Fair Value Gaps (FVG) are impulse price movements caused by an imbalance between buyers and sellers.

This article provides a practical guide with examples of what a FVG is, how to identify it on a chart, and how to use this pattern in trading. You will also learn how to apply a strategy using the Fair Value Gap indicator and volume analysis tools to make better trading decisions.

Read more:

Disclaimer. The ATAS company is not affiliated with Michael Huddleston (Inner Circle Trader) and does not promote or endorse his trading strategies. This article explores the popular Fair Value Gap (FVG) pattern among traders and discusses how the tools on the ATAS platform can be useful for trading the FVG model.

What Is ICT Fair Value Gap (FVG) in Trading?

The Fair Value Gap (FVG) was developed by Michael Huddleston, a trader and analyst from the USA, also known as The Inner Circle Trader (ICT).

He has a popular YouTube channel where he promotes his Smart Money Concept, which includes the Fair Value Gap setup.

The Fair Value Gap is a pattern made up of three candles:

- A Bullish Fair Value Gap forms on a second rising candle between the high of the first candle and the low of the third candle, without any overlap;

- A Bearish Fair Value Gap forms on a second declining candle between the low of the first candle and the high of the third candle.

Although ICT prefers not to trade cryptocurrencies, his pattern can be applied across various timeframes in forex, stock, and commodity markets. Examples of both bullish and bearish Fair Value Gaps are shown below on a Bitcoin futures chart.

On the left, you see a Bullish Fair Value Gap formed by candles 1–2–3. The gap (highlighted in yellow) is the area between the high of candle 1 and the low of candle 3.

On the right, you see a Bearish Fair Value Gap formed by candles 4–5–6. The concept is the same but in reverse.

These examples show how Fair Value Gaps are used in trading to enter positions during pullbacks in the direction of the main trend.

Example of the Fair Value Gap from Inner Circle Trader

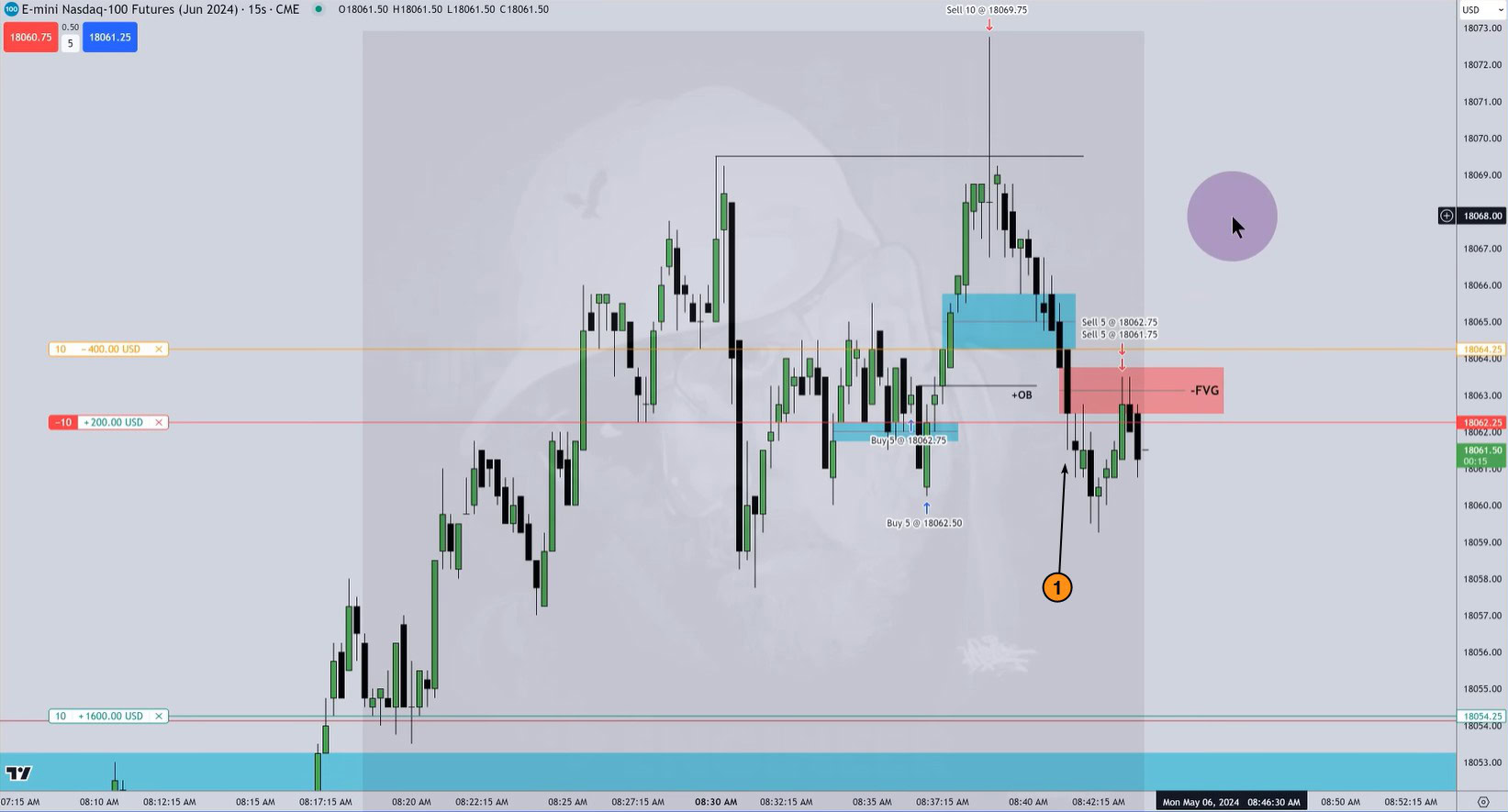

In the screenshot below from YouTube, Michael Huddleston (ICT) demonstrates his Fair Value Gap pattern on an E-mini futures chart for the Nasdaq 100 index:

The Bearish Fair Value Gap is shown with a red rectangle, it appeared when the price was easily declining on candle (1). When the price later returned to the FVG area, Michael opened a short position (indicated by the red arrow down), setting a stop-loss just above the upper edge of the gap.

For a more detailed explanation on identifying Fair Value Gap zones, check out this video on our channel:

Let’s move on to trading based on Fair Value Gap signals.

What Does the Fair Value Gap signal Mean?

Let’s examine two Fair Value Gap patterns on a Nasdaq 100 futures chart to understand how a FVG works.

Vertical arrows indicate spikes in positive and negative values on the Delta indicator during the formation of the Bullish and Bearish Fair Value Gaps, respectively:

Next, we will add two market profiles to assess their shape when the Fair Value Gap forms on the candles. We notice (marked with horizontal arrows) that in both cases the profile was narrow, indicating that the price moved quickly without staying at certain levels.

This suggests an imbalance between buyers and sellers. Due to these pricing variables, there is a “gap” in the asset’s value to a zone where supply and demand are more balanced.

When trading the Fair Value Gap pattern, the strategy relies on the idea that the imbalance is still present and that the price will keep moving in its initial direction.

How to Identify Fair Value Gap on a Chart

You can identify Fair Value Gaps using just a candlestick chart (ICT trades without any indicators). However, to make confirmation easier and improve analysis accuracy, ATAS platform users can use:

✔ Fair Value Gap Indicator – this tool automatically detects and highlights Fair Value Gaps on the chart. More details are available in the knowledge base.

✔ Volume Profile – as mentioned earlier, a narrow profile can confirm an imbalance between buyers and sellers.

✔ Delta Indicator – its spikes, as shown before, can confirm that one side of the market has become more active, which creates an imbalance.

✔ Stacked Imbalance Indicator – it analyzes the ratio of market buys and sells within the candle levels and identifies (based on specified criteria) areas where one side’s trades significantly outweigh the other. More information about this indicator is available in the knowledge base.

Example. The screenshot below shows three examples of Fair Value Gaps on a 1-minute chart for E-mini Nasdaq futures:

The first Fair Value Gap is bearish. It formed during a decline between the low of the 03:34 candle and the high of the 03:36 candle, with the price dropping easily from around 19785 to 19776. The advantage of sellers is also confirmed by:

- a spike in negative Delta;

- red bars indicated by the Stacked Imbalance Indicator.

Interestingly, the green bars on the 03:36 candle show buyer activity, suggesting these buyers might have been trapped.

Shortly after, a second Bearish Fair Value Gap formed, confirmed by a narrow profile (2). This indicates that there were few trades, likely due to a lack of buyers.

The reaction to the second FVG was a price decline (3). The start of this movement could be indicated by the green bars from the Imbalance Indicator.

The price reaction to the first FVG was also a decline (4). A possible signal for the start of this move was the spike in positive Delta on the 04:38 candle.

Notice that the decline (4) ended with the formation of the third FVG (5), this time a bullish one. The spike in sales (6) near 19766.25, which did not lead to a further price drop (a failure of the bears → a potential bullish signal), indicated that the bulls might try to take control.

How to Trade Using Fair Value Gap

After reviewing how to identify the three-candle FVG pattern, let’s go over the trading rules for Fair Value Gaps.

Step 1. Identify the pattern. When identifying Fair Value Gaps, indicators such as Delta, Volume Profile, and Stacked Imbalance can be helpful. Other indicators, like Speed of Tape, might also be used to show high trading activity during the formation of the FVG pattern.

Step 2. Plan your entry.

You can enter a position by:

- Placing a limit order within the FVG zone;

- Waiting for the price to return to the FVG zone and then confirming a reversal that suggests the price will continue in the direction of the initial move. Confirmation can come from indicator signals, footprint analysis, or reversal patterns on candles like Renko or Range.

Step 3. Set your exit targets.

A stop-loss can be effectively placed outside the FVG.

For take-profit, the level is set based on your judgment. For instance, if you identify a Bearish FVG, a good option might be to set the take-profit near significant support below, ensuring that the potential reward is several times greater than the risk.

Example of FVG on a Footprint Chart

In the screenshot below, the Bearish Fair Value Gap (on the left) and the Bullish Fair Value Gap (on the right) are highlighted in yellow. This is the E-mini NQ futures market, CME exchange data.

Number (1) shows a sharp price drop, forming a Fair Value Gap pattern. The dominance of sellers is indicated by the bright red clusters within the candle and the spike in negative delta. When the price reached this zone, it struggled to push higher later on. The bright green clusters on the footprint are particularly notable (indicating trapped buyers). From that point, the price began to fall, eventually reaching the area of a smaller Bullish Fair Value Gap (4).

Later, likely due to the release of significant economic news, a Bullish Fair Value Gap pattern (2) formed. The circle on the profile highlights that during the sharp price rise, there were few trades executed, signaling a lack of sellers. When the price returned to the thin profile area in less than 10 minutes, this could have been used as a setup for entering a long position, expecting the bullish momentum to continue.

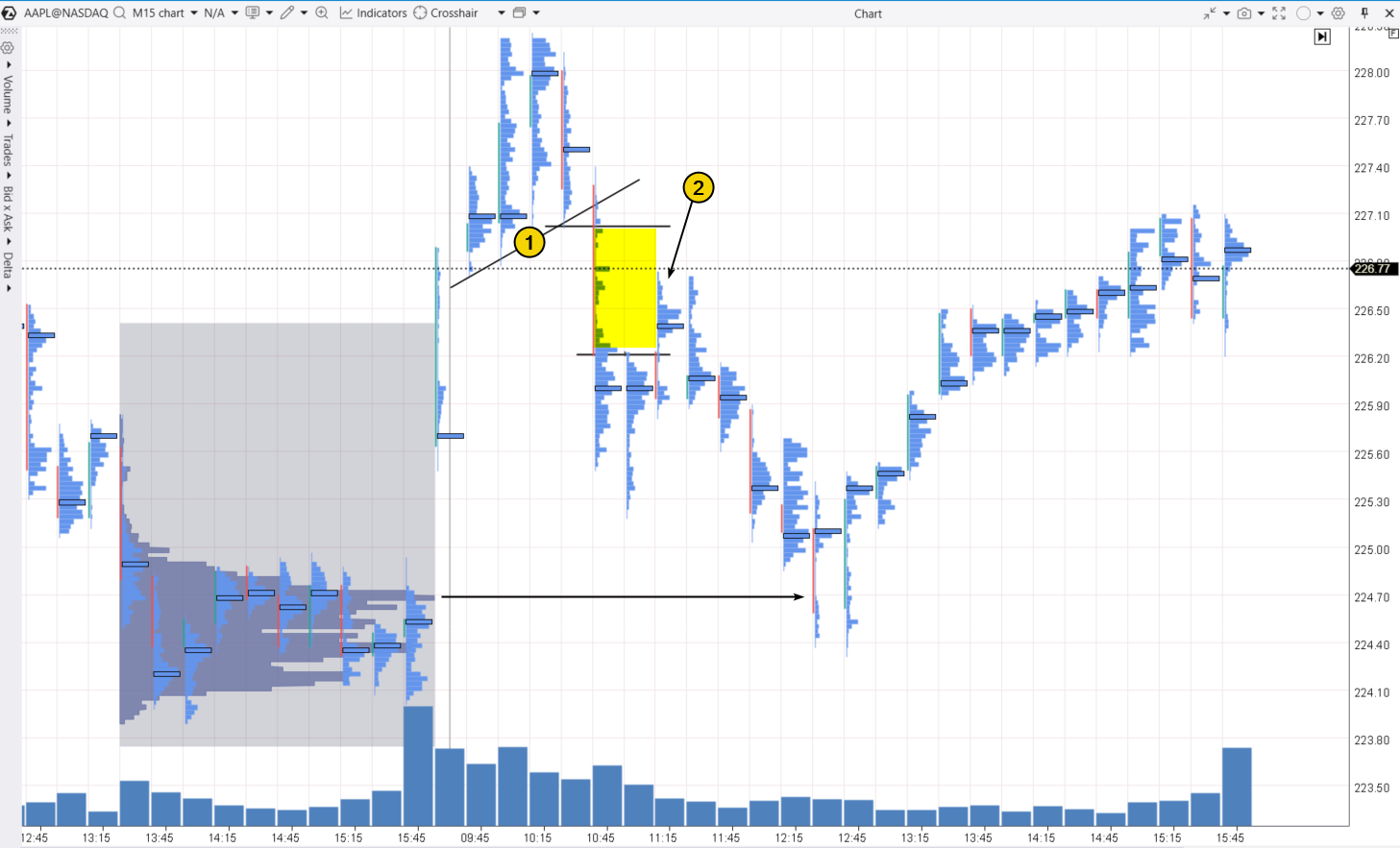

Fair Value Gap on AAPL Stock Price Chart

Here is an example of a sell setup using the Fair Value Gap pattern on an intraday chart:

On August 23, 2024, the market sentiment was initially positive: AAPL stock opened with a bullish gap and found support from the trendline (1). However, the situation quickly reversed.

At 10:45, the price sharply declined, forming a Bearish Fair Value Gap, confirmed by a thin volume profile.

When the price retraced upwards (2), this provided a potential short entry opportunity, with a stop-loss placed just above the yellow zone. A suitable take-profit level could be set near the high-volume area formed at the end of the previous trading day around $224.70 (marked by a horizontal arrow).

Inversion Fair Value Gap

A Reverse (Inverted) Fair Value Gap occurs when a FVG area previously seen as support or resistance changes its role and starts acting in the opposite way. It is similar to how a support level can turn into resistance once broken, and vice versa.

An example of an Inversion Fair Value Gap. Below is a 15-minute chart of Bitcoin’s price.

Candle (1) shows a sharp price spike, forming a Fair Value Gap (highlighted in yellow).

As indicated by the bright green clusters (2), buyers were dominant just below the $61k level.

However, the bulls could not maintain momentum after pushing the price above $61k. The price held at this level for several candles but dropped to $60,700 on the wide 14:30 candle.

This breakdown through the yellow FVG zone caused it to act as resistance. The failed bullish Fair Value Gap turned into a bearish pattern, as shown by candle (3) and the following candles.

FAQ

What is considered Gap trading?

Gap Trading is a strategy based on the difference between a stock’s closing and opening prices. Gaps often act as key support or resistance levels for price movements.

What does Fair Value Gap (FVG) mean in trading?

A Fair Value Gap (FVG) refers to a zone on the chart where the price moves easily due to an imbalance between supply and demand. Once this imbalance levels out, price movement tends to slow, and the FVG area often acts as support or resistance.

Is a Fair Value Gap a bullish or bearish pattern?

A Fair Value Gap can be either bullish or bearish, depending on the direction of the price movement.

Which time frame is best for FVG?

The best timeframe for identifying a FVG depends on your trading style, but daily and hourly charts are commonly used by traders. For example, you can spot a Fair Value Gap on a 30-minute candlestick chart and then switch to 3-minute footprint charts to look for reversal signals within the FVG.

What is the best indicator for Fair Value Gaps?

ATAS provides a specialized Fair Value Gap indicator that highlights areas matching FVG criteria. However, in practice, you may find that market buy and sell imbalances are better assessed using tools like market profiles, footprint charts, the Stacked Imbalance indicator, and other volume analysis tools.

How to Learn Trading Using Fair Value Gap Patterns

While the Fair Value Gap may seem like a straightforward 3-candle pattern, several challenges can arise in practice:

- zones formed by this pattern may appear too frequently;

- zones may be either too narrow or too wide;

- the pattern may produce false signals.

This creates the need for additional checks using volume analysis tools to confirm the presence of a buyer-seller imbalance.

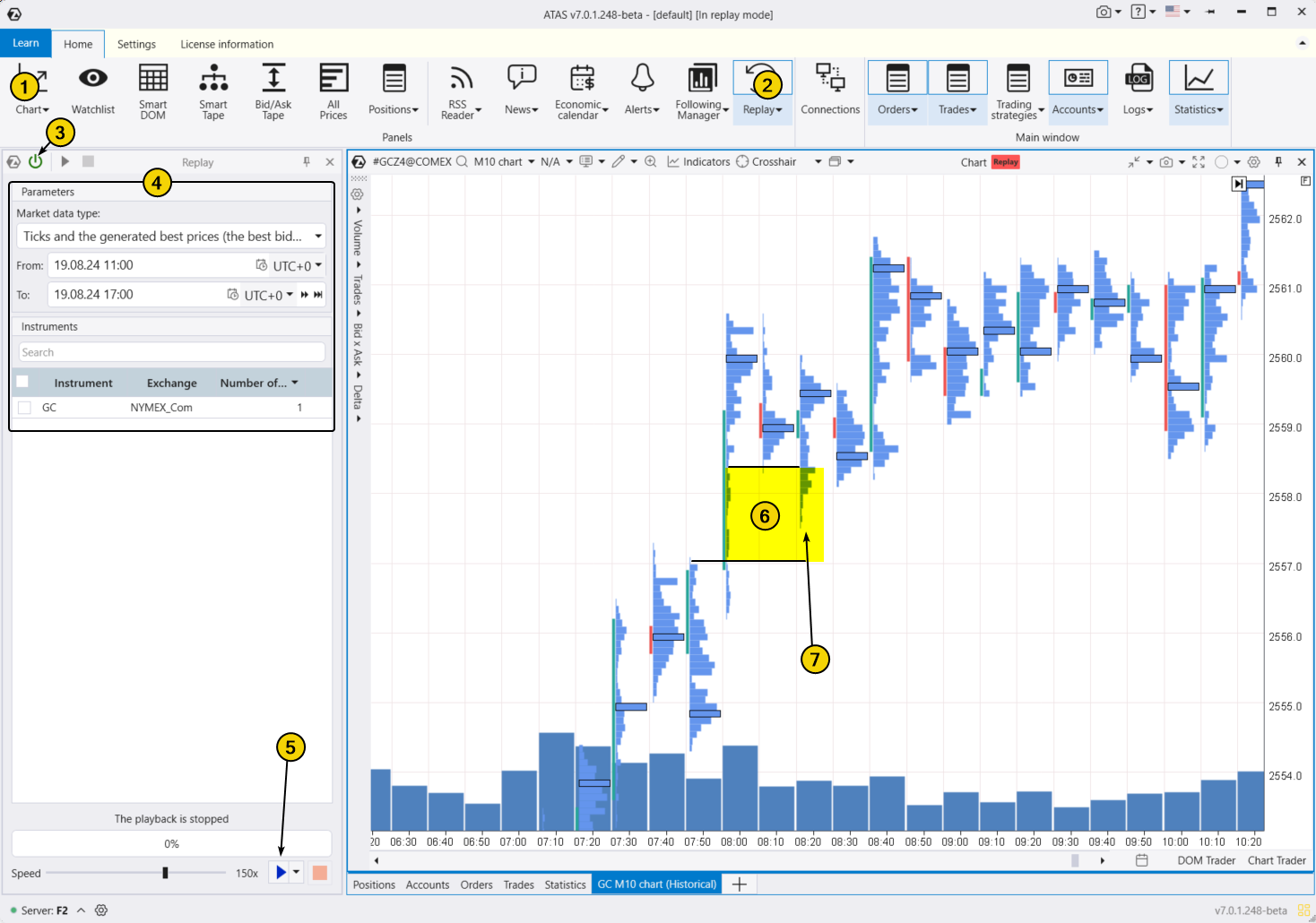

To see whether you can profitably trade using the Fair Value Gap pattern, use the ATAS Market Replay simulator for traders. This module of the ATAS platform uses historical data to recreate real-time trading conditions. There is no financial risk involved.

To try the simulator, download the ATAS platform for free, install, and launch it, and then:

- Open a chart of a financial instrument.

- Click on the Market Replay button in the main ATAS menu.

- Activate the Replay mode (the icon should turn green).

- Adjust settings like date and data type if needed.

- Start the playback and monitor when a Fair Value Gap appears on the chart to open a position during its test.

In the gold price chart example below, the FVG zone is highlighted in yellow (6) and is confirmed by a narrow profile. You can also see a test (7) of the zone where the thin profile indicates an ongoing shortage of gold sellers around the 2558 level — this can be used as a setup for entering a long position.

When practicing trading patterns in the Market Replay simulator, you can:

- adjust the playback speed, and pause;

- analyze footprint charts;

- use over 400 indicators: for example, Delta or Speed of Tape can help you identify the Fair Value Gap pattern;

- use Chart Trader and other features to trade on the built-in demo Replay account and then analyze your performance;

- use drawing objects, for example, mark support and resistance levels;

- use exit strategies;

- do much more to master the use of buyer-seller imbalances.

ATAS enables you to load tick-by-tick data from cryptocurrency, stock, and futures markets, providing a comprehensive basis for analyzing price and volume interactions. This helps refine your trading strategy by identifying key patterns.

Conclusions

The Fair Value Gap (FVG) trading strategy takes advantage of opportunities that emerge from new impulse movements. Despite having “Gap” in its name, the FVG pattern on intraday charts is not actually a gap. Instead, it is usually recognized as a three-candle formation where the second candle is the widest.

The key feature of the Fair Value Gap trading strategy is that it is based on market imbalances, enabling you to better track the prevailing market sentiment.

What are the main advantages of trading with Fair Value Gaps?

✔ The idea behind a FVG is to trade based on supply and demand imbalances, which are key drivers of price movements in financial assets;

✔ Fair Value Gaps offer an effective way to join an existing trend;

✔ Additional volume analysis tools can provide a solid confirmation of the pattern.

What are the potential risks of using the fair value gap strategy?

✘ The pattern might turn out to be false;

✘ Successful trading with Fair Value Gaps requires considerable experience and skill in understanding the market context;

✘ There are no specific guidelines for setting stop-losses and take-profits — just general recommendations.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.