Copy trading is a form of interaction in financial markets where trading operations on one account are automatically replicated on another.

The accounts can belong to the same or different individuals (provider and follower), and the copying occurs based on the proportional capital allocation on respective accounts. There are also other nuances to consider.

In this article, we will explain how copy trading works and how to profit from replicating trades:

How Does Copy Trading Work?

The concept behind copy trading is just as its name suggests – it involves the replication of trades (orders) from one account to others. This practice is common in cryptocurrency, forex, and other markets.

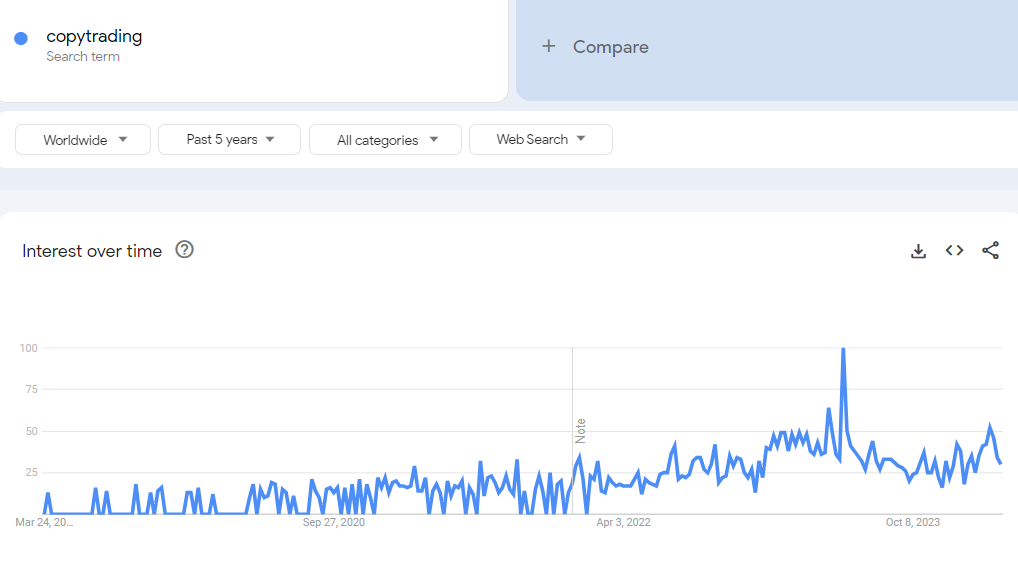

According to Google Trends data, copy trading is gaining popularity worldwide:

To copy trading activity, you will need:

- A provider account (from which trades or orders will be copied).

- A follower account where trades or orders will be replicated (usually across multiple accounts).

- A platform with copy trading settings.

It is clear that:

- there should be funds available in the accounts;

- the platform needs to have access to the accounts;

- all necessary legal formalities must be met.

To put it simply, the process of copying trades (orders) involves the following steps:

- Pre-configuration. Setting up parameters such as provider and follower accounts (which can be more than one), copying proportions, objects to be copied (orders/positions), conditions for stopping copying, etc.

- Once the settings are configured and the process is initiated, the platform monitors activity on the provider account.

- As soon as trading operations are detected on the provider account, the platform replicates them on the follower accounts (according to the specified settings).

Copying trading activity between accounts occurs in a matter of seconds.

Pros of Copy Trading:

- Diversification. Traders can manage multiple accounts, which enables them to spread their investments across different strategies or assets.

- Accessibility for beginners. Copy trading enables beginner traders to start trading without needing in-depth knowledge of the market and trading strategies.

- Risk diversification. You can trade yourself while allocating part of your capital to copying other traders’ transactions. Diversification across markets and other criteria is also applicable.

- Educational aspect. Investors can learn by observing the actions of experienced traders.

- Control. Investors usually have the option to stop copying trades at any time, freeing up capital if needed.

Cons of Copy Trading:

- Risk of losses. The market is unpredictable, and even trades made by successful traders can lead to losses.

- Dependency on traders. Investors might become reliant on the actions of others, neglecting to develop their own trading skills.

- Technical aspects. Trades may be copied with slippage or other technical nuances.

Ways to Use Copy Trading

The first and simplest way to use copy trading is by managing multiple personal accounts. For example, if you have accounts on Binance and OKX. You want your trades on one exchange to be synchronously replicated on the other. You can use cryptocurrency copy trading settings on your accounts.

A broader approach involves setting up a social trading platform, where:

- Experienced traders (providers) can show their trading results and attract followers (investors).

- Followers (investors) compare the performance of different traders and set up copying trades of selected ones (one or several) to their own accounts, thereby generating passive income.

Copy trading is a win-win situation, benefiting brokers and exchanges through commissions.

Next, we will examine two described methods: copying trades between your own accounts and social trading of cryptocurrencies.

Following Manager

The professional trading and analytical platform ATAS offers reliable functionality for managing multiple accounts available to the user.

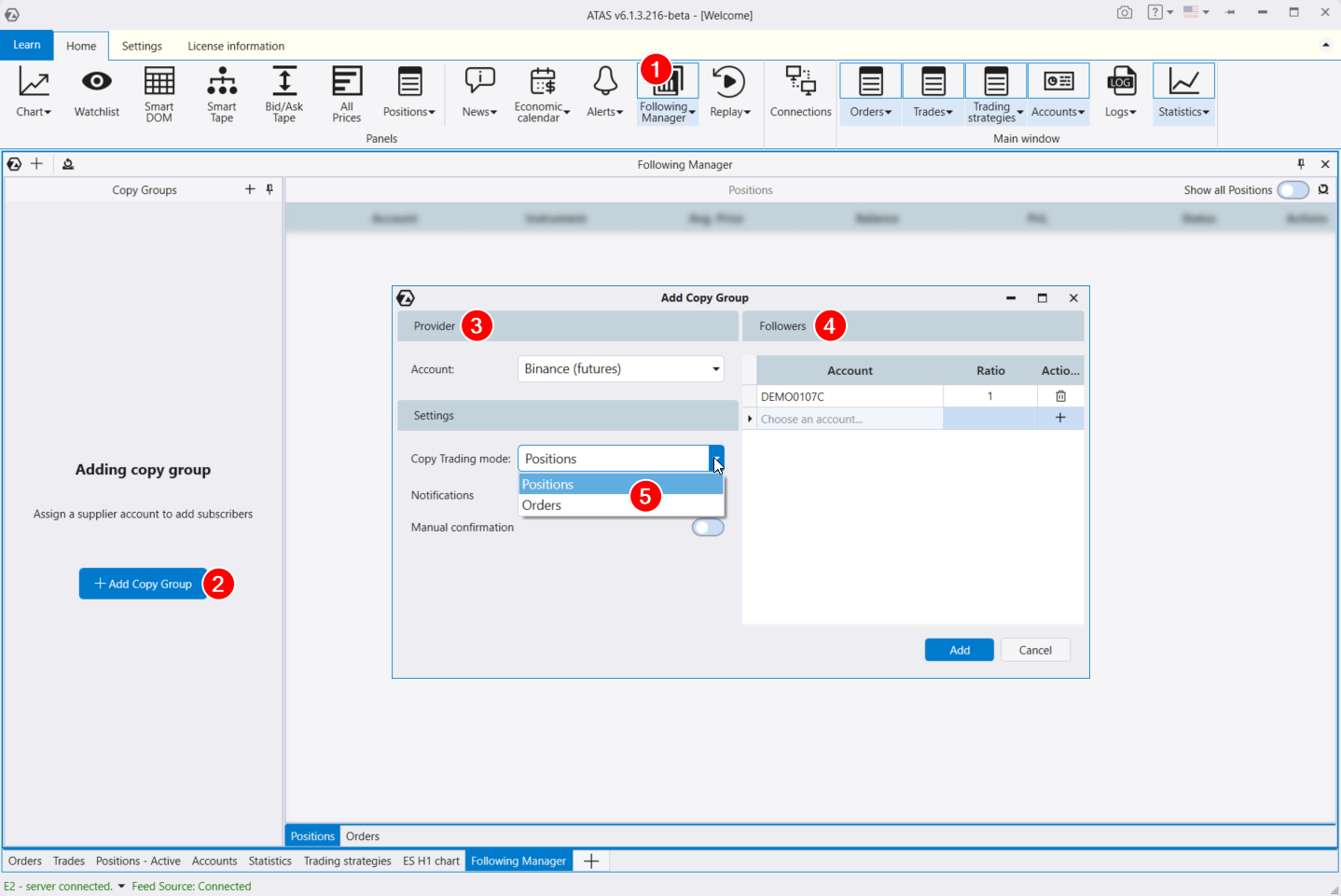

Setting up Following Manager in ATAS:

- Open the settings window.

- Create a group.

- Specify the Provider account in the settings – copying will be performed from this account.

- Set the Follower account (or multiple accounts) to which the copying will be done. The Ratio parameter determines the proportions, for example, with a proportional increase or decrease in volume.

- Choose one of the two modes to specify what will be copied: positions (trades) or orders.

Click Play button to start the copying process.

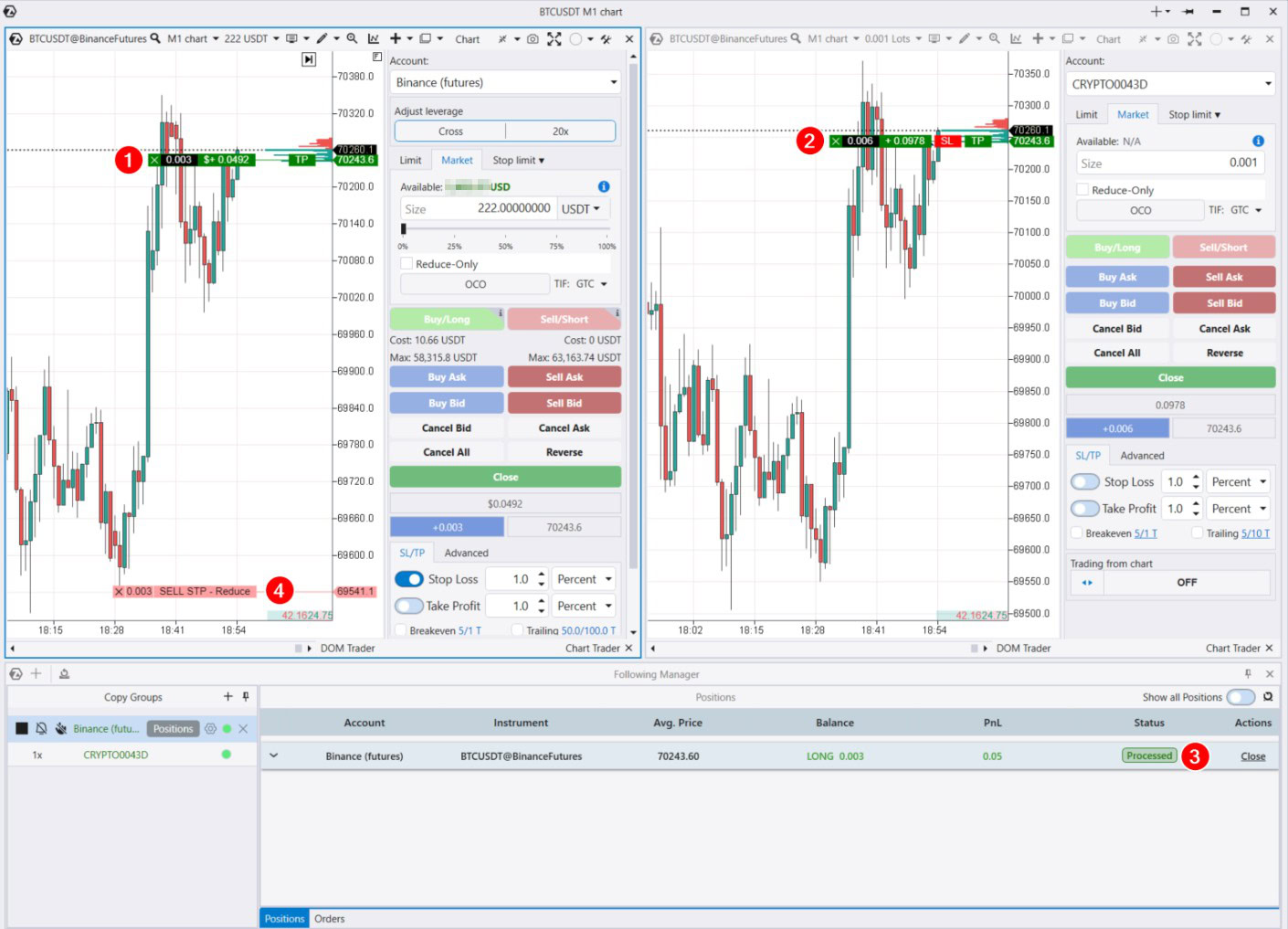

Below is the result of the Following Manager’s operation – copying a trade in the cryptocurrency market:

Numbers indicate:

- An executed trade on the provider account.

- An executed trade on the follower account.

- Information about the copied trade in the Following Manager window.

- An exit order, automatically placed on the provider account, was not copied to the follower account because the copying mode was set to Positions in the settings.

Detailed instructions on setting up trade copying in the Following Manager are available in the Knowledge Base article.

Next, we will explore another way of using copy trading – the social trading platform for cryptocurrencies.

Copy Trading Cryptocurrencies

To start copy trading cryptocurrencies on Binance:

- Register on Binance.

- Fund your account.

- Go to the Binance Copy Trading page.

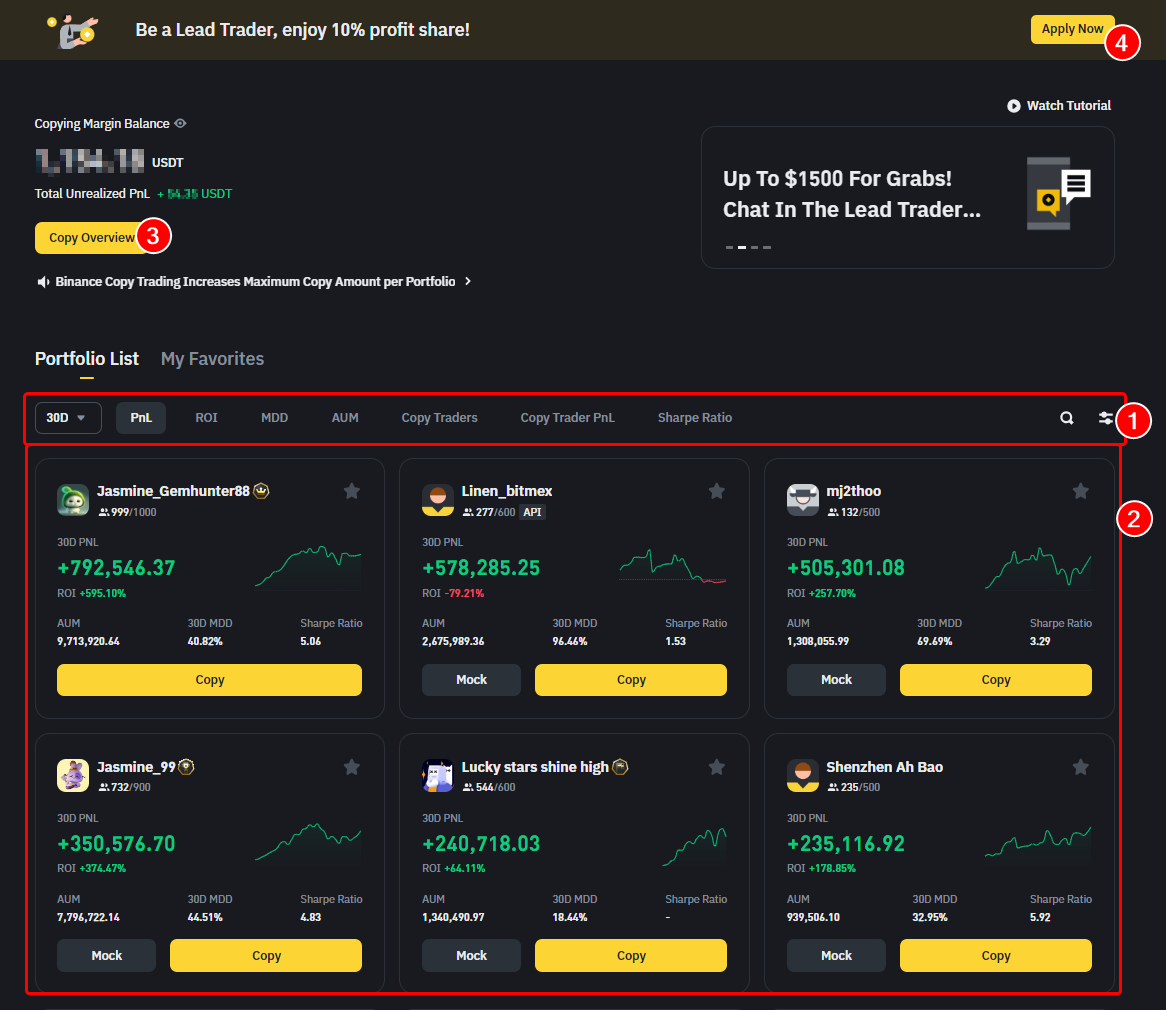

Here is how it looks:

Numbers indicate:

- Adjusting the display of Provider accounts. Among hundreds of accounts, you can sort options based on various criteria: such as profit size or drawdown, over a selected period.

- Information about traders’ performance. The capital change curve is highly beneficial for evaluation. To start copying trades of a selected trader to your account, click Copy. Then the system will prompt you to specify the amount and settings for stopping copying (for example, when the drawdown reaches -15%).

- Access to your account for copy trading. It will display the results of copying trades – you can manually stop copying at any time or lock in floating profit.

- A button for those interested in becoming a Lead Trader. This offers an opportunity to earn a share of the profit (10-15%) obtained by investors (followers).

How to Benefit from Copy Trading Cryptocurrencies

Button #4, highlighted in the screenshot above, is particularly appealing to those aiming to profit from cryptocurrency copy trading.

Here is one possible scenario:

- Use ATAS to gain a trading advantage in the cryptocurrency market and create a strategy.

- Sign up as a Lead Trader on Binance’s copy trading service.

- Show the effectiveness of your strategy by outperforming competitors. The greater your results, the more attention you will attract from potential investors.

- Gradually attract investors who will share profits from copying your trades.

All calculations are automated.

How much can you make through copy trading using this approach?

Let’s say you are able to grow your account by 20% per month. You have attracted investment capital of $100,000, with a personal profit share of 15%. Your own capital = $5,000.

The monthly profit = 0.2 * $5,000 + 0.2 * $100,000 * 0.15 = $1,000 + $3,000 = $4,000.

Using copy trading, you can increase your profit by 4 times compared to if you were trading solely with your own funds.

How to develop a profitable trading strategy for cryptocurrencies?

To effectively analyze and capitalize on cryptocurrency market opportunities, ATAS provides powerful analysis and trading tools, including:

- Connectors for establishing a safe connection to cryptocurrency exchanges like Binance, ByBit, OKX, and more. Instructions are available in the Knowledge Base.

- Footprint Charts. Cluster charts offer filtering options and delta display, providing hundreds of variations.

- Crypto Chart Trader. Trading panel equipped with volume calculation functions, margin adjustment, and automatic exit strategy settings.

- Advanced indicators: Big Trades, DOM levels, Market Profiles, Cluster Search, Speed of Tape, and others.

- Additional modules: Smart DOM, Smart Tape.

- Market Replay. A trading simulator that enables you to trade not only Bitcoin but other cryptocurrencies using a detailed historical database. You do not risk your real capital. This kind of simulator lets you test your strategy in real conditions.

Moreover, ATAS enables you to use non-standard timeframes, connect robots via API, set up alerts, flexible visualization settings, and much more. Our responsive support team is always available to assist and provide guidance on any questions you may have.

FAQ

What Is Copy Trading?

Copy trading is a type of automated trading where the transactions and strategies of traders (providers) are replicated on the accounts of other users (investors, followers). Copy trading can be used not only for interacting with different individuals (social trading) but also for more efficient management of one’s own capital which is distributed across multiple accounts.

How much can you earn from day trading?

Copy trading offers earning opportunities for both investors (who can generate passive income without trading experience) and experienced traders (who can earn a share of the profits from attracted investors). In both cases, the amount earned from copy trading cannot be determined in advance. It depends on the size of the investments, the efficiency of the trader, market conditions, technical delays, and other factors. Exercise caution when making decisions related to earning from copy trading.

Is it legal?

The legality of copy trading depends on the jurisdiction and regulations in the user’s country of residence; in many countries, it is allowed under certain conditions.

Conclusions

Copy trading is the replication of trading activity from one account to another (or to multiple accounts). Modern copy trading solutions offer flexible settings both for the trader (provider, the source of trading activity) and for the investor (follower).

The ATAS platform provides powerful functionality for volume analysis and effective trading, including professional-level cluster charts, useful indicators, and many other advantages.

For copy trading, ATAS offers two primary methods:

- managing one’s capital across multiple accounts using the Following Manager;

- developing a personal profitable strategy and then attracting investors through social trading platforms.

Download ATAS. It is free. During the trial period, you will get full access to the platform’s tools to experiment with copying trades, strategy development, and more. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.