In today’s financial markets and crypto trading, the term FOMO (Fear Of Missing Out) is becoming more common. This phenomenon greatly influences the behavior of traders and investors, pushing them to make impulsive decisions driven by emotions and the fear of missing potential profits.

In this article, we will explain what FOMO is in trading, how it manifests, and the potential consequences for market participants. Most importantly, we will discuss how to reduce the negative impact of FOMO on the trader’s trading strategy and mental well-being.

Read more:

What Does FOMO Mean in Cryptocurrency Trading?

FOMO, or “Fear of Missing Out,” is a psychological effect characterized by anxiety and the fear of missing significant events, profitable trades, or valuable opportunities. The term was first used in the early 2000s by marketer Dan Herman, who studied consumer behavior and noticed that many people experience a strong fear of missing out on something important or meaningful.

The FOMO Effect Is Part of Our Nature

Humans have an inherent desire to be part of significant events and to avoid missed opportunities, which is also evident in trading. In the book “Extraordinary Popular Delusions and the Madness of Crowds” written by Charles Mackay in 1841, several historical examples of mass delusions and economic bubbles are presented, which can be considered manifestations of FOMO:

- Tulipomania. A speculative bubble in the Netherlands in the 1630s, where prices of tulip bulbs reached astronomical heights before sharply crashing. People invested huge sums in buying tulips, fearing to miss out on earning profits in the booming market.

- South Sea Bubble. In the early 18th century in Britain, the South Sea Company’s stock experienced rapid growth due to speculations and promises of huge profits from trading with South America. This led to a mass frenzy and subsequent market collapse when it became clear that the promised profits would not materialize.

- Mississippi Bubble. In early 18th century France, financier John Law created the Mississippi Company, which gained a monopoly on trade with French colonies in North America. Massive issuance of shares and subsequent speculation led to soaring prices, followed by a catastrophic collapse.

Technologies may evolve, but human nature remains unchanged. Therefore, the FOMO effect in the 21st century has spread to social networks and cryptocurrency trading.

Example of FOMO in the Cryptocurrency Market

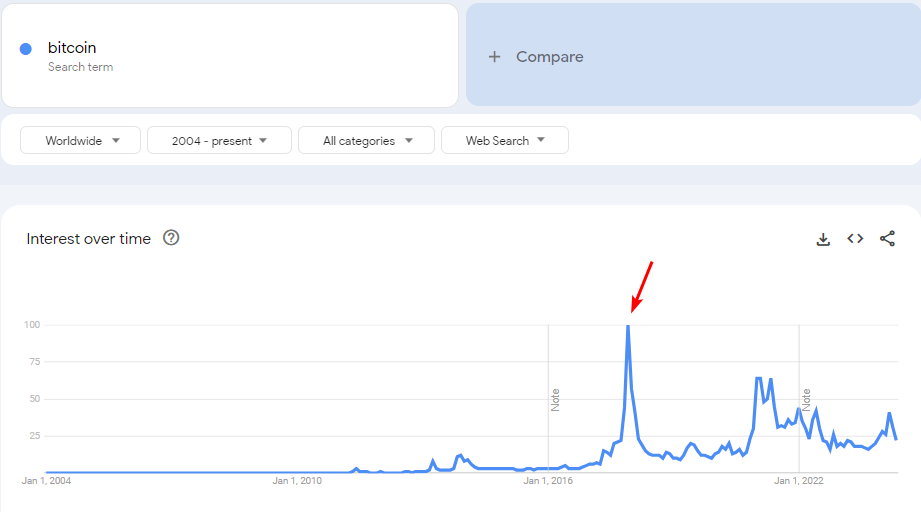

It is visible on Google Trends that the peak of global interest in Bitcoin was recorded in December 2017.

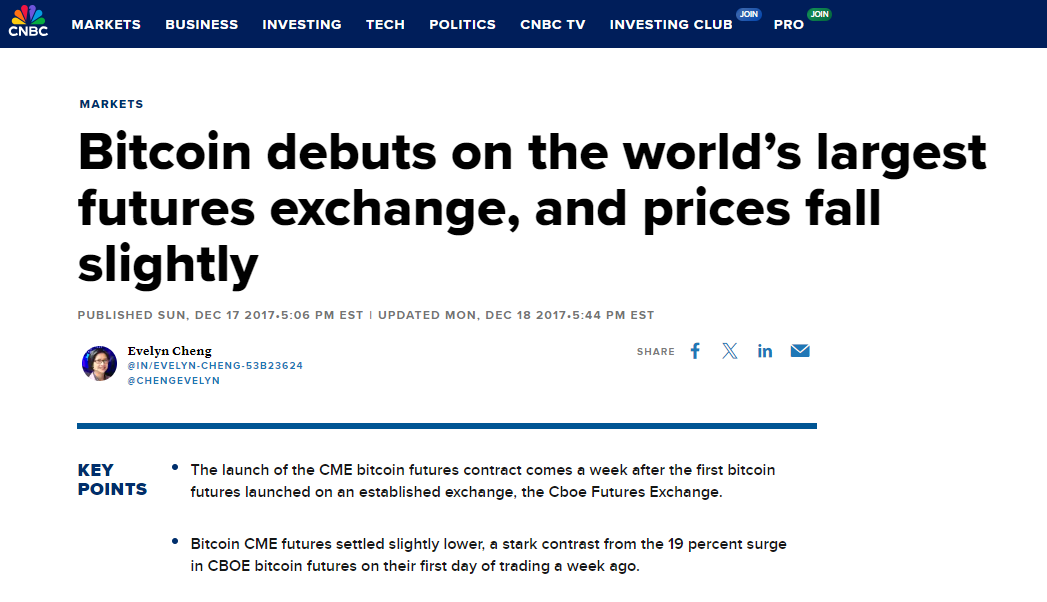

During that period, Bitcoin was gaining widespread attention due to the CME Group exchange’s decision to introduce futures trading for Bitcoin The surging Bitcoin prices attracted new investors who drove the prices even higher, fueling the interest of others. Many market participants were afraid of missing out on the opportunity to invest in Bitcoin, which was rapidly rising:

However, after the launch of Bitcoin futures trading on the CME exchange on December 17, prices started to decline, as reported by major financial media:

The price chart of Bitcoin futures on the CME exchange shows that within about a month and a half after trading began, the price of the leading cryptocurrency dropped by roughly 66%.

This example confirms a conclusion that can be drawn by studying charts and correlating them with news — after the FOMO effect fades, the price of a financial asset tends to decline.

How FOMO Manifests in Trading

FOMO in trading manifests through various forms of emotional and behavioral pressure. There are several typical situations in which traders may experience FOMO.

Impulsive buying and selling

Traders may make decisions based on short-term market fluctuations, fearing to miss out on potential profits. This often leads to buying at the peak and selling at the bottom, which contradicts the fundamental principles of successful trading.

Example: FOMO effect related to Bitcoin ETF approval in 2024

Rumors that the SEC (U.S. stock market regulator) would approve applications for launching Bitcoin ETFs were a significant driver of BTC/USD growth in 2023. The crypto community viewed the ETF approval positively, expecting it to attract institutional investors and increase demand for Bitcoin.

The arrow points to a wide bullish candle on January 8th, breaking through previous local highs. It was tempting to buy Bitcoin then, as it seemed poised to surpass the psychological $50,000 mark.

The official decision on the ETF approval came out on January 10th. Note that after a period of volatility, the price started to decline. This reinforces the rule: “when the FOMO effect fades, the asset price typically drops.” Within 10 days, there was a correction of around 17% before the price resumed its trend.

Following the Crowd

Seeing other market participants making profits on a particular stock or cryptocurrency, traders may start copying their actions without careful analysis, which can lead to losses.

Example. FOMO effect related to the short squeeze of GameStop (NYSE: GME) stocks.

It all started with discussions on the r/WallStreetBets subreddit, where users noticed that GameStop stocks were heavily undervalued and had become the target of a significant number of short positions by major hedge funds. Forum participants decided to buy up GME stocks massively to trigger a “short squeeze” — a situation where stock prices rapidly rise, forcing traders with short positions to buy stocks to cover their obligations, which drives up the price even more.

In January 2021, GameStop stocks began to rapidly rise in price (marked as 1 on the chart). This caused:

- mass panic among large investors holding short positions,

- a frenzy among retail investors eager not to miss out on quick profits. The price of GME stocks surged from around $20 to nearly $350 within a few days. This incredible growth triggered a wave of FOMO, urging even those who had never traded stocks before to invest in GME, fearing they might miss the “opportunity of a lifetime.”

People shared their profits on social media, encouraging others (the herd mentality effect) to do the same.

During the frenzy, trading platforms like Robinhood started restricting GME stock trading, sparking outrage and conspiracy theories among retail investors. Eventually, the price of GameStop stocks began to drop (marked as 2) just as quickly as it had risen. Many investors who entered the market at its peak suffered significant losses as the stock price retraced back to more reasonable levels.

It is worth noting that a similar scenario played out to some extent in May 2024 when the leader of the r/WallStreetBets subreddit, known as Roaring Kitty, reappeared publicly after a long period of silence. This led to a surge in GME stock prices. This led to a surge in the price of GME stocks.

One could assume: the price of GME stock dropped as the FOMO effect faded.

The examples given above have become classic displays of FOMO in today’s financial markets, demonstrating how events can unfold rapidly and unpredictably when mass psychology takes precedence over rational analysis.

Other Consequences of the FOMO Effect:

Inability to stick to a trading plan

Under the influence of FOMO, traders often stray from their previously developed strategies and plans, trying to chase every opportunity. This ultimately leads to chaotic actions with negative impacts.

Emotional burnout

The constant anxiety and pressure from the fear of missing out can lead to emotional burnout and deteriorate a trader’s psychological well-being.

5 Tips to Overcome FOMO

A deep understanding of FOMO and its manifestations is key to learning how to control your emotions and make more rational decisions in cryptocurrency or stock trading.

Here are 5 principles to help overcome the FOMO effect:

1. Let go of the past

Constantly regretting missed opportunities prevents rational decision-making. Remember, the market offers new opportunities every day. Focus on current trends rather than what could have happened if you had bought Bitcoin at $1. For example, if you did not buy Tesla shares in 2010, it does not mean there are no promising investments now. Staying emotionally detached is crucial to build resilience against FOMO in trading.

2. Buy when others sell, and sell when others buy

Follow Warren Buffett’s principle: “Be greedy when others are fearful, and fearful when others are greedy.” This counter-cyclical strategy enables you to take advantage of market fluctuations. During periods of panic, when most investors are selling, you can buy assets at lower prices. For example, in March 2020, when markets crashed due to the pandemic, it was a great opportunity to purchase stocks at discounted prices.

However, it is essential to consider risks and take precautions to:

- avoid buying shares of a company on the brink of bankruptcy;

- avoid investing in a fraudulent cryptocurrency project;

- avoid “catching falling knives“;

- avoid becoming a victim of trading against the trend.

3. Set clear goals

Define your financial goals and investment time horizons. This will help you stay focused and avoid impulsive decisions. For example, if your goal is to save for retirement in 20 years, short-term market fluctuations should not worry you. The same applies to a “buy and hold” strategy for the cryptocurrency market. Clearly outline your goals, such as: “increase capital by 50% in 2 years” or “generate an additional income of 15% annually.” Having well-defined long-term goals makes it easier to ignore short-term FOMO spikes in the markets.

4. If you have no trading ideas — wait

Sometimes doing nothing is the best option. Trading for the sake of trading often leads to losses. If you are not confident in a trade, why open it? Famous investor Peter Lynch said, “You don’t need to trade a lot to make money. It is important to make fewer, but better trades.” This is especially relevant in volatile FOMO markets, where emotions play a significant role.

5. Strategy is the key

Develop and adhere to your strategy based on:

- a clear trading advantage;

- your risk profile, time horizon, and financial goals.

Take the FOMO effect into account when developing your strategy. Stock trading operates on a zero-sum basis (buyers profit from sellers’ losses, and vice versa). When a lot of inexperienced individuals rush to buy a rapidly appreciating asset and enter the market, it can increase the potential for profits on the short side of the market, although not always.

Considering that FOMO describes the anxiety and impulse to act without careful thought, driven by the fear of missing out on significant events, opportunities, or information, it is reasonable to say that FOMO (Fear of Missing Out) is a psychological syndrome. If this pathology is too strong, it is best to avoid trading.

How to Use FOMO in Cryptocurrency Trading

Follow these tips:

- Study market psychology.

- Study volume analysis.

- Practice before trading.

Studying Market Psychology

It is important not only to read books on trading psychology but also to study charts and analyze market trends in retrospect, asking yourself questions like:

- what news is shaping market participants’ sentiments?

- who is experiencing losses – buyers or sellers?

- who is currently in control and profiting?

Pay special attention to round psychological levels.

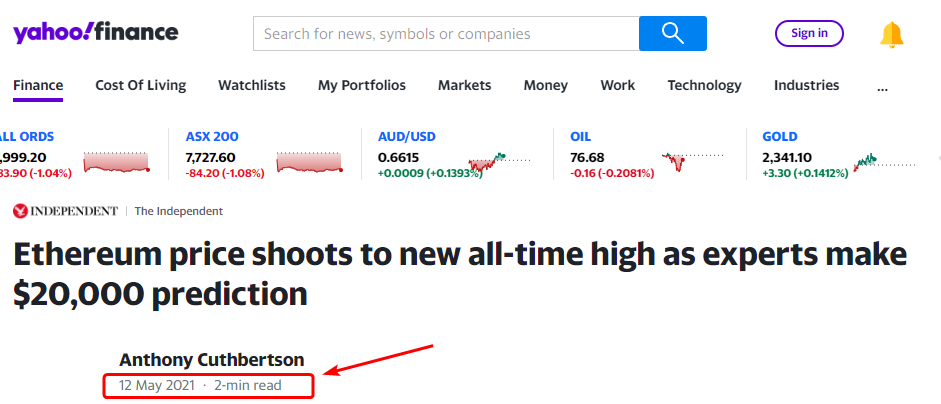

Example from 2021. FOMO at Ethereum’s historical peak.

In May 2021, the ETH/USD rate surpassed $4,000. At the same time, experts were discussing the potential for it to reach $20,000.

The chart shows a confident rise in price – it seemed like “buying at 4 and selling at 20” was a sure way to profit.

However, the price could not hold above the psychological level and started to decline.

There are many such examples. They can be used to develop a cryptocurrency trading strategy based on false breakouts of psychological levels, making the FOMO effect an integral part of such a strategy.

Read more: The Magic of Round Levels – What Traders Need to Know

Study Volume Analysis

Volume analysis allows you to assess the balance and imbalance of supply and demand, helping you form your own viewpoint based on chart facts rather than media publications. The best way to do this is by studying cluster charts.

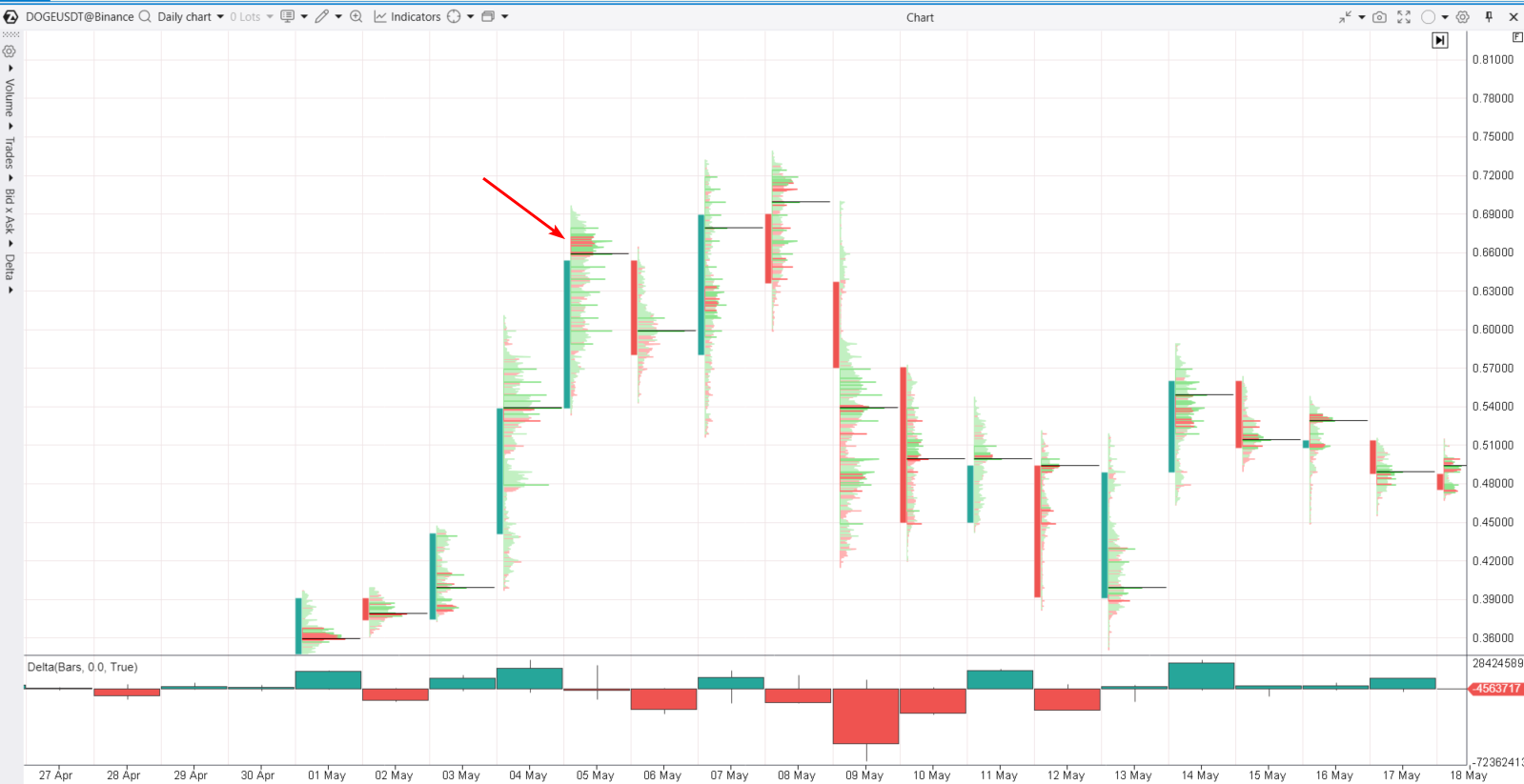

Example from 2021: FOMO at Dogecoin’s historical peak

Once again, in May 2021, Google Trends showed a peak in interest in the rapidly rising price of the meme currency Doge, supported by Elon Musk.

However, the cluster chart indicates (marked with an arrow) the appearance of large market sellers slightly above the 0.66 level on May 5th:

- the next day, on May 6th, the price closed lower;

- an attempt to surpass the 0.66 level on May 7th and 8th was unsuccessful.

A large seller might have used the surge in demand and the FOMO effect to sell a huge amount of meme cryptocurrency (which the seller had bought earlier) at a high price to newcomers.

Read more: What Is Buying Climax?

Practice Before Trading

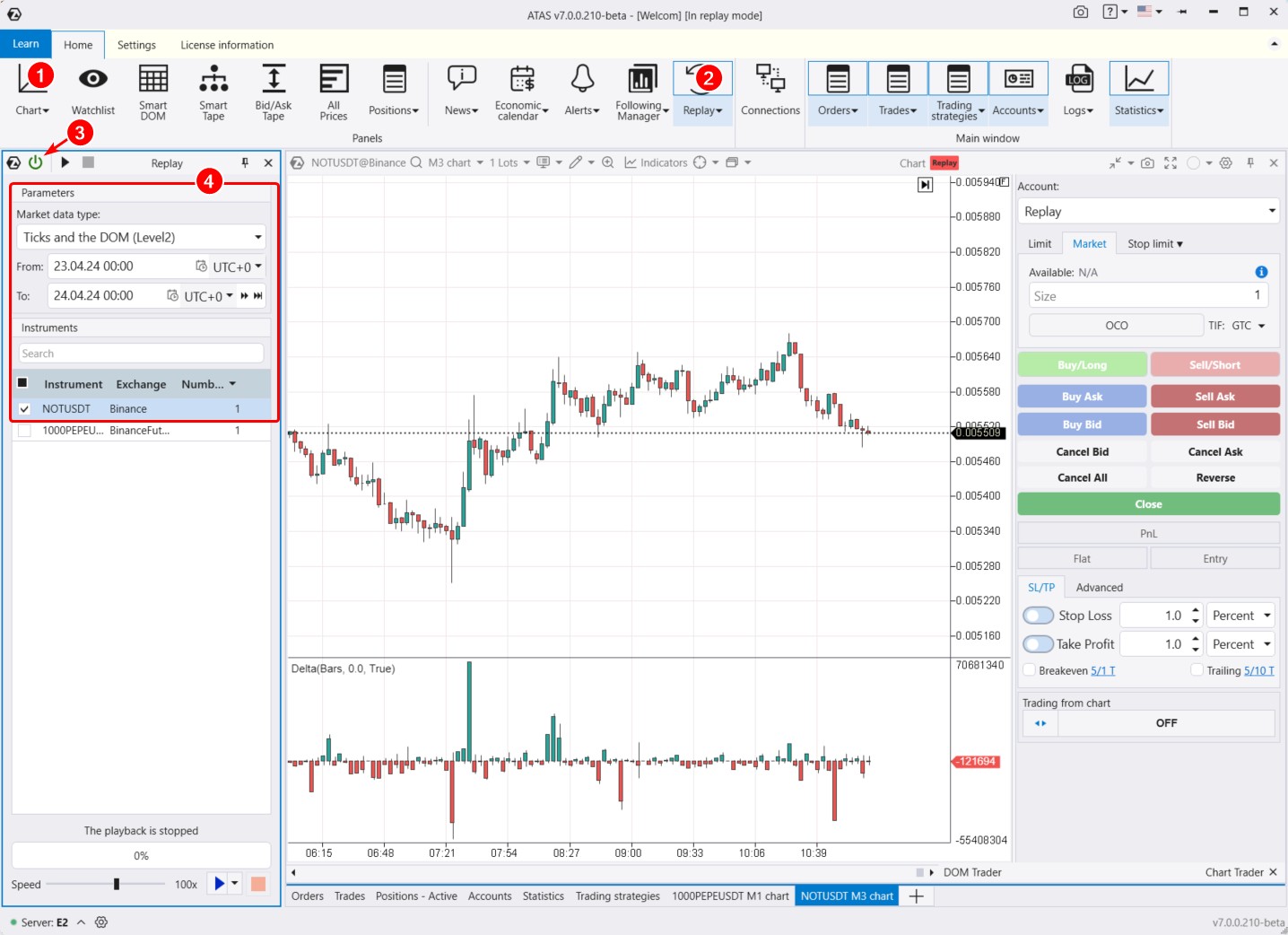

To avoid falling victim to FOMO syndrome, eliminate emotions through numerous practice sessions on a stock exchange simulator. This risk-free method helps automate the trading decision-making process to eliminate doubts, fear, and panic when trading on a real account.

To do this, download the ATAS platform for free, install, and launch it, and then:

- open the cryptocurrency chart (or another asset).

- Click on the Market Replay button in the main ATAS menu.

- Activate the Replay mode (the icon should turn green).

- Adjust settings if necessary (date, data type).

- Start the replay and develop as a trader by interpreting price movements from the perspective of market participants’ emotional states.

During your training in the Market Replay simulator, you can:

- adjust the playback speed, and pause;

- test your strategies, monitor signals from over 400 indicators;

- of course, use Chart Trader and other features to trade crypto and other assets on the built-in demo Replay account;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- analyze volumes in the Level II order book, for instance, using the DOM Levels indicator;

- use numerous other advanced features of the ATAS platform to become a trader from scratch.

ATAS allows you to upload tick-by-tick history from various markets. You can analyze market behavior down to each trade during periods when participants were affected by FOMO. Since human psychology does not change, this means you will identify patterns in the correlation between price and volume in highly volatile markets.

FAQ

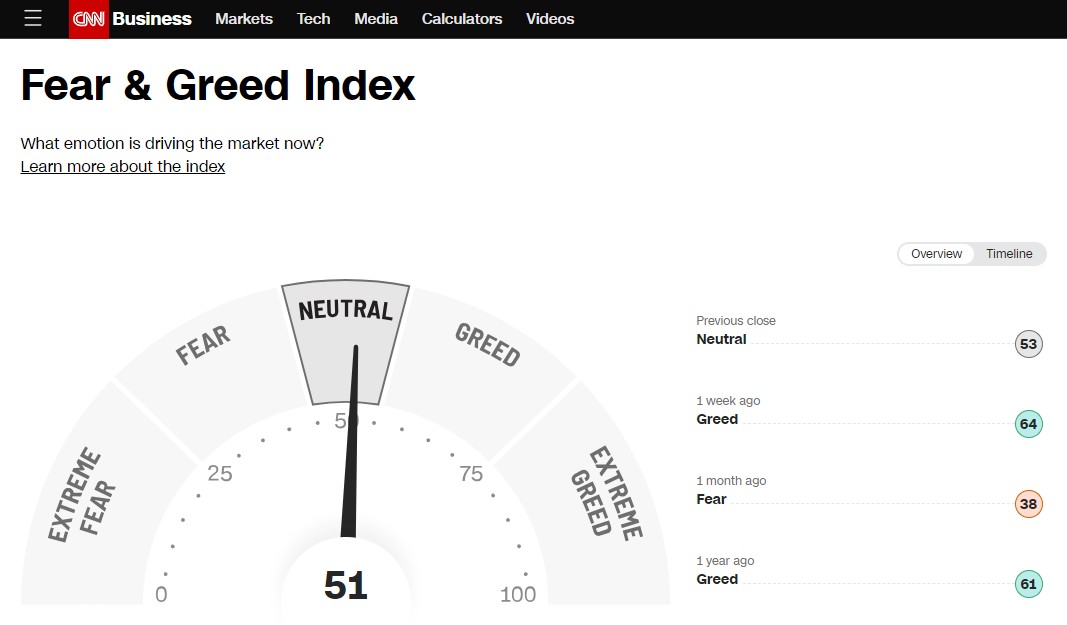

Is there a FOMO indicator?

Various resources provide their versions of the Greed & Fear Index for stock and cryptocurrency markets. However, the simplest and most universal FOMO indicator can be considered the basic vertical volume indicator. The logic is quite simple: if trading activity per unit of time is high, it indicates a high probability that the FOMO effect is influencing the market.

What is FUD in trading?

FUD (Fear, Uncertainty, and Doubt) in trading is a manipulative tactic aimed at influencing market perception by spreading negative, misleading, or dubious information. This can lead to panic selling and a decrease in asset prices, creating opportunities to buy at lower prices.

Is it normal to experience FOMO?

Feeling FOMO is a natural reaction in today’s information-saturated world. However, it is crucial to manage this feeling and not let it drive your important decisions. While FOMO can motivate you to stay active and seek new opportunities, it can also lead to impulsive actions and risks.

How to overcome FOMO?

If you recognize that FOMO is a psychological issue for you, acknowledging it is the first step. Apply the five tips mentioned earlier or seek help from a professional.

What triggers FOMO?

Market volatility, a series of winning trades, consecutive losses, news and rumors, social media, and statements from influential people.

Pros and Cons of Trading in Fomo-Driven Markets

Pros of trading

- High volatility. This offers opportunities for quick profits. Traders who can react swiftly and accurately assess the market can benefit from short-term price movements.

- Increased liquidity. During periods of heightened interest in certain assets, liquidity increases, even in less popular markets. This makes it easier to buy and sell assets without significantly affecting their price.

- Use of technical analysis tools. Even though market participants may exhibit irrationality in decision-making, tools like volume analysis and chart patterns remain effective.

- Learning and skill development. FOMO markets are often widely covered in the media, attracting new participants who may pursue trading careers. Experienced traders can improve their skills in analysis, risk management, and quick decision-making in a dynamic market environment.

Cons of trading

- High risks. Sharp price fluctuations can lead to significant losses, especially for inexperienced traders who succumb to emotional pressure.

- Emotional stress. The constant fear of missing out and anxiety over making the wrong decision can cause severe emotional strain, negatively impacting a trader’s mental health.

- Manipulation risks. High-FOMO markets are vulnerable to manipulation by large players or scammers who exploit the frenzy for personal gain. This can create artificial price spikes and drops, adding extra risks for traders.

- Lack of long-term stability. Prices often drop after periods of frenzy, making long-term investing in such markets extremely challenging and risky.

- Overlooking fundamental analysis. Relying on rumors and neglecting fundamental analysis can lead to misjudging asset values, resulting in losses.

Conclusions

A deep understanding of FOMO and its effects is crucial for making well-informed and rational trading decisions. This results in:

- greater emotional resilience;

- a more insightful interpretation of price behavior based on assumptions about the prevailing sentiments among market participants.

Do not worry about missing out on the current trend. There will always be new trends.

First of all, make sure that you have a solid theoretical foundation in trading:

- Check out the Learn section in the main menu of the ATAS platform for educational materials.

- Explore ATAS tools like professional-grade cluster charts, the Smart DOM order book, Smart Tape, useful indicators, and more.

- Your trading advantage may be based on technical analysis, volume analysis.

Download ATAS. It is free. During the trial period, you will have full access to the platform’s tools to experiment with various futures trading strategies and determine which one suits you best. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis in futures markets.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.