XRP is a digital asset that consistently ranks among the top ten largest cryptocurrencies in terms of capitalization. The trading volume of the XRP coin exceeds $1 billion per day.

What is special about XRP? The main information about Ripple that novice cryptocurrency traders need to know is in this overview article.

Read more:

History of Ripple

2004 – programmer Ryan Fugger, while working on a project on an exchange in Vancouver, became interested in decentralized payments.

2005 – Fugger developed the concept as well as the initial implementation called RipplePay. The goals of the project were laid down even then: the creation of a decentralized system that could compete with the main banking transaction system (for example, SWIFT) or even replace it. Despite his best efforts, Fugger was unable to achieve widespread adoption of his system due to the risks associated with the architecture.

2011 – as the popularity of Bitcoin grows, the idea of decentralized payments is gaining more fans and specialists. Fugger invited Jed McCaleb, one of the first BTC enthusiasts, to join the company. His main task was to solve those very problems with the system architecture. With the same goal, David Schwartz (now the CTO of Ripple), as well as Arthur Britto, joined the project.

2012 – Ryan Fugger left the RipplePay project. McCaleb created the OpenCoin company, whose CEO was American entrepreneur Chris Larsen.

2013 – it was decided to change the name of OpenCoin to Ripple Labs. Andreessen Horowitz, Google and other large funds invest in the company.

2014 – McCaleb leaves Ripple Labs to start his own project, Stellar.

2015 – Brad Garlinghouse succeeds Chris Larsen as CEO.

2018 – the XRP rate reached a historical maximum of about $3.3 per coin.

2020 – The US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs. The main theses of the prosecution were allegations that the company was selling unregistered securities, under the definition of which the XRP coin fell. The XRPUSD exchange rate fell sharply.

Over the next two years, the SEC tried to prove to the court its vision regarding the XRP cryptocurrency and the Ripple Labs company involved in it, however, no solid evidence was provided for these allegations.

2022 – amid a protracted litigation, on September 17, 2022, both parties filed motions with the court for an immediate ruling. Against the backdrop of this news, the XRPUSD rate rose as investors believed that the court decision could be made in favor of Ripple Labs.

XRP Ledger Blockchain Features

XRP Ledger (XRPL) — is the blockchain platform on which the Ripple ecosystem operates. The platform has several important features, we list them below.

Unique consensus mechanism. It is called the Federated Consensus Protocol (or XRP Ledger Consensus Protocol) and is different from the Proof-of-Work algorithm at the heart of Bitcoin, as well as from the Proof-of-Stake that Ethereum switched to in 2022.

The process of confirming transactions involves independent servers (validators) managed by different organizations, exchanges and individuals. At the time of writing (November 2022) there are more than 150 of them around the world.

High speed. Thanks to the unique consensus mechanism, transactions are confirmed in less than 5 seconds, transaction fees are usually less than 1 cent, and the processing volume can reach more than 1500 TPS.

Openness. The platform is open source, all transactions are transparent.

Utility. The main product of Ripple Labs is a global network for making cross-border payments. It can be used by banks, payment systems. According to Ripple Labs, more than a hundred large clients in more than 50 countries use its services.

In addition to the network for making payments, Ripple can be used by DeFi service developers to deploy smart contracts, tokenize digital assets, and other purposes.

For example, in Colombia, Ripple is used to create a registry of land.

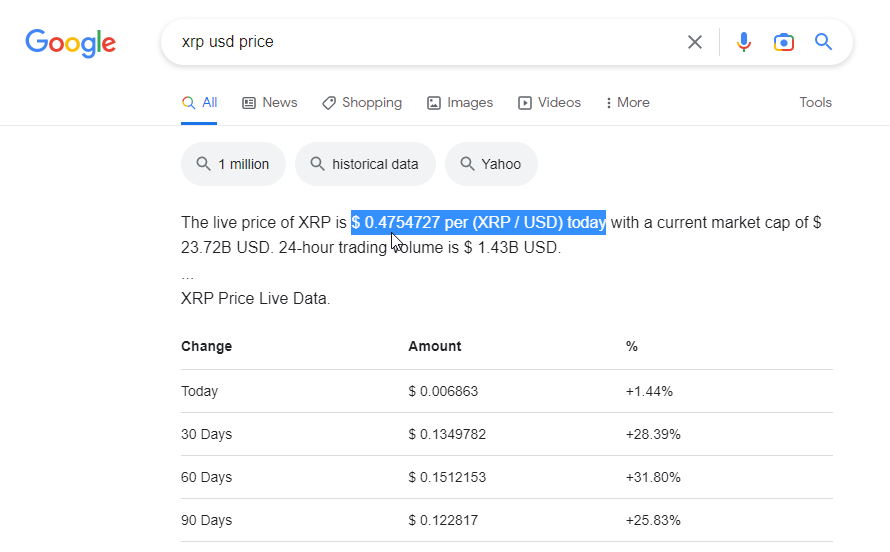

How to see the price of XRP?

XRP is the native coin of the Ripple ecosystem. When the network was launched, it was decided to release the full issue of coins at once in the amount of 100 billion XRP. Of the total issue, 65% went to Ripple Labs, the remaining 35% went into free circulation.

The fastest way to find out todayʼs XRP price is to ask Google for the XRP price.

However, this method has disadvantages:

- there is no way to analyze the XRPUSD price chart;

- there is no way to analyze XRPUSD trading volumes;

- it is impossible to draw trend lines and other graphic elements.

So if your task is to form an opinion on investment attractiveness, predict a trend, find an entry point to a position, we recommend downloading the ATAS platform for free to get the XRP price from the exchange to your computer and analyze the chart in real time.

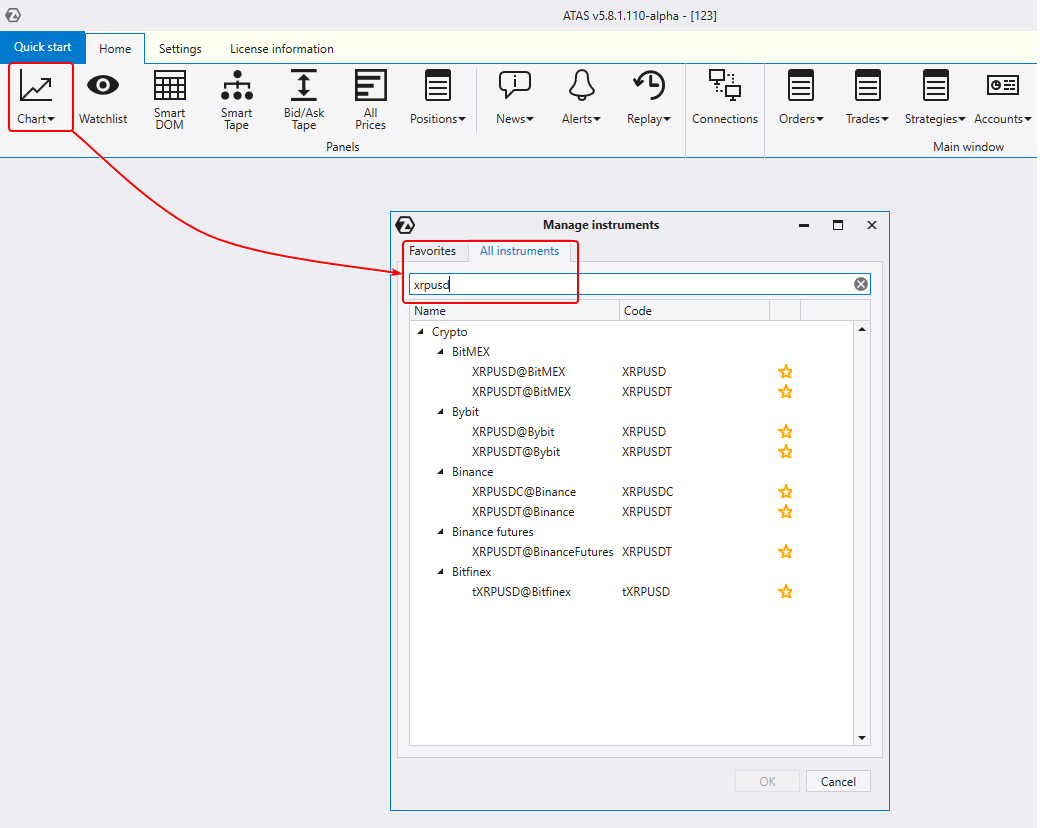

After installing the platform, open the chart, specify the XRPUSD ticker in the tool manager.

You will get a list of options – you can download XRP prices from different cryptocurrency exchanges. Select the exchange you are interested in to see the Ripple price for now.

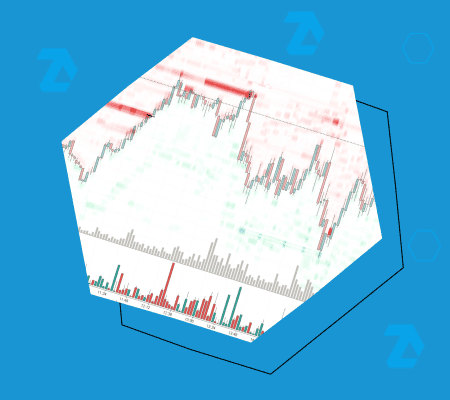

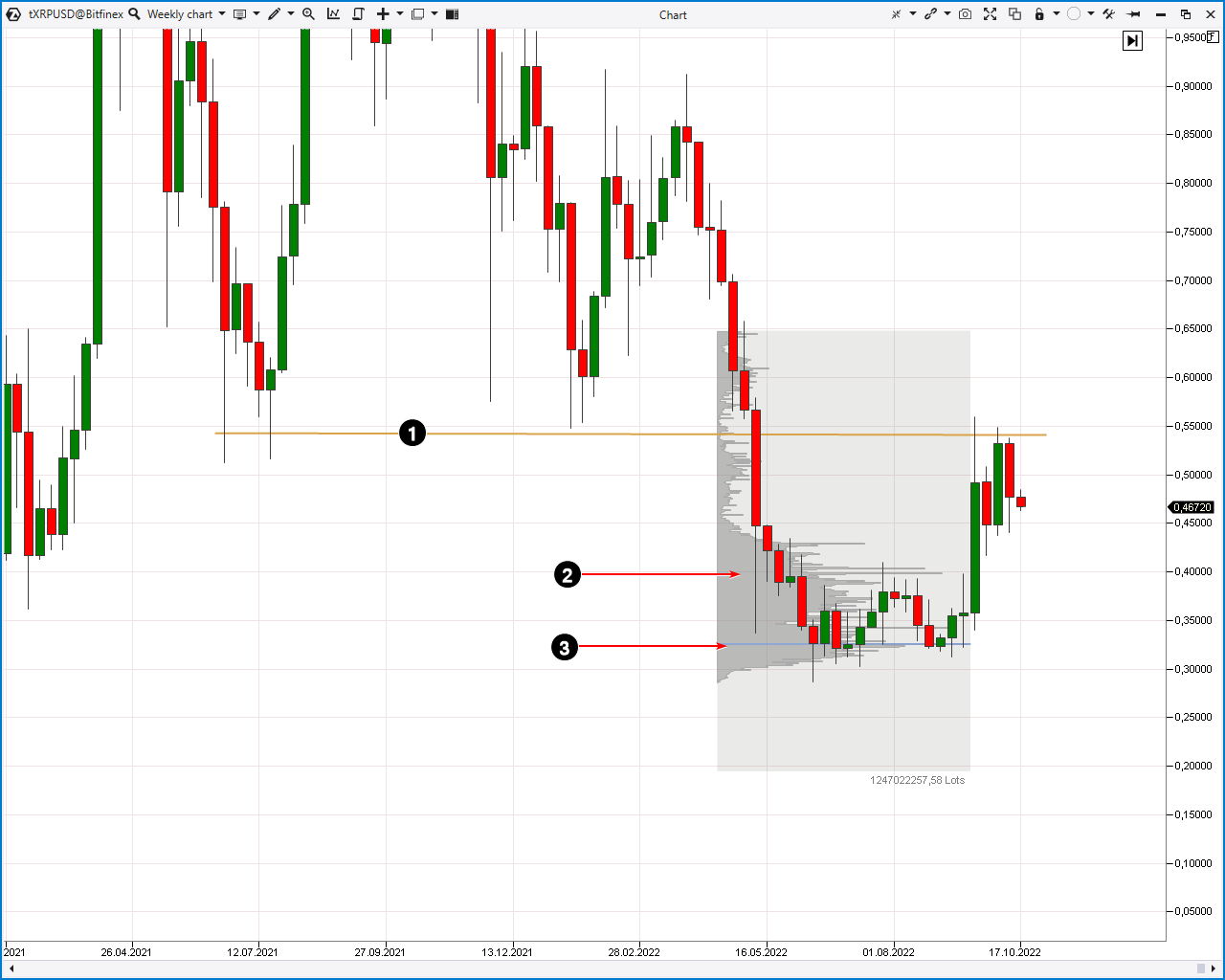

Analysis of the graph allows us to identify three important levels:

- The level is about 0.56. This level worked as support in 2021, so its ability to resist rising prices in 2022 (time of writing) is not surprising. This situation is explained by the principle of mirror support and resistance levels.

- Large volume level 0.4. It is also a psychological round level.

- Large volume level around 0.328.

The quote shot up from high volume levels, suggesting that high interest used the 2022 bearish trend to accumulate coins at bargain prices. Perhaps the “whales” are counting on a successful resolution of the litigation between the SEC and Ripple Labs. And perhaps on the intrinsic value of the coin, due to the wide possibilities of using the Ripple blockchain.

One way or another, the 0.328–0.4 zone can become a support for a bullish trend in the future if the big players “protect” it.

The professional tools of the ATAS platform will help you conduct a more thorough analysis on lower timeframes, taking into account the latest prices.

How to start trading XRP?

On cryptocurrency exchanges, transactions are made on the spot section (here you can actually buy an XRP coin), as well as on the futures section (speculative trading in contracts). If your goal is to capitalize on the price action of XRPUSD, futures trading is more worthwhile as it offers relatively low fees and high liquidity.

To trade futures:

- Download ATAS. The platform offers many benefits for futures traders. Learn how to use convenient cluster charts and useful indicators of the ATAS platform.

- Open an account on a cryptocurrency exchange.

- Connect to the exchange via ATAS.

To reduce the risks, we recommend that you first practice on a demo account. Read our blog, subscribe to the Youtube channel – learn how to use the ATAS arsenal to gain an advantage and develop your own strategy.

Conclusions

Despite the lawsuit with the SEC, Ripple managed not only not to lose its partnerships with large financial institutions, but also to conclude new ones, including pilot projects to launch CBDCs.

In addition, against the backdrop of the outcome of the SEC case, the price of XRP went beyond the formed balance, which can also indicate the growing interest of the buyer in this asset and the potential for a bullish trend.

To benefit from intraday fluctuations in the XRPUSD rate, use the ATAS platform for trading futures on cryptocurrency exchanges.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.