Clear visualization of order flow

Smart Tape, ATAS’s unique order aggregation tool, processes raw exchange data and presents actual trade volumes (Time and Sales) in a clear and readable format:

- get information on the real size of aggressive market trades;

- filter trades by volume to track actions of players with different capital levels;

- analyze market imbalances with the buy/sell strength indicator;

- monitor activity spikes using the speed of tape indicator;

- track UpTick & DownTick movements with + and – markers;

- capture market inflows and outflows with Open Interest (OI);

- analyze trade flow for any time frame with the History mode;

- pause the tape to ensure you don’t miss critical details.

Spread tape

Bid/Ask Tape is a simplified version of Smart Tape, displaying volume distribution within each spread:

- track the exact time, price, and volume of market buys and sells, along with the delta for every trade;

- analyze the balance between buyers and sellers to see who’s driving the market.

Volume filtering for Best Bid/Best Ask

Customize your tape display by filtering trades based on order volumes at the best price levels:

- set your own minimum and maximum volume thresholds for Best Bid and Best Ask;

- track the most relevant changes in the DOM for your strategy;

- focus on trades with specific liquidity levels.

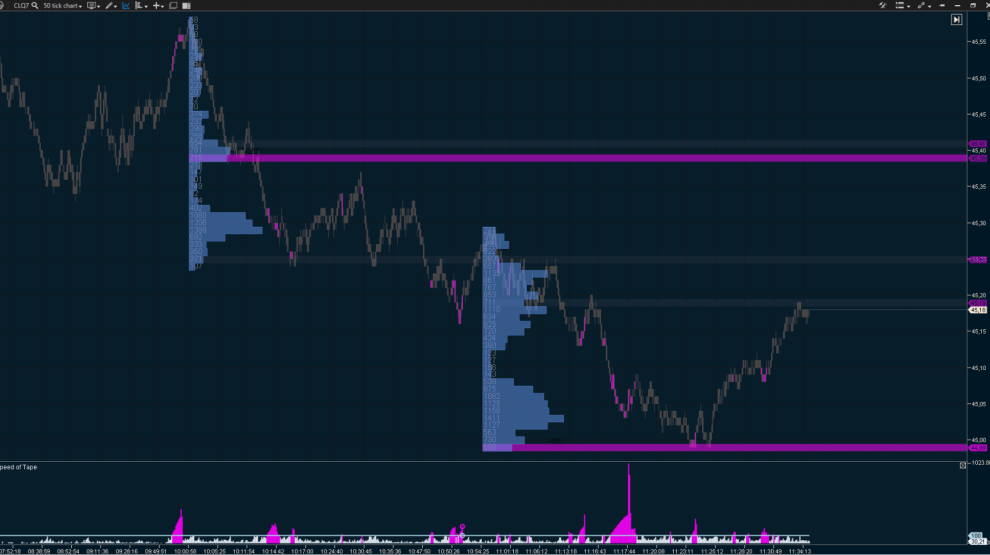

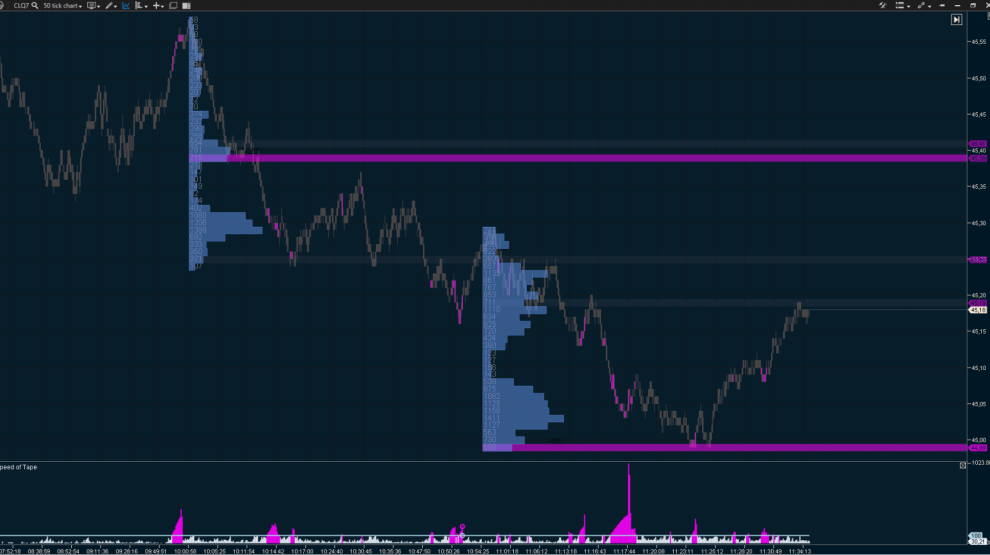

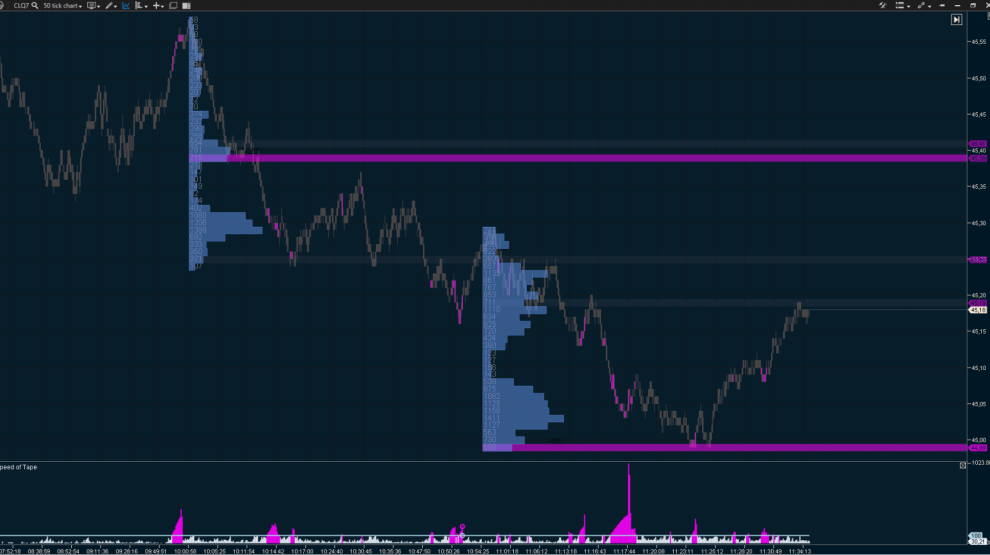

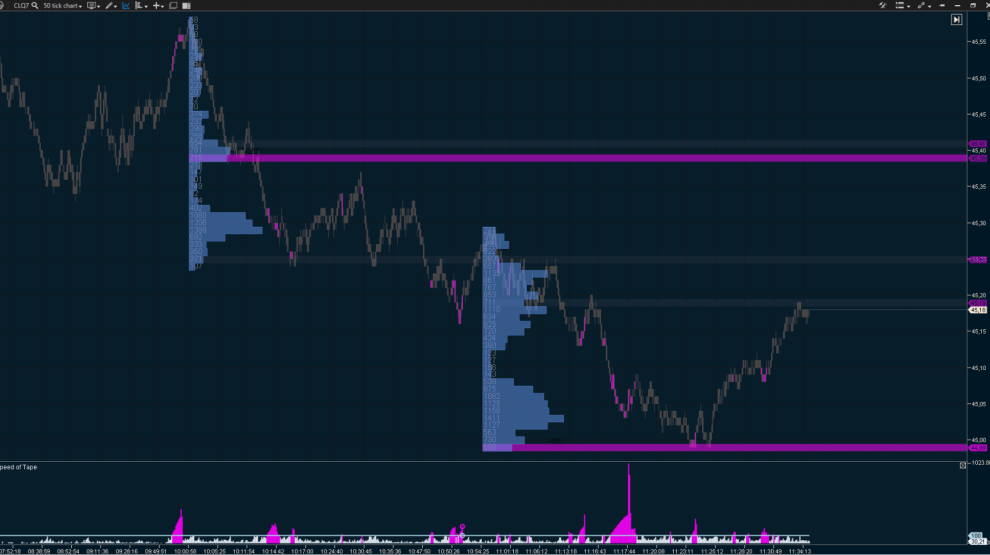

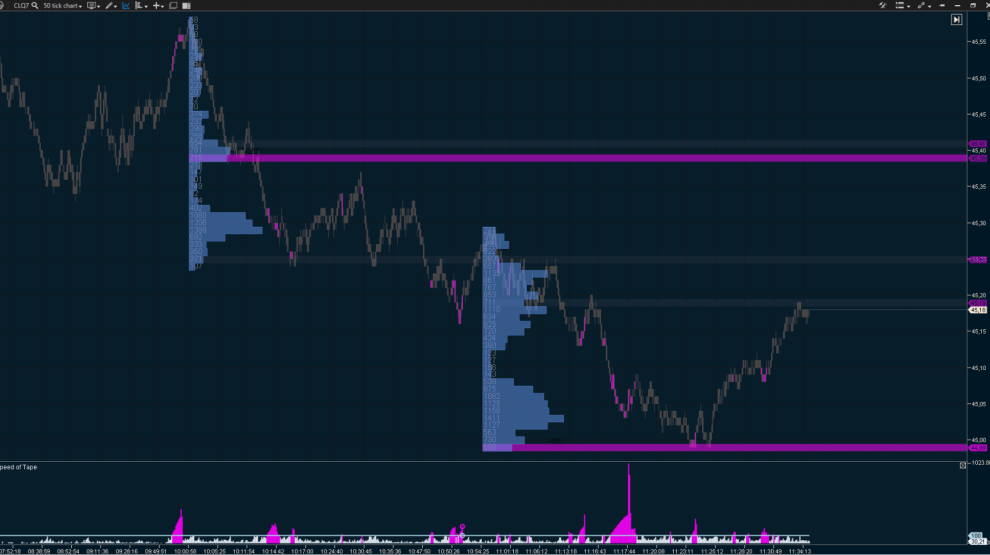

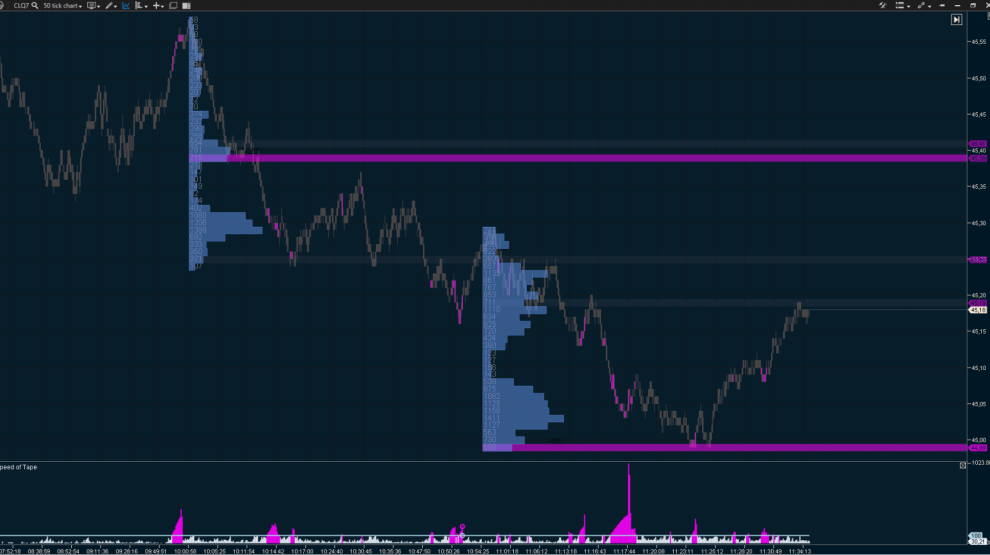

Horizontal volumes

The All Prices module provides horizontal volume data for a selected time frame, adjusted to price levels. These insights can reveal strong support and resistance zones.

- track the number of contracts traded at a specific level during your chosen period;

- monitor the total number of trades executed at precise price levels;

- analyze market buy and sell volumes, including their delta.

Detailed tape view

Smart Tape, by default, consolidates a large number of ticks (individual prints) into clear, aggregated market orders. If you prefer a more detailed view, you can disable this aggregation to see all individual prints:

- analyze exchange activity under a ‘microscope’;

- filter individual prints within a specified range to identify large executed limit orders.

Detecting abnormal activity

Buys above Best Ask and sells Best Bid can provide valuable insights for your strategy:

- easily identify trades with abnormal activity using a color-coded marker;

- quickly respond to shifts in market sentiment.