Staking cryptocurrencies is a powerful tool to increase the profitability of cryptocurrency investments. It allows users to earn passive income, diversify their portfolios, and actively contribute to the development of blockchain technologies.

However, the concept of staking can be a bit complex for beginners. In this article, we will try to explain all the important things you need to know about passive income from cryptocurrencies in simple terms.

Read more:

Cryptocurrency Staking in Simple Terms

Cryptocurrency staking is the process of holding a certain amount of cryptocurrency in a wallet to support the functioning of a blockchain network. In return, a guaranteed reward is paid out, typically in percentages.

In cryptocurrency contexts, “stake” refers to the amount of cryptocurrency you are willing to invest to participate in the functioning of the blockchain network.

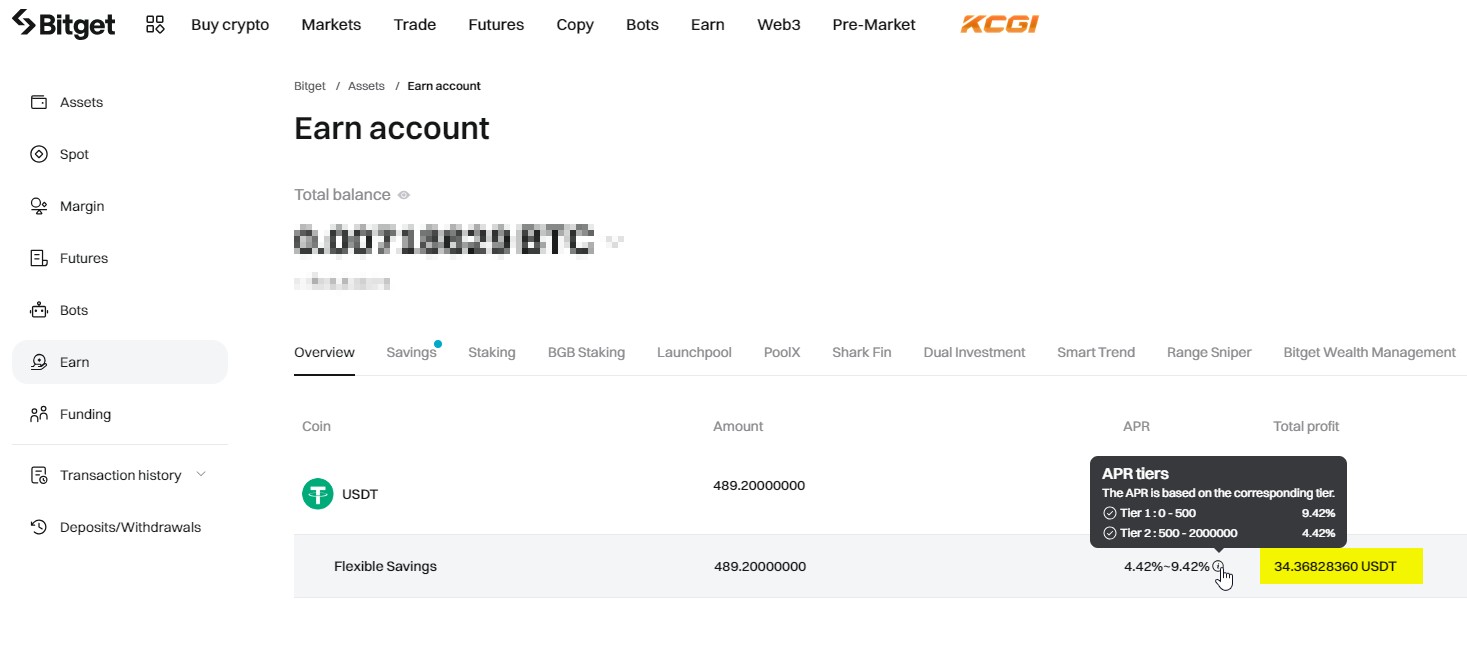

For instance, depositing 489 USDT into BitGet exchange’s staking account could yield almost 35 USDT in earnings without much effort.

Put simply, staking resembles a bank deposit: you deposit funds into an account and earn interest over time. However, with staking, you are not just storing your money; you are actively contributing to the security and functioning of the blockchain network.

How Cryptocurrency Staking Works

Blockchain technology is versatile and, when applied to finance, has led to the emergence and development of the world of cryptocurrencies. To understand how crypto staking works, let’s break down key concepts like blockchain, validators, and consensus.

How Do Cryptocurrencies Work?

Imagine a chain composed of numerous links called blocks:

- The chain. Blocks are linked in a precise order, forming an endless sequence.

- Blocks. They store the transaction history between wallets (which anyone can create). When people trade cryptocurrencies, these transactions are recorded in new blocks.

The blockchain is distributed and maintained in synchronized copies across multiple computers globally. This makes it decentralized and secure because no one can tamper with records or delete blocks.

Who Are Validators?

Someone needs to verify all new transactions to ensure they are fair and correct. This role is performed by validators.

Validators are individuals or computers that create new blocks in the chain. They ensure there is no fraud (for example, you cannot send more coins than you have in your wallet).

Validators are rewarded for their work with new coins.

What Is Consensus?

Consensus is an agreement among all network participants that transactions are correct, and corresponding blocks should be added to the blockchain. Imagine a group of friends agreeing on which movie to watch – everyone must express consent.

There are different ways to achieve consensus in blockchain. One of them is Proof of Stake (PoS) – with “Stake” being the key term. This mechanism is used by Ethereum 2.0, Solana, Toncoin (TON), Solana (SOL), Cardano (ADA), Polygon (MATIC), and other cryptocurrencies.

Becoming a validator in a blockchain operating on the PoS consensus mechanism is open to anyone interested, but they must meet certain conditions to become a validator:

- Staking. Different blockchain networks have varying minimum staking requirements. For instance, in Ethereum 2.0, the minimum stake is 32 ETH.

- Technical requirements. Validators must run and maintain a network node. This requires specific knowledge and skills. The validator node must be reliable and consistently operational to participate in the continuous process of transaction validation and block creation. Node downtime can lead to income losses and penalties.

- Additional conditions. These may include having specific experience or reputation, adhering to network rules, and participating in network governance.

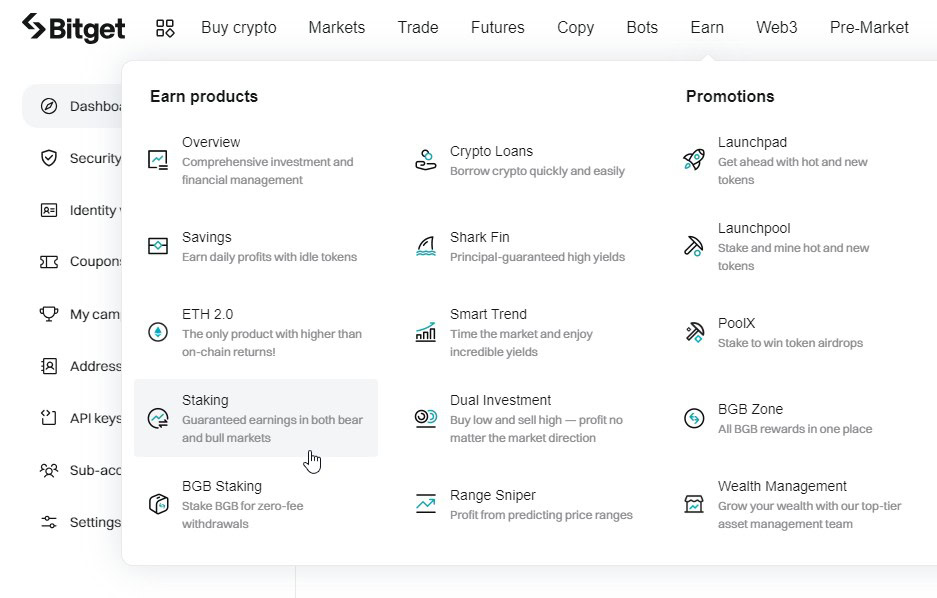

In reality, meeting these conditions can be quite challenging, but modern cryptocurrency exchanges simplify this process by creating corresponding investment products. Below is an example of staking within the interface of the BitGet cryptocurrency exchange:

Exchanges gather funds from many users and use them to launch and maintain validator nodes. Here is how the roles are distributed:

- Exchange. Handles all the organizational, technical, and operational aspects of managing nodes, like setup, support, and ensuring their smooth operation.

- User. Contributes their funds as stakes. This makes the user a delegator, not a validator (since the exchange is the validator, and the user assists it). Users receive rewards for staking, which are divided between them and the exchange (the exchange might charge a fee for its services).

The exchange (or another platform) makes the staking process accessible and easy, eliminating the need for you to create, configure, and maintain a 24/7 operational node.

How Does Staking Work?

Now that we know about blockchain, validators, and consensus, let’s put it all together to understand how staking works:

- You choose a cryptocurrency exchange (validator);

- Select the cryptocurrency for staking;

- Deposit into the staking wallet – become a delegator;

- Validators verify new transactions and create new blocks. You earn rewards for aiding in transaction verification and block creation.

Therefore, staking is not just a way to store cryptocurrency but also a method to assist in the functioning of the blockchain network, earning rewards in return.

How Much Can You Make From Crypto Staking?

The earnings from staking cryptocurrency can fluctuate based on several factors, such as the cryptocurrency type, network conditions, exchange terms, current inflation rates, the number of stakers, and how rewards are distributed.

Special indicators are used to assess the profitability of staking – APR and APY:

- APR (Annual Percentage Rate) considers only the annual percentage income without reinvestment (compound interest).

- APY (Annual Percentage Yield) factors in compound interest, meaning the income from reinvesting the earned interest.

In crypto staking, APR is more commonly used because it is easier to calculate and understand. However, understanding APY is crucial if your rewards are automatically reinvested, thereby boosting your overall returns.

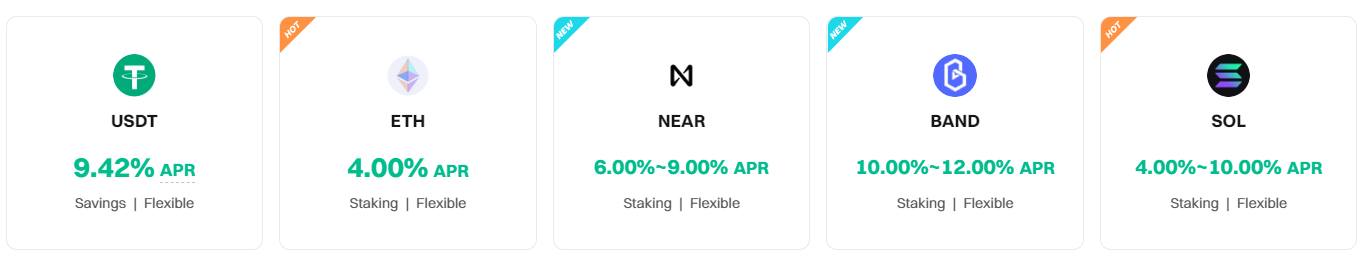

Average annual yields of popular cryptocurrencies:

- Ethereum 2.0 (ETH): around 3-5%.

- Cardano (ADA): around 4-6%.

- Polkadot (DOT): around 10-12%.

- Tezos (XTZ): around 5-7%.

These listed coins have a good reputation and can be considered reliable and long-term assets. On the other hand, there are cryptocurrencies offering higher APR in staking, but they tend to be very risky.

How to Choose a Cryptocurrency for Staking

Let’s say you:

- Have registered on a cryptocurrency exchange;

- Have funded your account (deposit is credited to your spot wallet);

- Want to choose a cryptocurrency for staking. But how?

A lot (if not everything) depends on your financial goals and risk preferences. Here are three approaches to finding the most profitable coins for staking:

1. An option with low-risk and stable returns. This applies to staking Tether (USDT) or USD Coin (USDC). Both of these stablecoins are pegged to the US dollar, so they have low volatility. The typical APY for staking Tether and/or USDC ranges from 3% to 15%, depending on the platform.

2. Staking cryptocurrencies with strong long-term prospects. These include coins like Polygon (MATIC) and Cardano (ADA), which are infrastructure projects with strong development teams and growing ecosystems. With these cryptocurrencies, investors can:

- earn rewards from staking;

- benefit from potential price growth in the long term (if the market is bullish).

3. Promotional offers. These are often used to promote new projects and attract new users. For example, in May 2024, Huobi offered a chance to stake USDT for one week with a 100% APY. With such an APY, the income for one week would be about 1.38% (due to compound interest). Of course, users cannot just do this every week — the offer has its limitations. Another option: an exchange might offer its own tokens to make the offer more attractive. For instance, Gate often rewards users with GT (Gate Token) in addition to staking rewards for other tokens. For example, staking USDT with an APY of 9.88% could yield an additional 8.87% in GT tokens.

Which option to choose is up to you. But remember: the higher the potential return, the greater the risks.

Step-By-Step Instructions. How to stake crypto

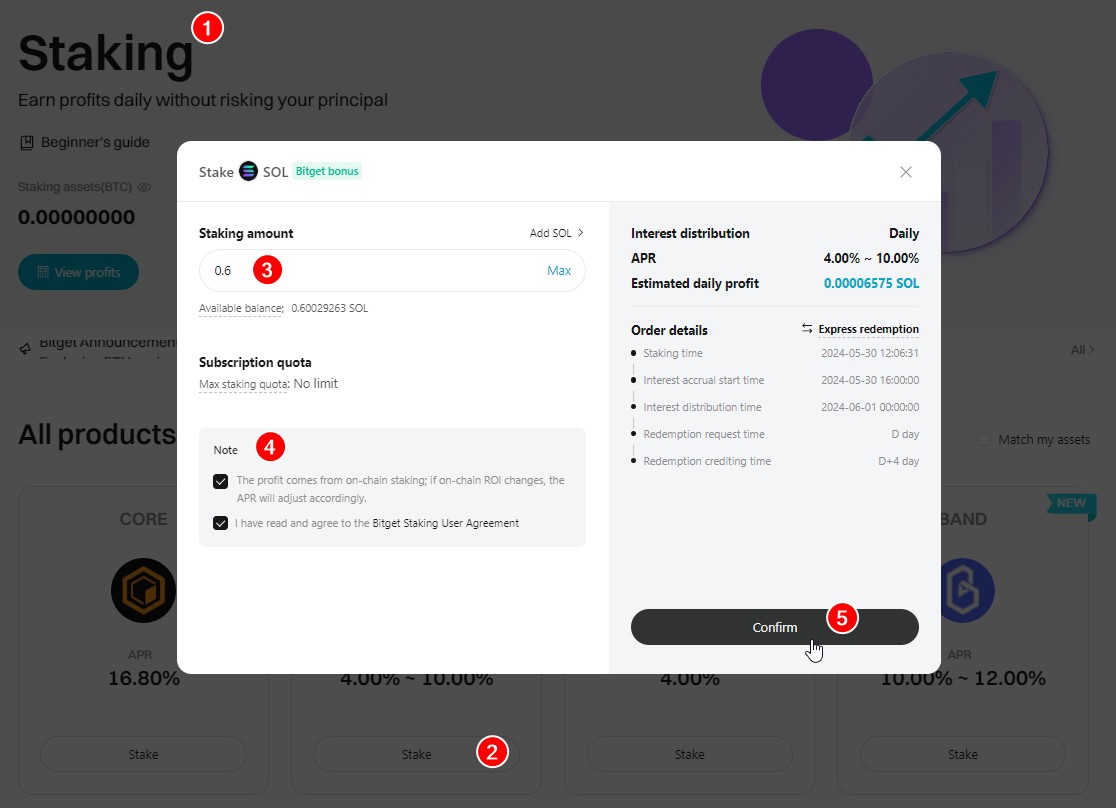

Let’s say you have an account on the BitGet exchange and you have decided to stake Solana.

Here are the steps you need to follow:

- From the Earn / Staking main menu, go to the Crypto Staking section.

- Click Stake next to Solana to open the staking form.

- Enter the number of coins you want to stake (they must be available in your Spot wallet).

- Agree to the terms and conditions.

- Confirm your decision.

The specified amount of Solana will then be credited to your Staking wallet.

FAQ

What is flexible staking?

Flexible staking in cryptocurrencies means that users can withdraw their funds at any time. This is different from fixed staking, where coins are locked for a specific period, and early withdrawal may incur penalties.

What do you need to start staking cryptocurrencies?

To start, you need to register on a cryptocurrency exchange or wallet that supports staking and buy the necessary amount of tokens. After that, you can stake your tokens directly through the platform’s interface. This is a general procedure that may vary depending on the chosen platform.

When will I receive staking rewards?

Interest is credited the day after you start staking.

What are the risks of staking?

First, there is market risk — you could lose money if the value of the staked coin drops relative to the dollar. This can happen to any coin if the market crashes. Second, there are network risks — software bugs or hacking attacks on staking platforms can lead to a loss of access to your funds. Additionally, some platforms have fixed staking periods, and early withdrawals may incur penalties.

Which is better – staking or trading?

Staking has many advantages, but it is not suitable for everyone.

| Staking | Trading | |

| Risk | Low to medium (depends on market conditions) | High (depends on market conditions) |

| Income Potential | Low, predictable passive income | High, but unpredictable and risky |

| Time Commitment | Minimal, requires less attention | Requires constant monitoring and market analysis |

| Knowledge and Skills | Basic knowledge of cryptocurrencies needed | Advanced trading knowledge required |

| Access to Funds | May be limited by fixed staking periods | High, quick access to funds |

| Suitable For | Long-term investors seeking stability | Active market participants ready for risks |

If you are a professional trader, you can allocate a portion of your earnings towards long-term cryptocurrency holdings in a wallet, creating a diversified portfolio akin to stocks and bonds. This is one way to combine trading and staking.

On the other hand, if you have earned income from staking, you can take the risk and use it as capital for trading, a potentially more profitable endeavor. Of course, this requires proper preparation beforehand.

How to Train as a Cryptocurrency Trader?

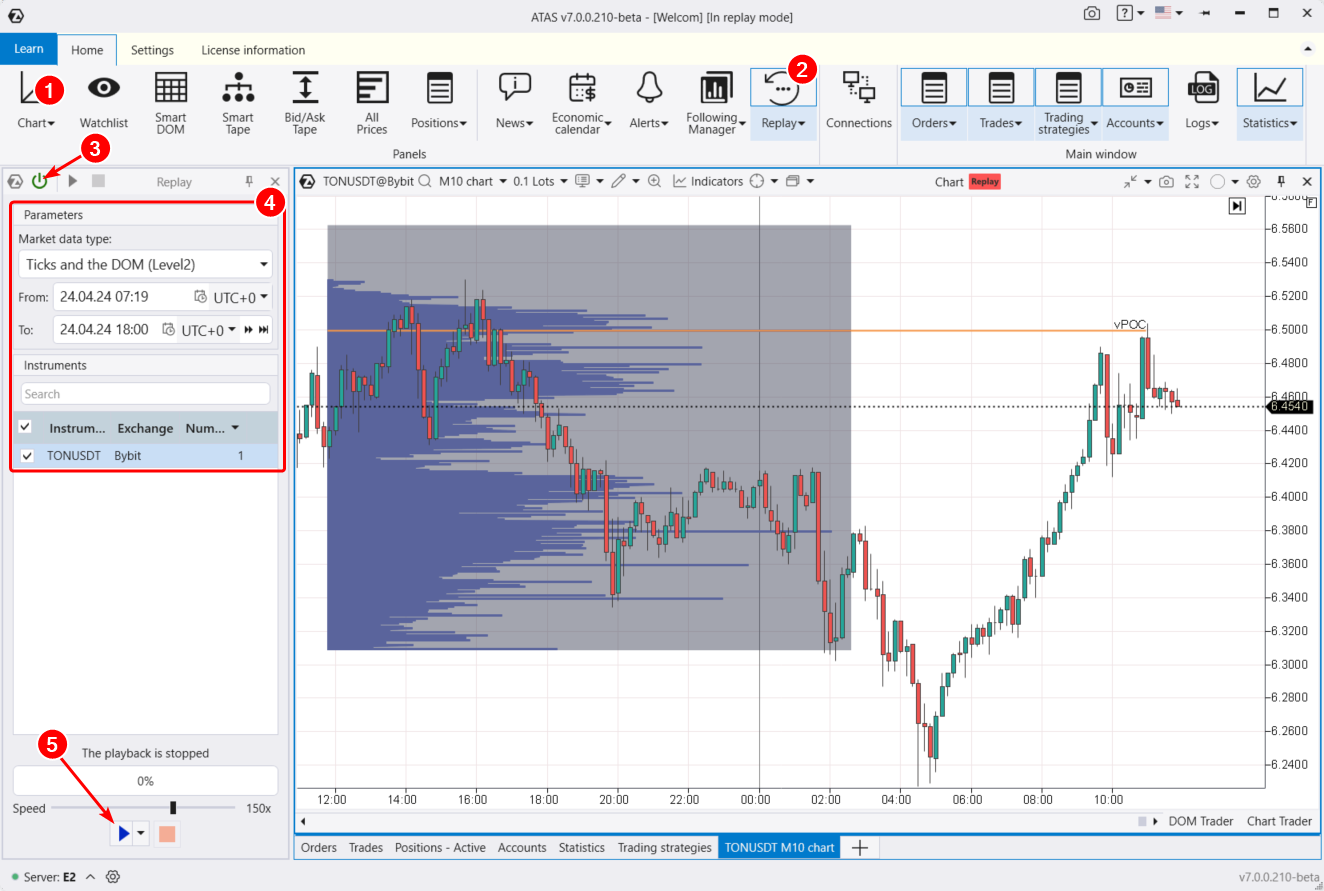

You can learn how to trade cryptocurrencies using the ATAS Market Replay simulator without any risk to your capital. Stable trends happen nearly every day, offering earning potential that surpasses even the best conditions offered in staking.

To start using the cryptocurrency trader simulator, download, install, and launch the ATAS platform for free – then:

- Open the cryptocurrency chart.

- Click on the Market Replay button in the main ATAS menu.

- Activate the Replay mode (the icon should turn green).

- Adjust settings if necessary (date, data type).

- Start playback and develop as a trader of any cryptocurrency assets.

During your training in trading crypto using the Market Replay simulator, you can:

- adjust the playback speed, and pause;

- test your strategies, monitor signals from over 400 indicators;

- of course, use Chart Trader and other features to trade on the built-in demo Replay account and then analyze your performance;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- analyze volumes in the Level II order book, for instance, using the DOM Levels indicator;

- perform other activities that will help you quickly become an effective trader from scratch.

ATAS enables you to download tick history from different markets, not just cryptocurrencies, providing you with a comprehensive foundation for identifying patterns in price and volume interactions.

Conclusions

According to Benzinga and other sources:

- in 2024, the number of cryptocurrency users worldwide ranges from 850 to 950 million,

- this number increases annually by 47.8-65.2%, indicating a high level of interest in cryptocurrencies.

With the development of the cryptocurrency industry, increasing competition, and the emergence of specialized platforms, the staking process has been greatly simplified – today, anyone can stake cryptocurrencies.

Staking is not only a way to store your crypto assets but also an opportunity to actively participate in the support and development of blockchain networks operating on the Proof of Stake consensus mechanism. Naturally, it is also a way to earn passive income.

Beyond its simplicity, this type of earning is attractive due to its low risk and the wide range of cryptocurrencies available for staking. On the other hand, staking may seem less appealing for those looking for quicker and higher returns in cryptocurrency markets, where trends develop actively every day.

Download ATAS. It is free. During the trial period, you will have full access to the platform’s tools to experiment with various futures trading strategies and determine which one suits you best. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis in futures markets.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.