Blue Chips – what does this term mean? It was invented by Oliver Gingold, who worked in the Dow Jones company, in 1923 to specify stocks, which cost more than USD 200 (big money at the time).

This article is about stock market Blue Chips. Read in the article:

What are Blue Chips?

Blue Chips – the term is taken from the poker game. Blue chips are of the highest weight in the game. Consequently, blue chips in the stock market are big stable companies, the stocks of which have been in the market for a long time and they show stable growth in value.

Despite the fact that the poker term became popular and has been used for nearly one hundred years already, including by capital management professionals, we should note that financial markets are not a place for gambling. If you want to experience excitement and a rush of adrenaline, you’d better avoid trading.

There is no generally accepted definition of a blue chip on the stock exchange. It is a general definition of a company which has:

- big market capitalization;

- long history of passing through financial crises;

- stable history of dividend payment;

- reputation, prestige and trust of investors.

That is why, if they say ‘blue chips’, they mean reliable, respected and responsible companies.

Blue Chip characteristics

- High capitalization. If we speak about the US stock market, blue chips are companies with capitalization of more than USD 10 billion. Usually, blue chip stocks are listed in stock indices, such as S&P 500, Dow Jones Industrial Average and / or Nasdaq 100.

- Practically guaranteed yield. As a rule, blue chip stocks provide their stockholders with a quarterly dividend yield. Confidence in a stable, yet small, income makes them attractive for investors who strive to reduce risks. Companies that pay dividends are considered to be mature companies, since they need to spend less income for their further development.

- Financial standing. Blue chips have enough capital to cover their financial liabilities.

- Investment horizon. The blue chip investment time-frame is usually wide – more than 7 years. This makes them suitable for achieving long-term financial goals.

- Growth prospects. Perhaps, they are not so fast-growing as young and ‘trendy’ start-ups, but blue chips are stable companies that have a business development potential, including due to their big financial capacities.

Blue chips are attractive because:

- their businesses are multi-branched, that is, their revenues have diversified sources;

- they provide a passive income in the form of dividends;

- their stocks are more stable in the times of recession.

Examples of Blue Chips in the US stock market

- Apple

- Coca-Cola

- Disney

- IBM

- Johnson & Johnson

- Microsoft

- Nike

- Pfizer

- Verizon

- Wal-Mart

This is far from being a complete list. It is just an example without any specific selection criterion. The stocks are blue chips despite the fact that stock values are very different.

Examples of Blue Chips in the Russian stock market

There is a special blue chip index on the Moscow Exchange (MOEXBC), which lists the most liquid stocks. You can read about it in detail on its official web-page: https://www.moex.com/ru/index/MOEXBC.

It included 15 stocks as of the moment of writing this article:

- GAZP

- GMKN

- LKOH

- MGNT

- MTSS

- NLMK

- NVTK

- PLZL

- POLY

- ROSN

- SBER

- SNGS

- TATN

- TCSG

- YNDX

Each of the issuers has a capitalization of more than RUB 1 trillion.

How to buy Blue Chips?

Blue chip stocks will definitely be of interest to you if you look, first of all, for reliable long-term investments, for example, in order to build a securities portfolio ‘for retirement’.

However, a shortcoming of this is that the following questions will arise, when you plan to buy stocks:

- Is the XYZ stock a blue chip or not?

- What stocks do I need to have in my portfolio?

- How to take dividends into account?

- How to diversify them by sectors and do I need to do it?

- How to rebalance my portfolio and do I need to do it?

If you want to invest in blue chips with ‘no questions asked’, you can consider investing in respective Exchange Traded Funds (ETF), for example, SPY, rather than buying individual stocks. This instrument, namely SPDR S&P 500 ETF Trust, tracks movements of S&P 500 index, which lists stocks of companies that could be called Blue Chips with different levels of confidence.

Another variant is to download the ATAS platform free of charge. It allows composing a blue chip stock watch list, while its powerful indicators and cluster charts, based on the tick data from US and European stock exchanges, will help you to find profitable entry points. This variant has a lot of pros, especially if you want to trade stocks more actively than just ‘bought and forgot’.

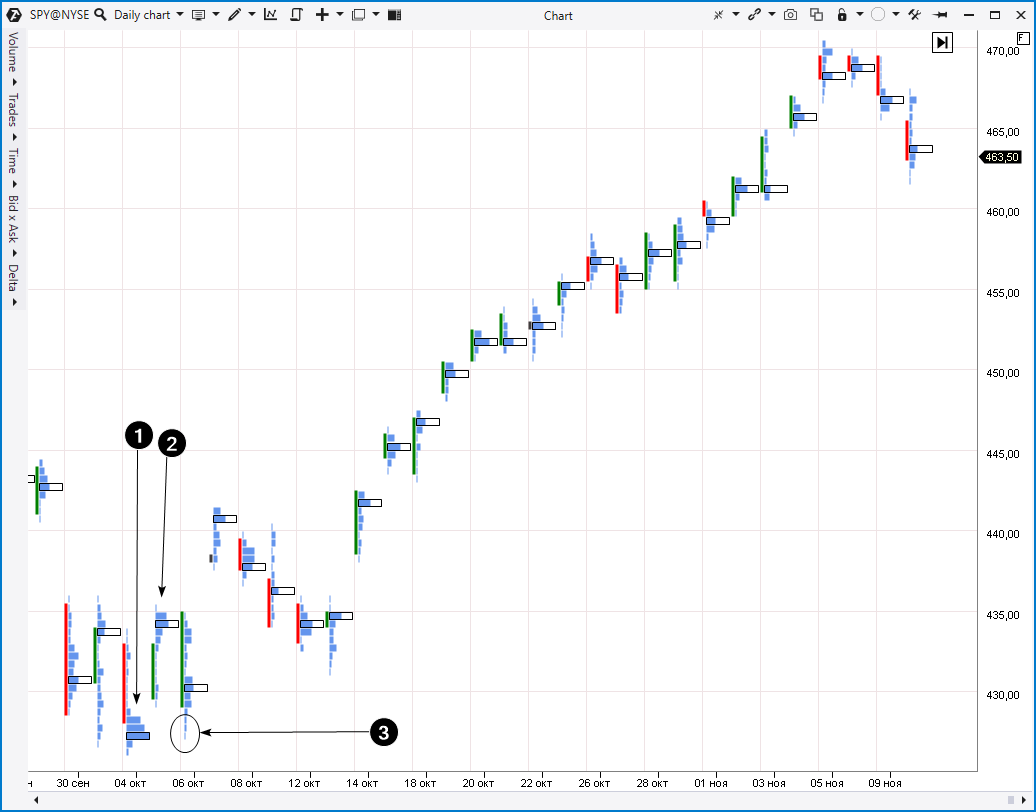

The example below shows it.

Example of SPY fund analysis

We see the SPY instrument trading dynamics in the cluster chart below (1 day period).

Number 1 shows that a b-shaped profile was formed on October 4, 2021, and the most active trades were executed in the lower candlestick section. However, why didn’t the price fall, if this high activity represented the sellers’ pressure? We have a ‘hidden’ bullish signal here.

Number 2 points to confirmation of the bullish assumptions that were received from the previous day’s profile. The price moved up from the October 4 bulge under the 430 level as if sending a message that 430 was too cheap.

Number 3 points to the October 6 narrow profile. Low activity, most probably, is the consequence of a lack of supply. If you had entered a position at that moment, you would have justified your decision with information from clusters and received a significant effect in the form of a long rally at the end of October – beginning of January.

Conclusions

Blue Chip stocks are stocks of the companies, which are respected, financially stable and have been working in their sectors for a long time.

There is no strict definition of what is required for receiving the Blue Chip status. However, a company which is considered a Blue Chip, as a rule, will:

- stay at the top of its sector;

- be listed in a stock index;

- consistently pay dividends;

- have a well-known brand.

Blue Chip stocks are usually considered to be low-risk ones. However, it doesn’t mean that they are guaranteed against bankruptcy, although such cases, as a rule, are very rare.

Blue Chip stocks are good for those investors who want to see stable growth of their portfolios.

On the other hand, they can be attractive for intraday speculators, because they have an active market. Trading dynamics analysis through a prism of cluster charts allows ‘catching’ short-term movements in practically any blue chip stock market.

Download the ATAS platform free of charge in order to conduct your own research and find profitable entry points.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.