Day trading futures is a promising way to earn money, accessible to anyone with a computer and an internet connection. At first glance, it might seem that the most important part of this process is the strategy, and while it does play a critically important role, the personal qualities of a beginner trader are just as crucial.

In this article, we will delve into the skills and personal qualities needed for beginners to successfully trade futures. We will discuss how traders can manage their emotions and capital to maximize their chances of success and how they can work on self-improvement to enhance their futures trading careers. Finally, we will explain how the ATAS platform can assist in this journey.

Read more:

1. What Skills Should Futures Traders Have?

2. FAQ

3. How to Develop Your Futures Trading Skills

What Skills Should Futures Traders Have?

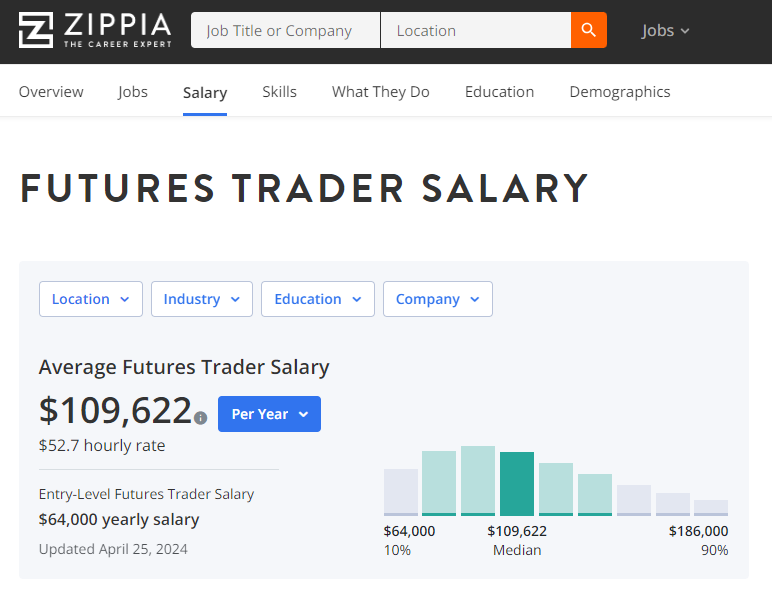

The salary of an employed futures trader typically averages around $50 per hour. This data can be found on specialized resources, such as in the screenshot below. While employed traders are unlikely to earn more than $200,000 per year, independent traders have no income ceiling.

To aim for a high salary and long-term success, the following six skills are essential for futures traders. Both employers and practicing independent traders emphasize these skills in their blogs:

- Analytical skills

- Emotional control

- Patience

- Organization

- Risk management

- Learning agility

What skills do you need to trade futures profitably? Let’s dive in.

Analytical skills

If you did not know, the word “analysis” comes from the Greek word “ἀνάλυσις” and is made up of two parts: the prefix “ἀνά-” (ana-), meaning “back” or “up,” and the root “-λύσις” (-lysis), which translates to “loosen” or “release.” Thus, the original meaning of the word is related to the process of breaking down a whole into parts for a deep understanding of its structure and functioning.

The trading and analytical platform ATAS is a great example of it as it can turn ordinary candlestick charts into more detailed cluster charts (or footprints):

The image above shows the same crude oil futures market. On the left are the traditional candlestick charts, while on the right are footprints breaking down the candles into trades, revealing information about volumes, prices, and the direction of a trade (market buy or market sell).

Successful futures traders need strong analytical skills to form their own opinions about market conditions, grounded in genuine price movement mechanisms. Understanding the relationship between price and volume is crucial for:

- identifying supply-demand balances and imbalances;

- spotting potential market reversal points based on support and resistance levels;

- confirming existing trends.

Moreover, analytical skills are essential for working with various trading indicators and chart patterns that help traders develop effective trading strategies, forecast prices, and make informed trading decisions.

Emotional control

Emotional control is an extremely important skill for futures traders because emotional decisions can lead to unpredictable and often undesirable outcomes in the market.

Control of impulsive decisions. The futures market is highly volatile, and prices can change sharply in short periods of time. Emotions such as greed or fear can prompt traders to make spontaneous decisions, such as closing a position too early due to fear of losses or too late hoping for further price growth. Ultimately, emotions can lead to deteriorating performance, even resulting in consecutive losses that can lead to the loss of the account.

Maintaining discipline. Effective trading requires strict adherence to a trading plan and strategy. Emotions can interfere with this, causing traders to deviate from proven methodologies and make decisions based on momentary market fluctuations, which raises risk levels and lowers the chances of consistent profits.

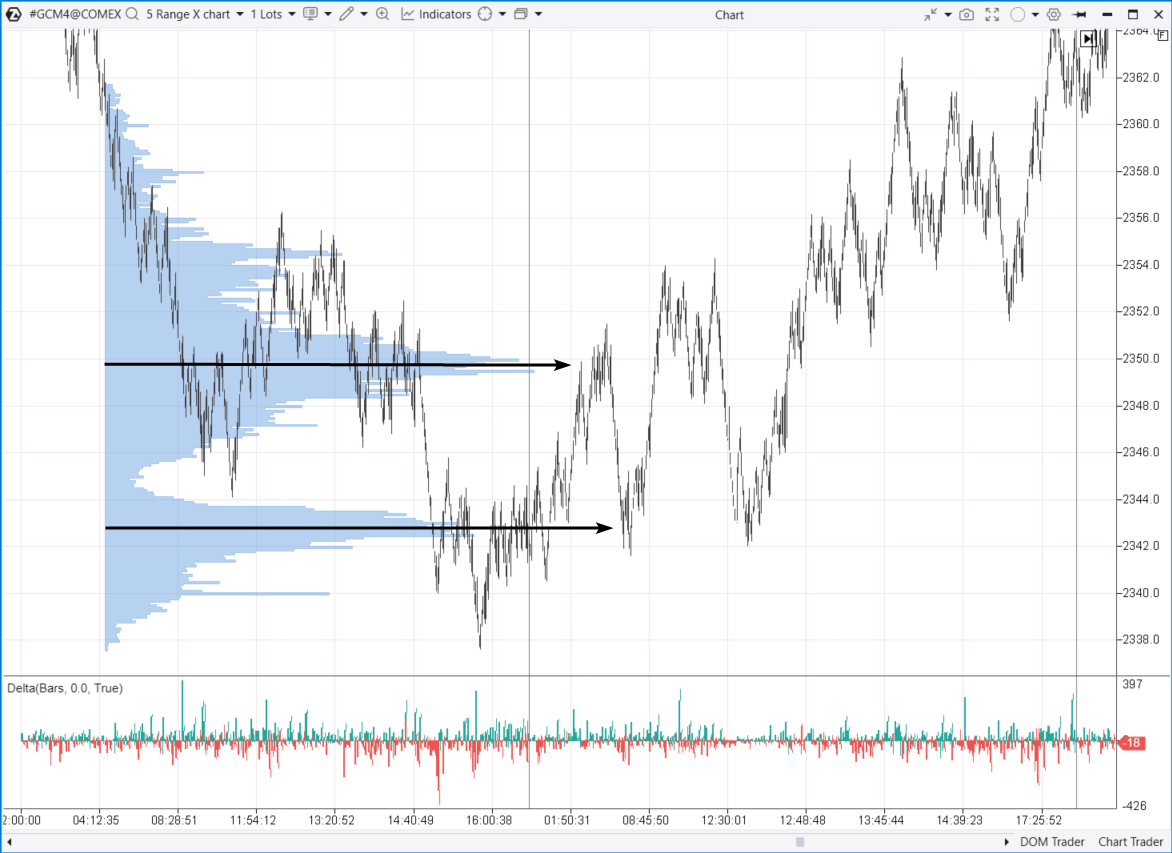

Let’s briefly explain the basics using the example of the crude oil futures market (below is a range chart with the Delta indicator):

The sharp price decrease is indicated by the red arrow accompanied by an increase in market sells (highlighted with a red circle). This situation is typical during panic moods when it is easy to get emotional and make a trade — this could either be buying (catching a falling knife) or selling alongside a sharply declining price.

However, the delta indicates that market sells have gradually decreased, and the appearance of market buys has countered the panic effect.

Therefore, analyzing market data helps develop emotional self-control and mindfulness skills. It assists in maintaining composure amidst market uncertainty and making well-thought-out decisions when trading futures.

We recommend reading:

Patience

Patience is a crucial skill for futures traders because it allows them to:

- Wait for optimal market conditions. Successful traders know when it is best to actively trade and when it is better to wait and observe, preserving their resources and capital for more confident and profitable opportunities.

- Avoid frequent and small trades that can lead to overtrading. Patience enables traders to focus on quality rather than quantity aspects of trading.

For instance, a gold futures trader, using market profile analysis (shown in the chart as a blue histogram), identified two price zones where significant contract volumes were traded. Based on this analysis, they anticipate these zones to act as support and resistance levels.

The chart clearly demonstrates the impact of these levels on the price – it reversed once downwards and twice upwards from them. However, the trader had to “wait on the sidelines,” observe, and wait for specific conditions to align:

- a significant volume level forming on the profile (a balanced state);

- the price breaking out of this level (a disruption of balance);

- the price returning to this level (known as a level test).

Only then would the trader have the necessary setup to open a position. Additionally, it is possible that on the chosen timeframe, the price remains balanced throughout the day, and a favorable setup does not form. The ability to wait out challenging conditions is crucial for maintaining consistency in trading according to one’s strategy.

Organization

Trading futures requires precision and systematic effort to achieve long-term success, making organizational skills crucial for good results.

By analyzing your trading statistics, you can assess the effectiveness of your strategies, learn from your mistakes, and reinforce successful methods. This continuous improvement and optimization are essential for effective trading operations.

Keeping your chart annotations up-to-date with drawing objects is also crucial. This helps you cover more markets and quickly analyze changes. Clearly marked support and resistance levels, trend lines, and other technical indicators allow you to visually assess market dynamics and react more efficiently.

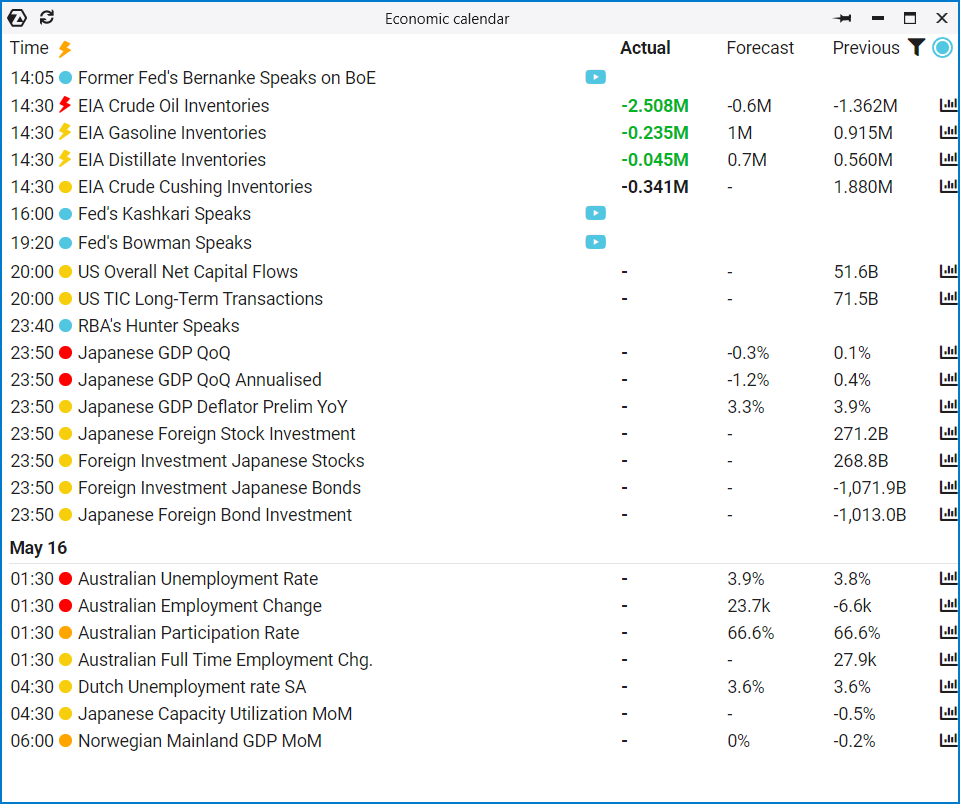

Staying aware of the time when economic news is released is another important aspect of being organized. This allows traders to avoid entering the market during periods of high volatility or, conversely, to capitalize on these moments by making trades based on the market’s anticipated reaction to the news.

Additionally, keeping a detailed journal where traders record not only their trades but also their thoughts and market conditions at the time of trading helps them understand their mindset and psychological reactions. This is critical for maintaining discipline and advancing in trading.

The ATAS platform offers a workspace feature, allowing futures traders to better organize their work across various instruments and timeframes.

Risk management

Among trading maxims, there is a concise and crucial idea about risk control:

It does not matter how many winning or losing trades you have. What matters is how much you lose on a losing trade and how much you make on a winning one.

The skill of risk management is essential for the sustainability of futures trading in the long term.

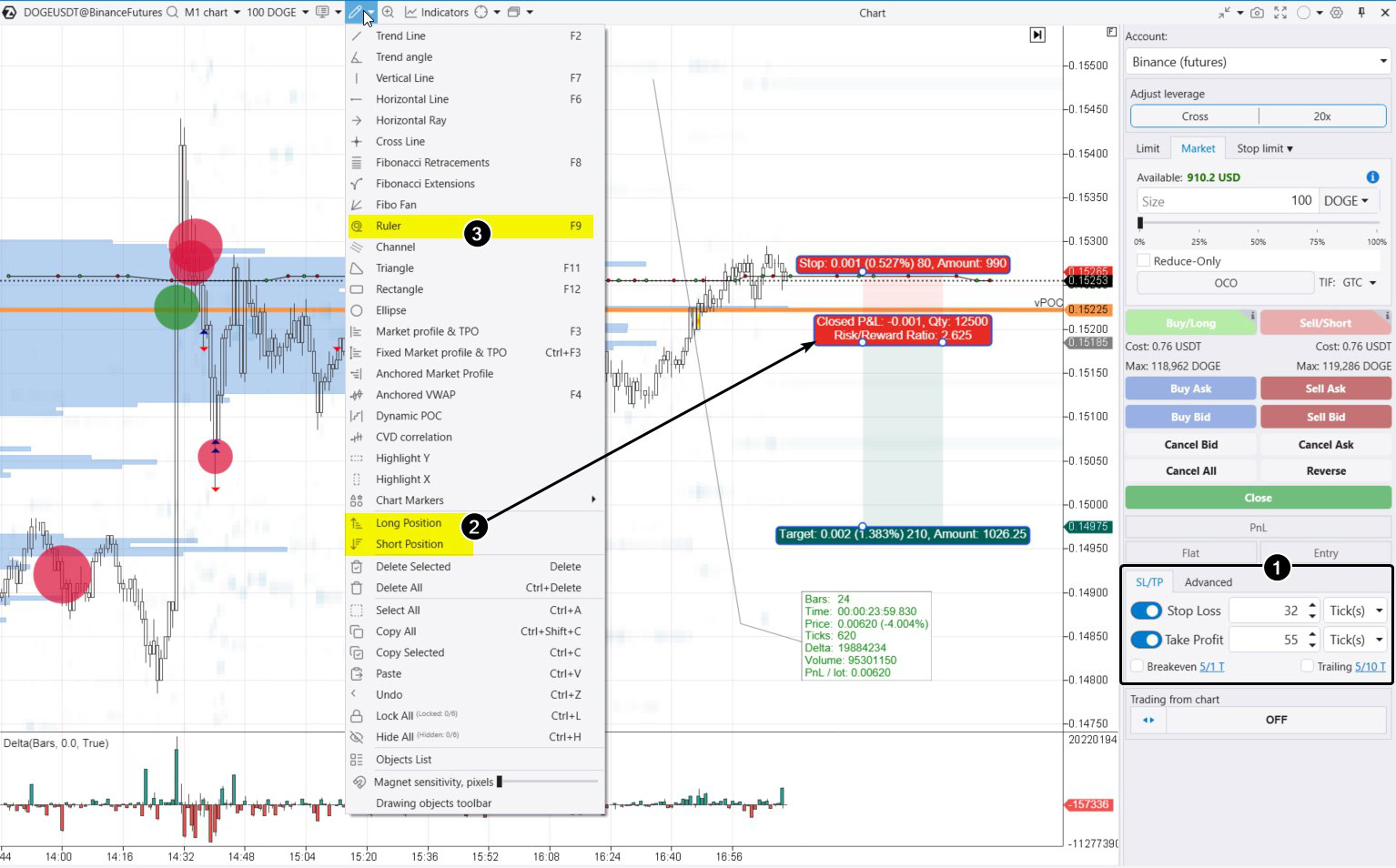

A stop-loss order helps limit losses to an acceptable, predetermined level, which is vital in the highly volatile futures market. This prevents emotional decisions to hold onto a losing position in the hope of a market reversal.

Alongside using stop-loss orders, planning the profit-to-loss ratio allows traders to set clear goals for each trade. It helps determine how much potential profit should exceed possible losses to ensure overall profitability.

For managing risks, ATAS provides futures traders with the following features (shown by numbers on the chart above):

- A drawing object for planning trades.

- A block of exit strategies on the Chart Trader panel.

- A ruler (available via the F9 hotkey).

Engagement

This might be the most crucial skill for futures traders. Engagement means being true to yourself while finding your place in the market.

Signs that you are on the right track and fully engaged:

- You are eager to learn and master new trading strategies, you study trading literature, watch educational videos, and read articles.

- You find joy in analyzing charts, even when it does not bring immediate benefits, whether it is during moments of rest or from the first moments of the morning.

- Chart analysis becomes not just work but a hobby, something you would do even without financial gain.

- You consistently develop trading plans, keep a detailed trading journal, and continuously strive to enhance your skills.

Signs that trading futures is not worth your time:

- You are not interested in analyzing market charts, and it seems tedious to you.

- Your main motivation is to make quick and easy profits, without the desire to delve deeply into the intricacies of the market and trading mechanisms.

FAQ

What is the core idea of futures trading?

Futures trading involves buying and selling futures contracts for various assets such as currency rates, cryptocurrencies, commodity assets, stock indices, and more. The goal is to profit from changes in the value of these contracts.

How do professional traders work?

Professional traders conduct thorough market analysis, employ proven trading strategies, manage capital and risks, and make informed decisions based on data and forecasts. They often work collaboratively in teams and/or utilize automation tools for trading.

What skills should a futures trader have?

Analytical skills, understanding of financial markets, risk management skills, psychological resilience, knowledge of trading strategies, and technical analysis.

What do traders use?

Trading platforms, analytical tools, news sources, economic calendars, strategies, and algorithms. These resources provide them with a competitive edge in navigating the highly competitive landscape of the futures market. One such resource is the powerful trading and analytical platform ATAS.

How to Develop Your Futures Trading Skills?

When placing an order, futures traders are not trying to predict future price changes. Instead, they respond promptly to market opportunities using their knowledge and skills, which can be developed using the ATAS Market Replay simulator, all without risking actual capital.

To boost futures trading skills:

- click on the Market Replay button in the main ATAS menu;

- activate the Replay mode (the icon should turn green);

- select settings (market, date, data type);

- start playback and enhance your skills as a futures trader.

The DOM Levels indicator and a custom market profile (drawn after pressing F3) have been added to the chart.

While enhancing your skills in Market Replay, you can:

- adjust the playback speed, and pause;

- test your strategies, monitor signals from over 400 indicators;

- trade futures on the built-in demo account;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- analyze volumes in the Level II order book;

- and much more to master professional skills for futures trading.

ATAS allows you to load tick data history from various futures markets: stock indices, commodities, and currency futures, providing you with a comprehensive database to identify patterns in the interaction between price and volume.

Ultimately, you should gather evidence that you are ready to transition to a live account. Your trading advantage may be based on technical analysis, volume analysis, professional futures chart reading, and DOM order book analysis.

Conclusions

While the initial requirements for beginners in the futures market are relatively small, success in trading is not solely determined by having starting capital, desire, and technical tools.

Effective trading in the futures market requires not only the skills to analyze the market but also psychological resilience, the ability to manage risks and make thoughtful decisions in uncertain conditions. These qualities become crucial in the long run and can significantly influence the final trading outcomes.

Are you starting futures trading from scratch? Developing practical skills will be aided by a solid foundation of theoretical knowledge:

- Check out the Learn section in the main menu of the ATAS platform for educational materials.

- Explore ATAS tools like professional-grade cluster charts, the Smart DOM order book, Smart Tape, useful indicators, and more.

- Read helpful articles about trading strategies in the blog. Test your skills in the simulator or in real time on the built-in demo account without risking real funds.

Download ATAS. It is free. During the trial period, you will have full access to the platform’s tools. Experiment with various futures trading strategies to understand which one suits you best. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis in futures markets.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.