For most, Halloween is an evening of scary costumes, candy and pumpkins. But for traders, the date is associated with the stock trading strategy of the same name. What’s behind this seasonal anomaly, and why are certain months considered more profitable for investing? We’ll talk about this and more in our article.

Read more:

THE ORIGIN OF THE HALLOWEEN STRATEGY

The background to the Halloween strategy dates back to sixteenth-century London traditions. Newspapers in the United Kingdom often used the phrase “Sell in May and Go Away”. It had a specific connotation based on the tendency of aristocrats, merchants, and bankers to leave the capital during the summer months and move to the provinces. Thus, trading in securities virtually ceased. There was no one to trade with.

The saying “Sell in May and Go Away” was revived hundreds of years later, and in 1964, the Financial Times recalled it.

However, it became popular among retail investors in the 1980s when The Wall Street Journal published a landmark article about the British stock market. The article hinted that May signaled the beginning of a dismal or even bear market and that investors should close their positions and keep their capital in cash.

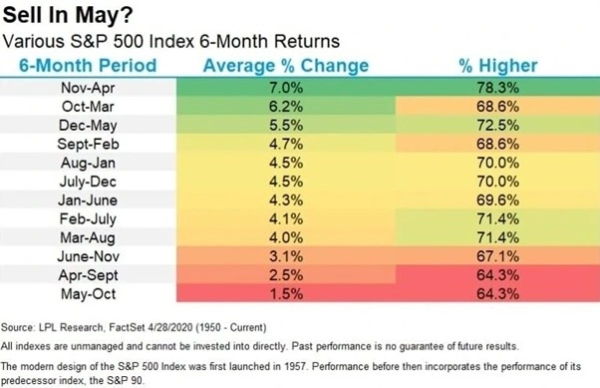

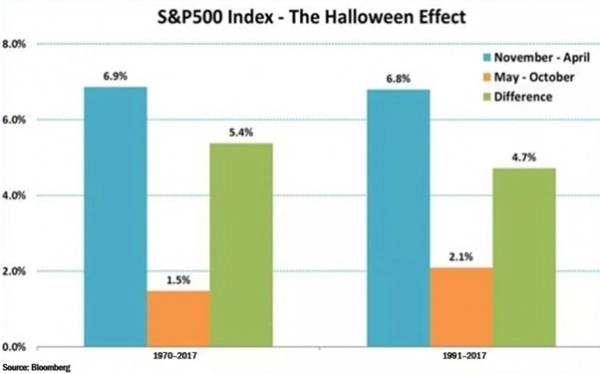

The 70-year study confirms that the market has historically experienced a lull between May and November compared to other seasons. Stocks are rising but at a slow tempo.

This characteristic was true in the 1980s, and it is still true today.

In 1990, Michael O’Higgins and John Downs published their book “Beating the Dow”. The authors recalled again the “Sell in May and Go Away” investment strategy, which found a sequel in the “Halloween” strategy.

In their book, O’Higgins and Downs suggested that investors enter the stock market on October 31st and exit on April 30th. The end of October is exactly the date of Halloween, hence the strategy’s name, which suggests buying stocks during Halloween and holding them for exactly six months.

DOES THE HALLOWEEN STRATEGY REALLY WORK?

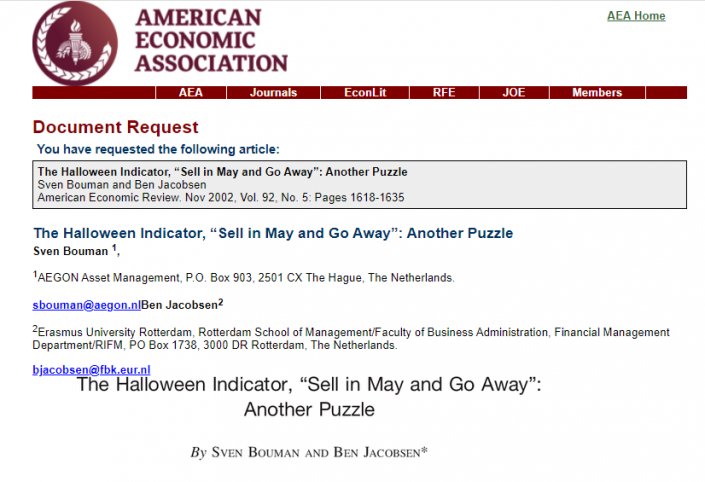

According to the American Economic Review, the stock returns of the major U.S. exchanges delivered significant returns between November and April.

The study examined 37 securities markets. The trend proved to be fair for 36 of them. The historical data confirms that the strategy is working.

This calls into question the validity of the efficient markets hypothesis, which states that there should be no rules for profitable mechanical trading. If the Halloween strategy were a reliable method of maximizing profits and minimizing risk, all investors would use it.

But the facts are irrefutable. The strategy works:

WHY THE HALLOWEEN STRATEGY WORKS

The higher yields from November through April can potentially be attributed to multiple factors:

- trading volumes gradually increase after the summer lull;

- important political events occur during the fall and winter period;

- Christmas sales boost companies’ earnings and shareholder payouts;

- companies are more active than in summer and announce new products more often;

- interest rates do not usually change in the summer.

The exact reasons for this seasonal phenomenon are still debatable. There are different opinions whether it is a consistent pattern or just a coincidence. And if the reasons remain unclear, it can rightly be called an anomaly.

SEASONAL MARKET ANOMALIES

The Halloween strategy isn’t the only seasonal anomaly in the market. Here are a few more:

- The January effect, or Santa Claus rally. This is a seasonal anomaly where stocks tend to rise during January after a drop in stock prices that usually occurs in December. It is thought that the decline in stock prices in December may be due to investors doing tax optimization, counting assets gained during the year. And in January, they get back into positions and spend the bonuses they received at the end of the year.

- January barometer. According to some opinions, stock market performance in January can predict results for the rest of the year.

- The Mark Twain Effect. Stock returns are lower in October than in other months. The effect comes from Mark Twain’s book Fatty Wilson.

- Super Bowl Indicator. The theory suggests that the future direction of the stock market can be predicted by who wins the Super Bowl of American soccer.

- Presidential Election Cycle. The theory suggests that U.S. stock markets exhibit their worst years after a new president is elected.

IS IT WORTH BUYING STOCKS ACCORDING TO HALLOWEEN STRATEGY?

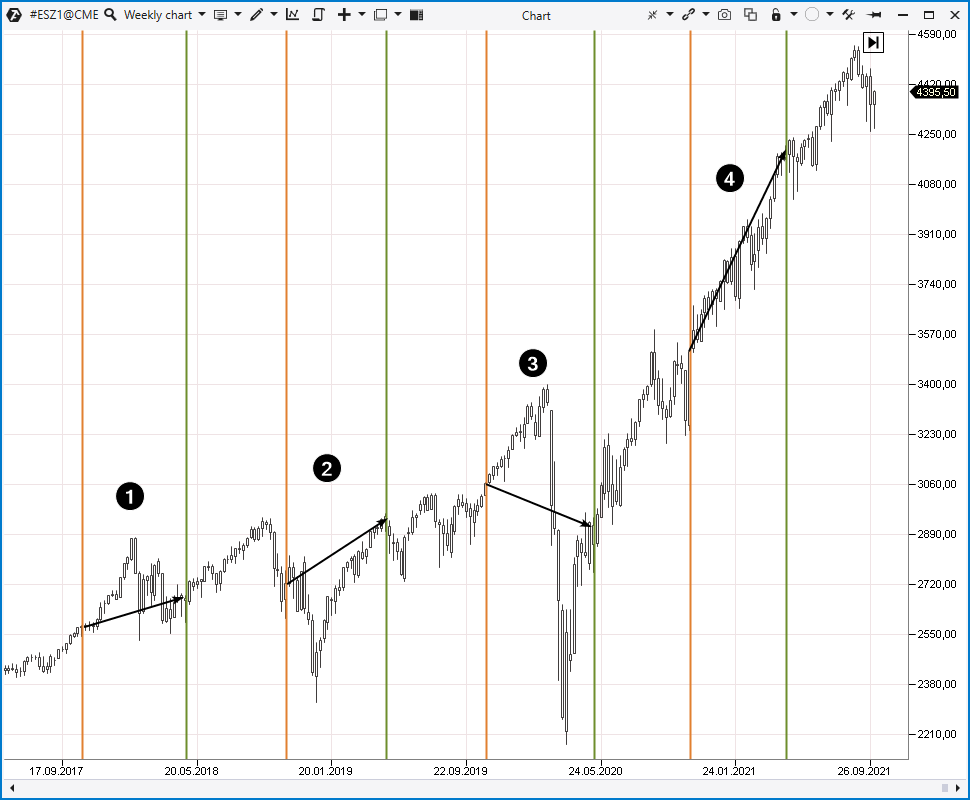

First of all, we can’t give advice. It is not right either. It is better when the investor is responsible for his own decisions. But take a look at the chart of the weekly period.

We have highlighted the end of April in green and the end of October in orange. As you can see, of the last 4 cases, 3 were profitable. And Halloween 2019 purchases were “ruined” by the coronavirus pandemic.

We recommend using cluster analysis to evaluate actual buying and selling behavior and then make more informed decisions than buying stocks based on simple statistical models.

Download ATAS. It’s free. Once you install ATAS, the free START plan is automatically activated – you’ll have access to cryptocurrency trading as well as the basic functionality of the platform. You can use it as long as you see fit until you decide to upgrade to a more advanced plan to expand your access to ATAS tools. Besides, at any time you can activate Free Trial – 14 days of free access to the full functionality of the platform, which will help you to evaluate the advantages of senior tariffs and make an informed decision on purchase.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.