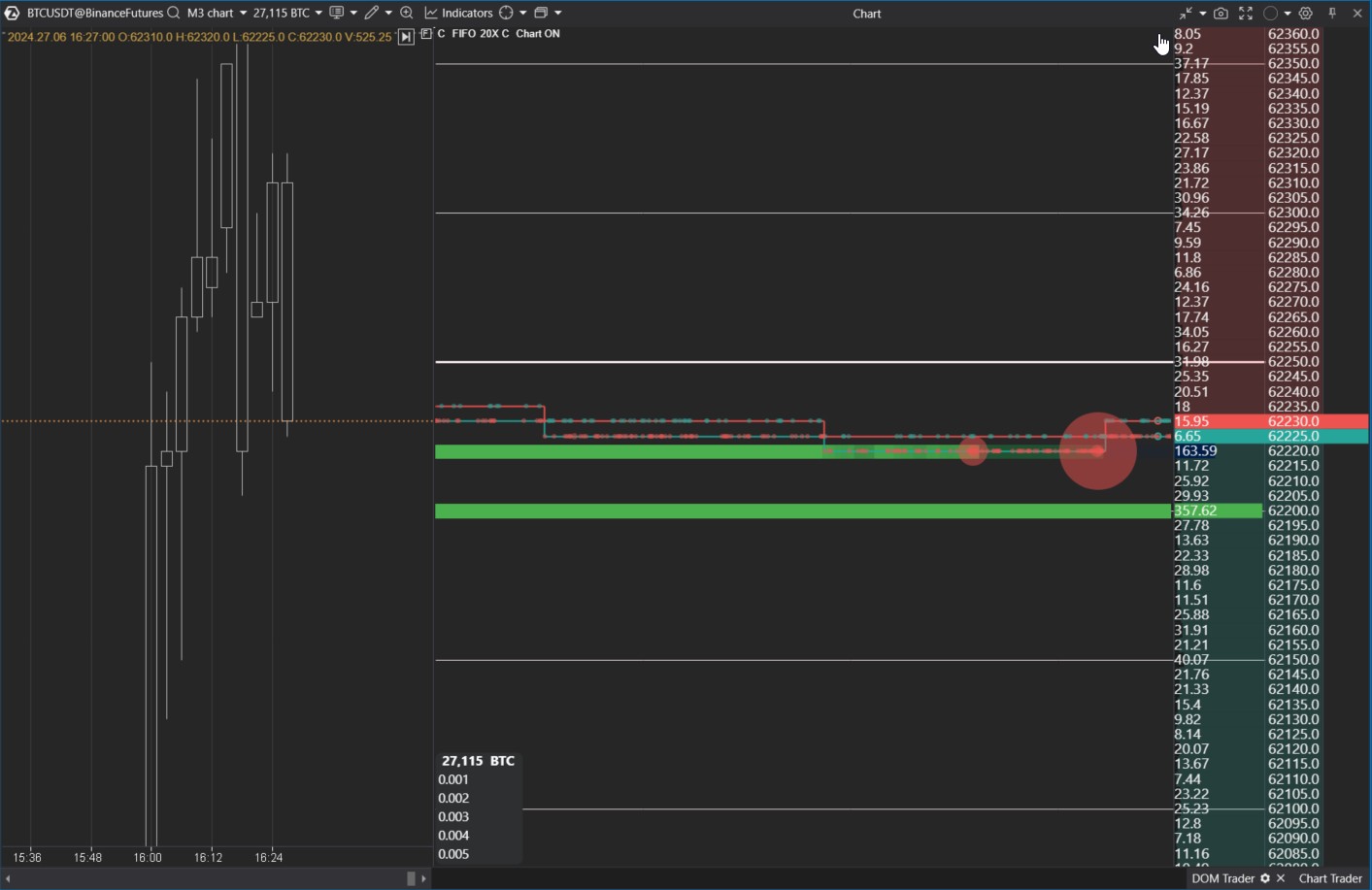

In the chart below, you can see:

- the Depth of Market indicator (on the right side of the chart);

- the Order Flow indicator, represented by a jagged line with circles, which filters out large trades (you can adjust the filter in the indicator settings).

The numbers show:

- (1) limit sell orders (asks);

- (2) limit buy orders (bids).

- a market buy order of 1.06 Bitcoin. This trade is displayed in green because it matches a market-buy order with a limit-sell order. Notice how large buy orders push the price upwards.

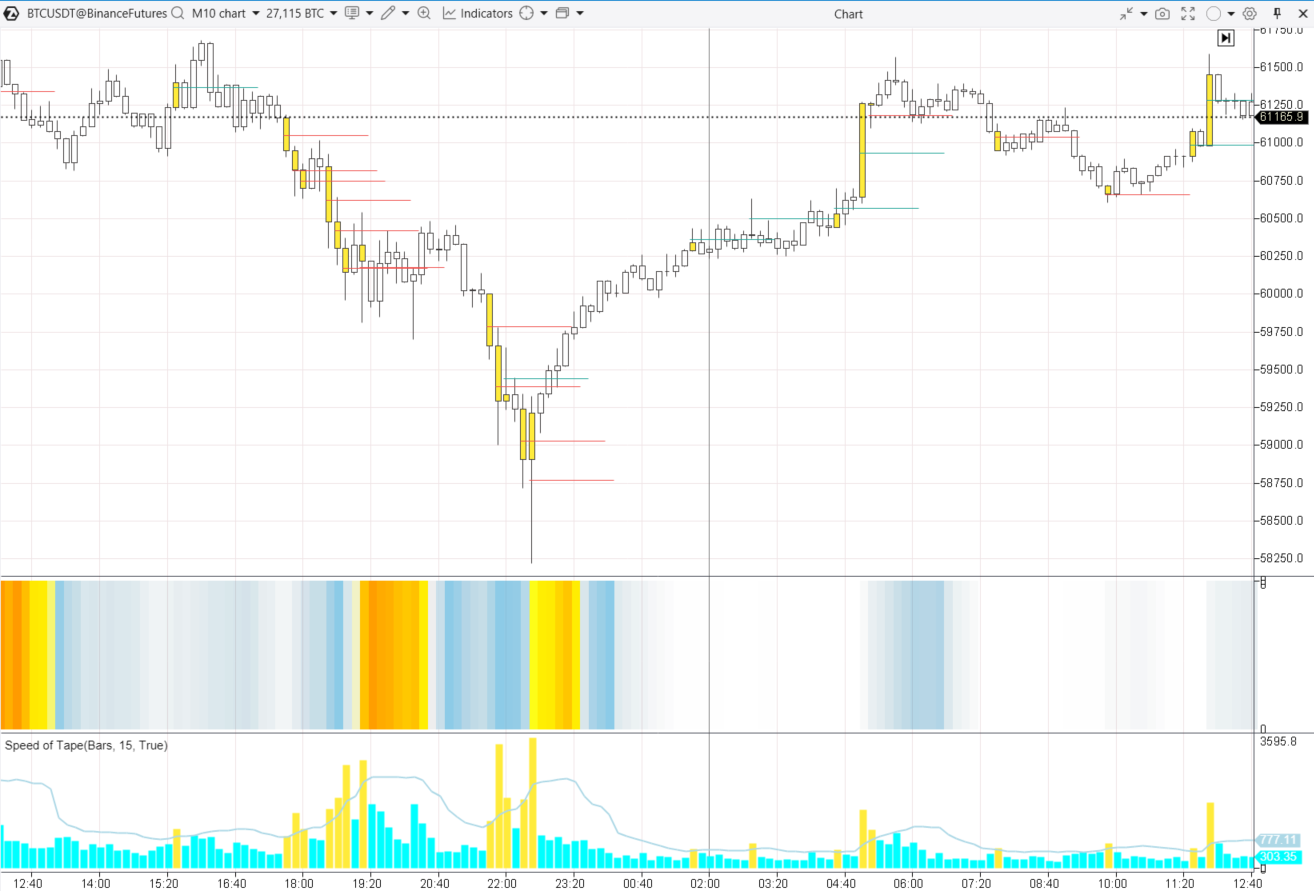

Speed of Tape and Order Flow Rhythm Indicators

These indicators show the pace of trades, indicating how quickly transactions are happening.

Candles that form when trades are executed more frequently can signal:

- breakouts of support and resistance levels;

- climaxes and subsequent trend reversals.

Volume, Delta, Bid & Ask Indicators

While Volume is a classic vertical volume indicator used since the early 20th century for market analysis, it is also valuable in Order Flow analysis. It is particularly effective when breaking down total volume into its components: market buys and market sells.

On the chart above, below the price area, the following indicators are displayed:

- Vertical Volumes (Volume).

- Bid Ask. Market sells are shown in red, and market buys in green.

- Delta. This indicator shows the difference between market buys and market sells.

For instance, if the delta shows high positive values but the price does not rise, it could indicate market weakness (bulls struggling to push the price higher despite their efforts) and may signal a potential price drop.

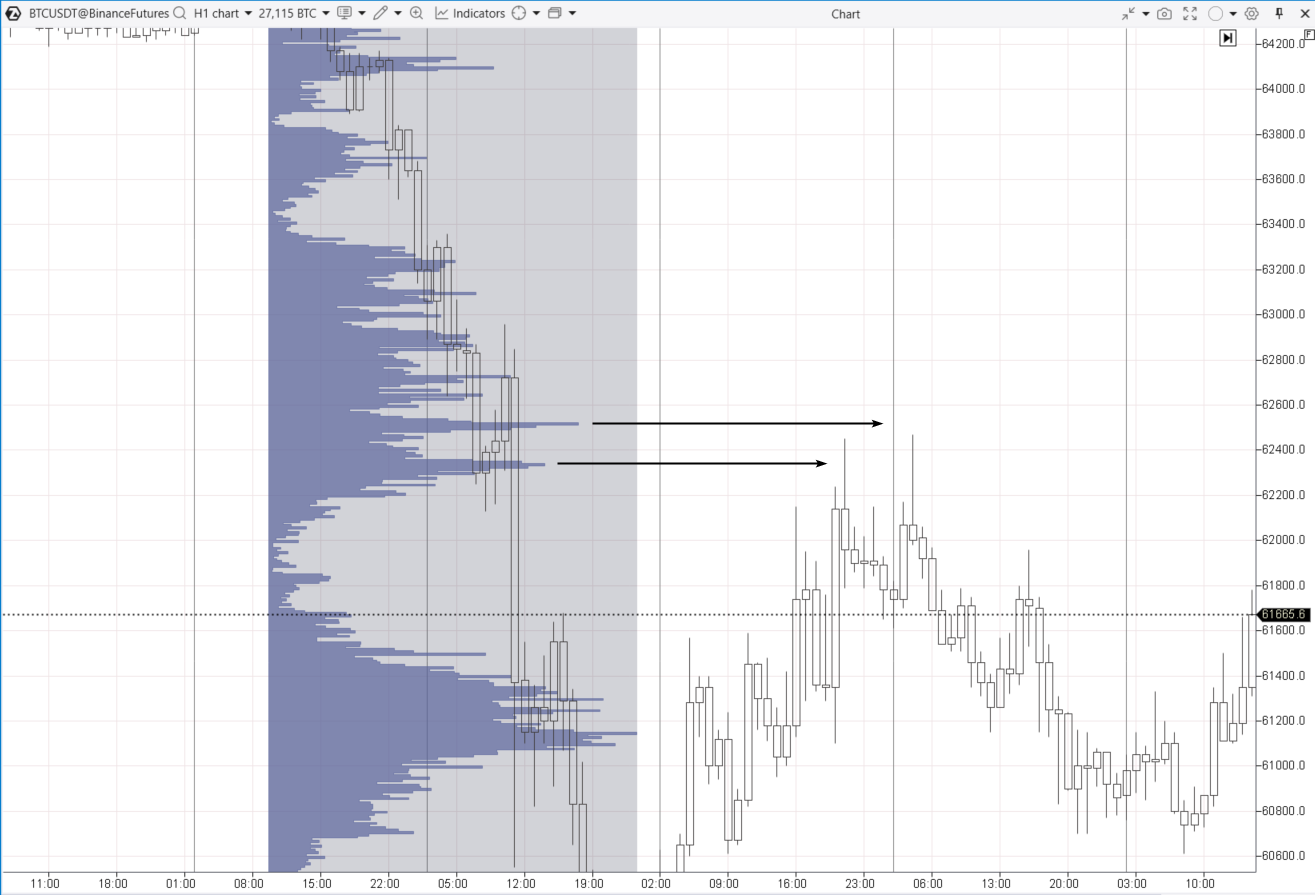

Horizontal Volume Indicators

Also known as Market Profiles.

Market profiles highlight key levels where a large number of trades have taken place, revealing popular price points among traders. In ATAS, these levels can be identified based on the total volume of trades or the number of orders placed, with a breakdown between buys and sells.

ATAS provides a powerful set of tools for working with market profiles:

- fixed profile;

- profile indicator for a specific time frame;

- profile construction for any section of the chart.

The example above shows, with arrows, levels where high volumes of trades took place as the price dropped. Buyers tried to “catch the bottom,” while others were actively selling, expecting the bearish trend to continue – and they were right. As the arrows indicate, these levels, where many orders with large volumes were processed, often turn into support or resistance levels later on.

Recommended reading:

Footprint

Footprint (or cluster chart) is a versatile chart type that enables you to “look inside” traditional candlesticks for a more detailed volume analysis, using profiles or other settings.

The Footprint combines both vertical and horizontal volumes, making it a flexible tool for analyzing executed orders.

The Footprint chart above illustrates how to analyze order flow (follow the numbered arrows):

- Executed sell market orders did not result in a continued price decline. The price closed higher than the levels where a significant flow of sell orders had occurred, indicating the end of the downtrend.

- Executed buy orders pushed the price higher. The bright green cluster at 11:00 shows strong buying activity as the price breaks through the resistance line (the descending trend line), signaling a bullish market.

Recommended reading:

DOM Trader Mode

The DOM Trader mode brings together a range of features, offering users an intuitive interface for Order Flow analysis and intraday trading.

It includes:

✔ a section for analyzing the liquidity map (showing the flow of executed orders);

✔ a section for visualizing the order book (showing active limit orders);

✔ trading features;

✔ flexible settings.

Learn more: Overview of the DOM Trader mode in the ATAS Knowledge Base.

DOM Levels Indicator

This innovative indicator enables you to assess the historical price reaction to significant volume levels in the order book.

The example above shows two price reversals downward from the levels where large sell orders were placed.

For more details on how the indicator works, visit the knowledge base.

Smart Tape Module

This module is also known as Time and Sales or Order Tape.

Smart Tape (shown below, to the right of the chart) displays a real-time flow of recently executed trades as continuously updating bars.

Some of the main features of Smart Tape include:

- the ability to analyze the flow for selected candles on any part of the historical candlestick chart;

- trade aggregation (making the tape easier to read);

- Min/Max filters;

- tape speed indicator;

- highlighting trades outside the spread (which can signal a trend reversal).

Imbalance Indicator

Stacked Imbalance shows:

- areas with a higher concentration of buyers are shown in green;

- areas with more sellers are marked in red.

These levels often highlight zones where a trend might accelerate or reverse.

For instance, if the buyer dominance is largely due to an influx of small traders’ buy orders, this could signal a potential trap for these traders, leading to a downward price reversal.

Recommended reading:

How to Analyze Order Flow

Order flow analysis requires more advanced skills and is significantly more complex than identifying moving average crossovers.

When analyzing Order Flow, an analyst considers:

- the effort from one side of the market compared to the achieved result;

- market participants’ psychology;

- price and volume behavior near key support and resistance levels;

- market participants’ psychology,and other factors, using logical reasoning to form a personal judgment on the market’s current character.

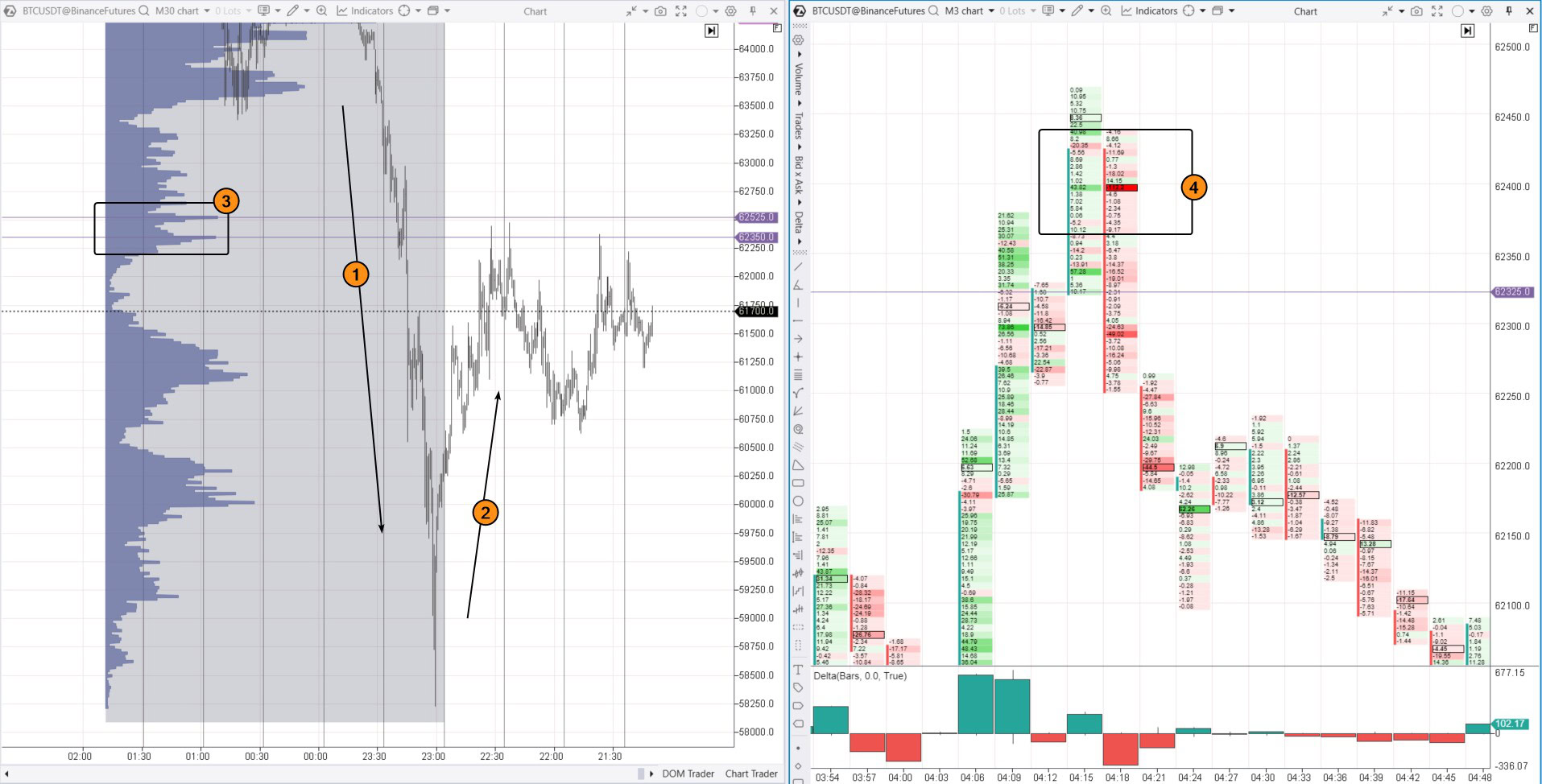

Example. A trader examined a Bitcoin price decline (1) on the 30-minute chart, observing a dip below the psychological $60k level, followed by a recovery (2). Using market profile, they identified a zone with two levels showing high order volume (3) and hypothesized that the recovery could encounter resistance at those levels.

To get confirmation, the trader switched to the 3-minute chart and, using the footprint, noticed a sharp shift in market sentiment (4) at the 62,400 level. Exhausted buying at the 4:15 bar was followed by a surge in seller activity at 4:18. In other words, the order flow dominated by market buys ended, giving way to an order flow dominated by market sells.

FAQ

Why analyze Order Flow?

Order Flow analysis is essential for forecasting price movements in the market. This analysis is conducted by observing how orders of different sizes are placed and executed, and how prices respond to aggressive trades and key levels.

Is Order Flow analysis free?

Typically, no. Real-time exchange data and specialized professional software with advanced analysis tools often require a fee. However, these costs can be worthwhile, given the valuable insights Order Flow analysis can provide.

Is Order Flow a good indicator?

Yes. By analyzing horizontal and vertical volumes, broken down into bids and asks, as well as examining orders in the order book, you can uncover the real forces driving market trends.

In what markets can Order Flow analysis be applied?

Order Flow analysis can be applied to any market. Since it focuses on the mechanics of trading, it can be used to predict prices in cryptocurrencies, stocks, and futures. However, it is particularly valuable for active intraday traders, as it focuses on the finer details that might be less relevant for swing traders.

How to learn Order Flow analysis?

First, you will need a professional program for analyzing Order Flow on cryptocurrency and traditional exchange markets, with features such as:

- The ability to analyze charts down to individual trades.

- Footprint or cluster charts..

- Vertical volume indicators with delta breakdowns.

- Market Profiles.

- Order book analysis tools.

✔ The ATAS platform is an ideal choice for this, you can download it for free here. By the way, ATAS was originally called OFT (Order Flow Trading).

✔ Second, you will need data from exchanges. Order flow data from cryptocurrency exchanges is usually available for free. However, there may be a small fee for order flow data from futures or stock exchanges.

✔ Third, you will need to dedicate time to learning. While it might take a few months, the skills you acquire will serve you for a lifetime.

For effective Order Flow training in ATAS, the following resources are available:

- Market Replay simulator for traders;

- learning materials in the Learn section of the platform;

- statistics analysis and demo account;

- educational articles on our blog.

Conclusion

Order Flow trading is a powerful method that gives traders an edge in the market.

It focuses on the real drivers of price movements, with supply and demand reflected in the orders placed on the exchange. This approach helps traders spot shifts in market sentiment early and make more informed trading decisions.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision. Do not miss the next article on our blog.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions or on Discord.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.